Amerigo Resources Ltd. (TSX:ARG) ("Amerigo" or the "Company") is pleased to

announce that it has made the regulatory filing of the National Instrument

43-101 ("NI 43-101") technical report (the "Report") prepared for Minera Valle

Central, S.A. ("MVC"), Amerigo's Chilean subsidiary. The Report has been filed

in conjunction with the announcement by Amerigo of the agreement entered into by

MVC with Codelco's El Teniente Division ("DET") for the acquisition of the

processing rights to the Cauquenes tailings deposit and the extension of MVC's

rights to process tailings from the El Teniente mine from 2021 to 2037.

Robert D. Henderson, P. Eng, President and COO of Amerigo is the author of the

Report, is responsible for the technical comments related to the resource

estimate and its parameters and is a "qualified person" for the purposes of NI

43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities

Administrators. Mr. Henderson has verified the data disclosed in this release.

MVC's plant is located approximately 90 kilometres south of Santiago, Chile and

has been in operation since 1992. MVC processes tailings from the current

production of the El Teniente mine ("Fresh Tailings") and tailings from the

historic Colihues tailings deposit. El Teniente is the world's largest

underground copper mine and has been in production since 1904. Construction of a

new mine level, scheduled for completion in 2017, is estimated to extend the

mine's useful life by 50 years.

In 2013, MVC produced 45.7 million pounds of copper and 809,057 pounds of

molybdenum. An expansion project (the "Project") is planned to develop the

historic Cauquenes deposit that is expected to double MVC's copper production to

approximately 90 million pounds per year.

The Colihues and Cauquenes tailings deposits are located in close proximity to

MVC's plant. The MVC plant has a capacity of 175,000 tonnes per day and consists

of grinding and flotation processing facilities. After being reprocessed at MVC,

the tailings are transported by gravity to the Caren tailings impoundment,

located approximately 50 km to the west of the MVC plant.

MVC currently mines the Colihues deposit with hydraulic monitors and plans to

mine the Cauquenes deposit using the same method. The Project will require

construction of additional mining infrastructure, grinding and flotation plants.

In Mr. Henderson's opinion there is sufficient geological and economic evidence

to conclude that MVC's contracts for the processing of Fresh Tailings and

tailings from the Cauquenes and Colihues tailings deposits constitute an

inferred mineral resource. Historical records of El Teniente's mill tailings

represent a detailed account of the tonnage and grade of material stored in the

Cauquenes and Colihues impoundments. A total of 30 holes have been drilled on

the Cauquenes deposit in four separate campaigns. MVC has a long operating

record of economic extraction of copper and molybdenum from Fresh and Colihues

tailings, and MVC's 2014 feasibility study demonstrates that tailings can be

profitably extracted from the Cauquenes deposit.

MVC's total inferred mineral resource estimate for the Fresh, Colihues and

Cauquenes tailings, after application of mining and mill recovery losses, is

1,494 million tonnes at a grade of 0.155% Cu and 0.012% Mo with 1,709 million

pounds of recoverable copper and 43 million pounds of recoverable molybdenum, as

set out in the following tables:

MVC Copper Inferred Mineral Resource Estimate - Dec 31, 2013

----------------------------------------------------------------------------

Tailings Deposit Tonnes (t) Grade (% Cu) Mill Recoverable

Recovery (%) Copper (M lbs)

----------------------------------------------------------------------------

Colihues 68,231,000 0.229 34 117

----------------------------------------------------------------------------

Cauquenes 338,139,000 0.267 48 961

----------------------------------------------------------------------------

Fresh 1,087,444,000 0.115 23 631

----------------------------------------------------------------------------

Total 1,493,814,000 0.155 34 1,709

----------------------------------------------------------------------------

MVC Molybdenum Inferred Mineral Resource Estimate - Dec 31, 2013

----------------------------------------------------------------------------

Tailings Deposit Tonnes (t) Grade (% Mo) Mill Recoverable

Recovery (%) Molybdenum

(M lbs)

