Layne Christensen Declares New Credit Facility - Analyst Blog

17 April 2014 - 4:00AM

Zacks

Layne Christensen

Company (LAYN) recently announced its agreement for a $135

million senior secured revolving credit facility – the ABL

Facility. The company’s assets will back the five-year

facility.

Layne Christian is a water

management; construction and drilling company catering to the

requirements of the water, mineral and energy industries across the

globe. The company had cash and cash equivalents of nearly $29

million as on Oct 31, 2013 whereas its long-term debt stood at

$102.7 million.

Major banks including PNC Bank

National Association, a unit of The PNC Financial Services

Group, Inc. (PNC), the banking unit of Wells Fargo

& Company (WFC) and Jefferies Finance LLC will

contribute to the ABL facility. The interest rate on the facility

will be based on London Interbank Offered Rate (LIBOR) and a

premium of 2.75%–3.25% based on quarterly performance. Layne

Christensen has also included the accordion feature in the

agreement, which entitles it to expand this credit facility to $200

million, if required.

These banks will play a significant

role that range from being an administrative agent, lead arranger,

book running manager, syndication agent and lender to being the

co-collateral agent as well.

The company earlier had a $150

million credit facility, which was done away with as the ABL

facility agreement materialized. Layne Christensen will be using

about $31 million from the ABL facility to cash collateralize

credit from the previous facility. The company intends to transfer

all of the earlier credit to the new facility.

This new credit facility has lower

borrowing costs in comparison to the earlier one, which gives Layne

Christensen greater flexibility while meeting its capital

requirements efficiently. This is likely to drive the company’s

growth, going forward.

Layne Christensen currently has a

Zacks Rank #3 (Hold). Investors interested in this sector could

consider AECOM Technology Corporation (ACM) with a

Zacks Rank #2 (Buy).

AECOM TECH CORP (ACM): Free Stock Analysis Report

LAYNE CHRISTENS (LAYN): Free Stock Analysis Report

PNC FINL SVC CP (PNC): Free Stock Analysis Report

WELLS FARGO-NEW (WFC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

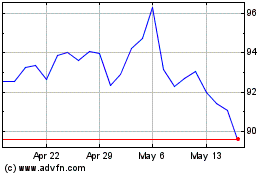

AECOM (NYSE:ACM)

Historical Stock Chart

From Mar 2024 to Apr 2024

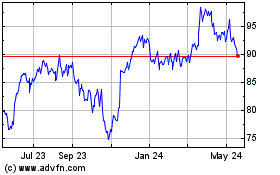

AECOM (NYSE:ACM)

Historical Stock Chart

From Apr 2023 to Apr 2024