Diamond Offshore Beats on Earnings, Down Y/Y - Analyst Blog

25 April 2014 - 2:00AM

Zacks

Diamond Offshore Drilling

Inc. (DO) reported first quarter 2014 earnings of 93 cents

per share, comfortably surpassing the Zacks Consensus Estimate of

67 cents. The outperformance was mainly backed by higher dayrates

and lower contract drilling expenses. However, the quarterly

results decreased 26.8% from the year-earlier earnings of $1.27 per

share.

Total revenue in the quarter, decreased 2.8% year over year to

$709.4 million but beat the Zacks Consensus Estimate of $704.0

million.

Dividend Story

Diamond Offshore declared a special dividend of 75 cents per share

in the quarter, unchanged from the prior quarter. The company will

also pay its regular quarterly dividend of 12.5 cents per share (50

cents per share annualized). Both dividends are payable on Jun 2,

2014 to shareholders of record on May 7.

Operational Performance

In the first quarter, revenues from the Contract Drilling segment

fell 2.1% year over year to $685.3 million, mainly due to a 3.9%

decrease in total floaters revenue. These floaters accounted for

93.1% of the total contract drilling revenue, while jackups

contributed 6.9%.

Ultra-Deepwater floaters recorded an average dayrate of $387,000,

up from $360,000 in the year-earlier quarter. Deepwater floaters

realized an average dayrate of $418,000 versus $389,000 in the

year-ago quarter. Mid-water floaters recorded an average dayrate of

$276,000, up from $262,000 in the year-earlier quarter. Jackup

rigs’ dayrates averaged $93,000, up from $85,000 in the first

quarter of 2013.

Rig utilization for Ultra-Deepwater floaters decreased to 66% from

73% in the year-ago quarter. Utilization of Deepwater floaters

decreased to 64% from 88% in the year-ago quarter. Mid-water

category rig utilization was 64%, unchanged from the comparable

quarter last year while jackup rig utilization increased to 79%

from 71%.

Financials

As of Mar 31, 2014, Diamond Offshore had approximately $420.1

million in cash and cash equivalents, while long-term debt was

$2,244.3 million. Debt-to-capitalization ratio at the end of the

quarter was 32.9% (up from about 24.4% in the preceding

quarter).

Outlook

Houston, TX-based Diamond Offshore exhibits long-term earnings

growth visibility based on its strong leverage to the offshore

deepwater drilling market. Additionally, the company’s significant

free cash flow generation potential and healthy balance sheet

enhance the possibility of further share buybacks and special

dividends, going forward.

However, given the volatile oil and gas price scenario as well as

geopolitical risks associated with international operations, we

maintain a Zacks Rank #3 (Hold rating) on Diamond

Offshore.

However, there are better-ranked stocks in the oil and gas

industry, like Range Resources Corp. (RRC),

Unit Corp. (UNT) and Helmerich &

Payne, Inc. (HP), which appear more promising. All these

stocks sport a Zacks Rank #1 (Strong Buy).

DIAMOND OFFSHOR (DO): Free Stock Analysis Report

HELMERICH&PAYNE (HP): Free Stock Analysis Report

RANGE RESOURCES (RRC): Free Stock Analysis Report

UNIT CORP (UNT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

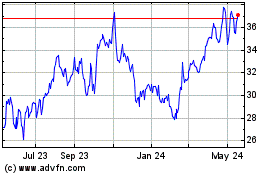

Range Resources (NYSE:RRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

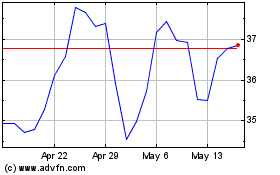

Range Resources (NYSE:RRC)

Historical Stock Chart

From Apr 2023 to Apr 2024