Encore Wire Corporation (NASDAQ Global Select: WIRE) today

announced results for the second quarter and six months ended June

30, 2014.

Net sales for the second quarter ended June 30, 2014 were $307.1

million compared to $289.5 million during the second quarter of

2013. Copper unit volume, measured in pounds of copper contained in

the wire sold, increased 10.0% in the second quarter of 2014 versus

the second quarter of 2013, accounting for most of the increase in

net sales dollars. Aluminum building wire sales also contributed to

the increased sales, constituting 8.9% of net sales dollars for the

second quarter of 2014 versus 6.6% in the second quarter of 2013.

The average selling price of wire per copper pound sold dropped

6.0% in the second quarter of 2014 versus the second quarter of

2013, somewhat offsetting the increase in sales dollars. Net income

for the second quarter of 2014 was $10.2 million versus $15.5

million in the second quarter of 2013. Fully diluted net earnings

per common share were $0.49 in the second quarter of 2014 versus

$0.75 in the second quarter of 2013.

Net sales for the six months ended June 30, 2014 were $584.3

million compared to $554.8 million during the same period in 2013.

Copper unit volume in the six months ended June 30, 2014 increased

9.6% versus the same period in 2013, offset by a 6.2% drop in

average sales prices. Aluminum building wire sales contributed to

the increased sales, constituting 8.4% of net sales dollars for the

six months ended June 30, 2014 versus 6.1% in the six months ended

June 30, 2013. Net income for the six months ended June 30, 2014

was $21.0 million versus $21.9 million in the same period in 2013.

Fully diluted net earnings per common share were $1.01 for the six

months ended June 30, 2014 versus $1.06 in the same period in

2013.

On a sequential quarter comparison, net sales for the second

quarter of 2014 were $307.1 million versus $277.2 million during

the first quarter of 2014. Copper wire unit volume increased 14.9%

on a sequential quarter comparison, offset somewhat by a 4.6%

decrease in average sales prices. Aluminum building wire sales also

contributed to the increased sales, constituting 8.9% of net sales

dollars for the second quarter of 2014 versus 7.9% in the first

quarter of 2014. Net income for the second quarter of 2014 was

$10.2 million versus $10.9 million in the first quarter of 2014.

Fully diluted net income per common share was $0.49 in the second

quarter of 2014 versus $0.52 in the first quarter of 2014.

Commenting on the results, Daniel L. Jones, President and Chief

Executive Officer of Encore Wire Corporation, said, “Continuing the

positive trend we saw developing throughout last year, the second

quarter was encouraging to us. Unit volumes were up in all building

wire products. We believe our expansion of product offerings to our

existing customer base over the last several years has been

critical to maintaining and perhaps boosting our market share, as

our capital expenditures help to drive increased sales. As we have

repeatedly noted, one of the key metrics to our earnings is the

“spread” between the price of copper wire sold and the cost of raw

copper purchased in any given period. That spread decreased 9.9% in

the second quarter of 2014 versus the second quarter of 2013, while

our copper unit volume shipped in the second quarter of 2014

increased 10.0% versus the second quarter of 2013. The copper

spread contracted as the average price of copper purchased fell

4.4% in the second quarter of 2014 versus the second quarter of

2013, but the average selling price of wire sold fell 6.0%, as a

result of slightly unfavorable pricing discipline in the industry.

That same trend was evident on a sequential quarterly comparison,

as copper unit sales increased 14.9% with a 6.1% decrease in

spreads. We believe that certain competitors cut prices in the

second quarter of 2014 to try to “remain competitive” with our

superior service levels. Along with the continued success of our

aluminum building wire launch, the increase in copper unit volumes

drove earnings per share in the second quarter. The aluminum

building wire products grew to 8.9% of net sales in the quarter,

driven by a unit sales increase of 28.9% on a sequential quarter

basis. We continue to strive to lead or follow industry price

increases to achieve profit growth. We produced these results due

to our low cost business model and aggressive cost control in all

facets of our operations. We believe our superior order fill rates

continue to enhance our competitive position, as our electrical

distributor customers are holding lean inventories in the

field.

Our balance sheet is very strong. We have no long term debt, and

our revolving line of credit is paid down to zero. In addition, we

had $19.1 million in cash as of June 30, 2014. We also declared

another cash dividend during the quarter. Our low cost structure

and strong balance sheet have enabled us to withstand difficult

periods in the past, and we believe that this strategy will serve

us well going forward. We thank our employees and associates for

their outstanding effort and our shareholders for their continued

support.”