----------------------------------------------------------------------------

Colihues 68,231,000 0.010 12 2

----------------------------------------------------------------------------

Cauquenes 338,139,000 0.021 18 29

----------------------------------------------------------------------------

Fresh 1,087,444,000 0.009 6 13

----------------------------------------------------------------------------

Total 1,493,814,000 0.012 11 43

----------------------------------------------------------------------------

The Cauquenes Expansion Project Environmental Impact Assessment study was filed

with the Chilean authorities on January 7, 2013, requesting an increase in the

historic tailings processing rate via an expansion of the MVC plant.

Environmental approval is expected to be received in the first half of 2014. The

January 2014 Cauquenes Expansion Project Feasibility Study development plan

anticipates construction to commence in the second half of 2014. The Study calls

for a Cauquenes processing rate of 60,000 tonnes per day and a phased start up

estimated to commence in Q2-2015, with full production expected to be achieved

in Q2-2016. Processing of the Colihues deposit is planned to be phased out and

restarted in 2034 when the Cauquenes deposit is depleted.

Average annual production over the initial ten year period (2016-2025) is

estimated to be 88 million pounds of copper per year at a cash cost of

production of approximately $1.51/lb Cu, excluding royalties. Royalty payments

are estimated to be $0.69/lb Cu at the base case metal prices used in the

economic analysis. The initial capital cost of the Project has been estimated at

$140 million, including contingency and excluding escalation. At an 8% discount

rate, the unlevered after tax net present value for the Project is estimated to

be approximately US$279 million at an assumed long term copper price of $2.95/lb

Cu, rising to US$441 million at a price of $3.50/lb Cu. Over the life of the

contract, assuming a copper price of $3.50/lb, total EBITDA for MVC is estimated

to be $3.1 billion, of which $1.6 billion is payable to DET as royalties.

Using these parameters, the preliminary financial analysis of the Project

indicates that MVC has a positive net cash flow and an acceptable internal rate

of return and supports progression to construction and development of the

Cauquenes deposit.

The results of the preliminary economic assessment represent forward-looking

information that is subject to a number of known and unknown risks,

uncertainties and other factors that may cause actual results to differ

materially from those anticipated in such information. This information speaks

only as of the date of this Technical Report, and is based on a number of

assumptions which are believed to be true but which may prove to be incorrect in

future. The preliminary economic assessment is preliminary in nature and it

includes inferred mineral resources that are considered too speculative

geologically to have the economic considerations applied to them that would

enable them to be categorized as mineral reserves. There is no certainty that

the preliminary economic assessment will be realized

In Mr. Henderson's opinion the data supporting the inferred mineral resource

estimates were appropriately collected, evaluated and estimated, and the Project

objective of identifying tailings mineralization that could potentially support

future processing operations has been achieved. Mr. Henderson's recommendation

is to proceed with construction of the Project.

Amerigo Resources Ltd. produces copper and molybdenum under a long term

partnership with the world's largest copper producer, Codelco, by means of

processing fresh and old tailings from the world's largest underground copper

mine, El Teniente near Santiago, Chile. Tel: (604) 681-2802; Fax: (604)

