ICF Study Sees Industry Ingenuity & Technological Improvements Driving Significantly Higher Natural Gas Production in the Mar...

25 April 2014 - 2:00AM

Business Wire

ICF International (NASDAQ:ICFI), a leading provider of

consulting services and technology solutions to government and

commercial clients, has released its ICForecast Strategic Natural

Gas Outlook for the second quarter of 2014. The study highlights

the near- and long-term future of natural gas prices and market

economics including a national and regional look at supply and

demand dynamics.

The ICForecast Strategic Natural Gas Outlook for the second

quarter of 2014 highlights a significant increase in production in

the Northeast U.S. from the Marcellus Shale and the Utica Shale.

For Marcellus, natural gas production growth continues unabated,

driven by producers’ continued improvements in drilling and

fracturing technologies and techniques. High production continues

to be a dominant theme despite decreased rig counts – another

indication that innovative uses of technology are contributing to

favorable production economics.

“Despite a slight downturn in the Marcellus rig count over the

past year, output has grown as producers reduce drilling time and

increase the production per well. The Utica, which was originally

expected to have higher oil production, has had significant growth

in gas production,” said Frank Brock, senior energy market

specialist for ICF International. “As a result, ICF has increased

its production projections for both the Marcellus Shale and the

Utica Shale to a combined total of 25 billion cubic feet per day by

2020.”

Even with strong production gains, natural gas prices are

currently being supported by increased storage demand stemming from

the recent long and cold winter. ICF projects gas prices to firm

through the end of 2014 – albeit somewhat lower than the current

New York Mercantile Exchange futures strip. For 2015, the company

forecasts the potential for gas prices to trend lower, as

production continues to grow and demand stays a step behind.

However, ICF projects gas prices firming from 2016 through 2020 as

increased demand from new liquefied natural gas export projects,

increased exports from Mexico and new industrial demand tighten the

supply/demand balance. Additionally, the recent court decision

upholding U.S. Environmental Protection Agency regulations will

continue to reinforce the trend away from coal-fired generation and

facilitate new natural gas-fired power generation development.

“The uncertainty over the timing of new demand sources and the

midstream infrastructure needed to bring new supplies to market

create the potential for increased price volatility through the end

of the decade,” said Brock.

The ICForecast Strategic Natural Gas Outlook is a quarterly

report that provides a comprehensive projection of gas supply,

demand, pipeline flows, price and basis for the U.S. and Canada as

well as for regional markets for 25 years forward. The study is

produced by ICF's natural gas market experts based on results from

the Gas Market Model (GMM®) - ICF's proprietary model of the North

American gas market. The report can be used, for example, to

examine the impact of pipeline expansions due online in the fall of

2014 on prices at key natural gas trading points throughout the

U.S. and Canada.

For More Information

- ICForecast Strategic Natural Gas

Outlook

- ICForecast Energy Outlook

About ICF International

ICF International (NASDAQ:ICFI) provides professional services

and technology solutions that deliver beneficial impact in areas

critical to the world's future. ICF is fluent in the language of

change, whether driven by markets, technology, or policy. Since

1969, we have combined a passion for our work with deep industry

expertise to tackle our clients' most important challenges. We

partner with clients around the globe—advising, executing,

innovating—to help them define and achieve success. Our more than

4,500 employees serve government and commercial clients from more

than 70 offices worldwide. ICF's website is www.icfi.com.

Caution Concerning Forward-looking Statements

Statements that are not historical facts and involve known and

unknown risks and uncertainties are "forward-looking statements" as

defined in the Private Securities Litigation Reform Act of 1995.

Such statements may concern our current expectations about our

future results, plans, operations and prospects and involve certain

risks, including those related to the government contracting

industry generally; our particular business, including our

dependence on contracts with U.S. federal government agencies; and

our ability to acquire and successfully integrate businesses. These

and other factors that could cause our actual results to differ

from those indicated in forward-looking statements are included in

the "Risk Factors" section of our securities filings with the

Securities and Exchange Commission. The forward-looking statements

included herein are only made as of the date hereof, and we

specifically disclaim any obligation to update these statements in

the future.

ICF InternationalErica Eriksdotter,

+1-703-934-3668erica.eriksdotter@icfi.com

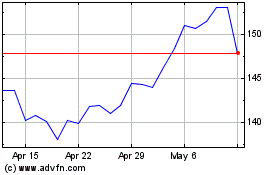

ICF (NASDAQ:ICFI)

Historical Stock Chart

From Mar 2024 to Apr 2024

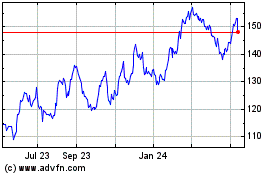

ICF (NASDAQ:ICFI)

Historical Stock Chart

From Apr 2023 to Apr 2024