682-2802; Web: www.amerigoresources.com; Listing: ARG:TSX

Certain of the information and statements contained herein that are not

historical facts, constitute "forward-looking information" within the meaning of

the Securities Act (British Columbia), Securities Act (Ontario) and the

Securities Act (Alberta)applicable Canadian securities legislation

("Forward-Looking Information"). Forward-Looking Information is often, but not

always, identified by the use of words such as "expects", "seek", "anticipate",

"believe", "plan", "estimate", "expect" and "intend"; statements that an event

or result is "due" on or "may", "will", "should", "could", or might" occur or be

achieved; and, other similar expressions. More specifically, Forward-Looking

Information contained herein includes, without limitation, information

concerning the agreement for the purchase by MVC of the processing rights for

the Cauquenes tailings deposit, extending the contract for the processing of

Fresh Tailings to 2037 (the "Master Agreement"), completion of construction of

the planned expansion of MVC's operations required for the processing of old

tailings from the historic Cauquenes tailings deposit (the "Cauquenes

Expansion"), future tailings production volumes and the Company's copper and

molybdenum production, all of which involve known and unknown risks,

uncertainties and other factors which may cause the actual results, performance

or achievements of the Company, or industry results, to be materially different

from any future results, performance or achievements expressed or implied by

such Forward-Looking Information including, without limitation, material factors

and assumptions relating to, and risks and uncertainties associated with, the

performance of the Master Agreement, the receipt of adequate debt financing

required for the Cauquenes Expansion, the receipt of environmental approval to

the Cauquenes expansion, the continued supply of tailings from El Teniente and

successful extraction of tailings from the Cauquenes and Colihues tailings

deposits, the achievement and maintenance of planned production rates, the

evolving legal and political policies of Chile, the volatility in the Chilean

economy, military unrest or terrorist actions, metal price fluctuations,

governmental relations, the availability of financing for activities when

required and on acceptable terms,

the estimation of mineral resources and reserves, current and future

environmental and regulatory requirements, the availability and timely receipt

of permits, approvals and licenses, industrial or environmental accidents,

equipment breakdowns, availability of and competition for future mineral

acquisition opportunities, availability and cost of insurance, labour disputes,

land claims, the inherent uncertainty of production and cost estimates, currency

fluctuations, expectations and beliefs of management and other risks and

uncertainties, including those described under Risk Factors in the Company's

Annual Information Form and in Management's Discussion and Analysis in the

Company's financial statements. Such Forward-Looking Information is based upon

the Company's assumptions regarding global and Chilean economic, political and

market conditions and the price of metals, including copper and molybdenum, and

future tailings production volumes and the Company's copper and molybdenum

production. Among the factors that have a direct bearing on the Company's future

results of operations and financial conditions are changes in project parameters

as plans continue to be refined, interruptions in the supply of fresh tailings

from El Teniente, further delays in the extraction of tailings from the Colihues

and Cauquenes tailings deposits, a change in government policies, competition,

currency fluctuations and restrictions and technological changes, among other

things. Should one or more of any of the aforementioned risks and uncertainties

materialize, or should underlying assumptions prove incorrect, actual results

may vary materially from any conclusions, forecasts or projections described in

the Forward-Looking Information. Accordingly, readers are advised not to place

undue reliance on Forward-Looking Information. Except as required under

applicable securities legislation, the Company undertakes no obligation to

publicly update or revise Forward-Looking Information, whether as a result of

new information, future events or otherwise. In addition, readers are cautioned

that the preliminary economic assessment in the NI 43-101 report is preliminary

in nature and includes inferred mineral resources that are considered too

speculative geologically to have the economic considerations applied to them

that would enable them to be categorized as mineral reserves. There is no

certainty that the preliminary economic assessment will be realized.

FOR FURTHER INFORMATION PLEASE CONTACT:

Amerigo Resources Ltd.

Dr. Klaus Zeitler

Chairman & CEO

(604) 218-7013

Amerigo Resources Ltd.

(604) 697-6201

www.amerigoresources.com

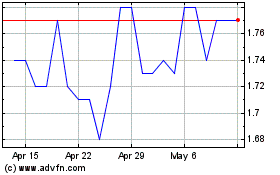

Amerigo Resources (TSX:ARG)

Historical Stock Chart

From Mar 2024 to Apr 2024

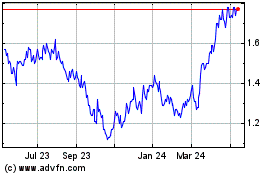

Amerigo Resources (TSX:ARG)

Historical Stock Chart

From Apr 2023 to Apr 2024