Encore Wire Corporation manufactures a broad range of electrical

building wire for interior wiring in commercial and industrial

buildings, homes, apartments, and manufactured housing. The matters

discussed in this news release, other than the historical financial

information, including statements about the copper pricing

environment, profitability and shareholder value, may include

forward-looking statements that involve risks and uncertainties,

including fluctuations in the price of copper and other raw

materials, the impact of competitive pricing and other risks

detailed from time to time in the Company’s reports filed with the

Securities and Exchange Commission. Actual results may vary

materially from those anticipated.

Additional Disclosures:

The term “EBITDA” is used by the Company in presentations,

quarterly conference calls and other instances as appropriate.

EBITDA is defined as net income before interest, income taxes,

depreciation and amortization. The Company presents EBITDA because

it is a required component of financial ratios reported by the

Company to the Company’s banks, and is also frequently used by

securities analysts, investors and other interested parties, in

addition to and not in lieu of Generally Accepted Accounting

Principles (GAAP) results to compare to the performance of other

companies who also publicize this information. Financial analysts

frequently ask for EBITDA when it has not been presented. EBITDA is

not a measurement of financial performance under GAAP and should

not be considered an alternative to net income as an indicator of

the Company’s operating performance or any other measure of

performance derived in accordance with GAAP. The Company has

reconciled EBITDA with net income for fiscal years 1996 to 2013 on

previous current reports on Form 8-K filed with the Securities and

Exchange Commission. EBITDA for each period pertinent to this press

release is calculated and reconciled to net income as follows:

Quarter Ended June 30, 6 Months Ended June 30,

$’s in 000’s 2014 2013 2014 2013 Net Income $

10,154 $ 15,502 $ 21,007 $ 21,897 Income Tax Expense 5,126 8,454

11,012 11,230 Interest Expense 82 60 146 123 Depreciation and

Amortization 3,918 3,700 7,813 7,052

EBITDA $ 19,280 $ 27,716 $ 39,978 $ 40,302

Encore Wire Corporation

Condensed Consolidated Balance Sheets

(In Thousands)

June 30, December 31,

2014 2013 (Unaudited) ASSETS

Current Assets Cash $ 19,094 $ 36,778 Receivables, net

238,622 215,739 Inventories 80,182 70,780 Prepaid Expenses and

Other 2,371 6,769 Total Current Assets

340,269 330,066 Property, Plant and Equipment, net 200,654

194,254 Other Assets 1,741 1,506

Total Assets $ 542,664 $ 525,826

LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities

Accounts Payable $ 20,468 $ 23,465 Accrued Liabilities and Other

24,378 24,453 Total Current Liabilities

44,846 47,918 Long Term Liabilities Non-Current Deferred

Income Taxes 20,290 21,327 Total Long

Term Liabilities 20,290 21,327

Total Liabilities 65,136 69,245 Stockholders' Equity Common

Stock 267 266 Additional Paid in Capital 50,226 49,459 Treasury

Stock (88,134 ) (88,134 ) Retained Earnings 515,169

494,990 Total Stockholders' Equity 477,528

456,581 Total Liabilities and

Stockholders' Equity $ 542,664 $ 525,826

Encore Wire Corporation Condensed

Consolidated Statements of Income

(In Thousands, Except Per Share Data)

(Unaudited)

Quarter Ended June 30, Six Months Ended June

30, 2014 2013 2014 2013 Net

Sales $ 307,088 100.0 % $ 289,460 100.0 % $ 584,286 100.0 % $

554,811 100.0 % Cost of Sales 273,576 89.1 %

249,309 86.1 % 518,598 88.8 % 490,359

88.4 % Gross Profit 33,512 10.9 % 40,151 13.9 %

65,688 11.2 % 64,452 11.6 % Selling, General and

Administrative Expenses 18,235 5.9 % 16,213

5.6 % 33,688 5.8 % 31,360 5.7 %

Operating Income 15,277 5.0 % 23,938 8.3 % 32,000 5.5 %

33,092 6.0 % Net Interest & Other Expense (3 )

0.0 % (18 ) 0.0 % (19 ) 0.0 % (35 ) 0.0 %

Income before Income Taxes 15,280 5.0 % 23,956 8.3 % 32,019

5.5 % 33,127 6.0 % Income Taxes 5,126 1.7 %

8,454 2.9 % 11,012 1.9 % 11,230

2.0 % Net Income $ 10,154 3.3 % $ 15,502

5.4 % $ 21,007 3.6 % $ 21,897 3.9 %

Basic Earnings Per Share $ 0.49 $ 0.75 $ 1.01

$ 1.06 Diluted Earnings Per Share $ 0.49

$ 0.75 $ 1.01 $ 1.06 Weighted

Average Number of Common and Common Equivalent Shares Outstanding:

-Basic 20,715 20,669 20,709

20,667 -Diluted 20,835

20,738 20,837 20,736

Dividend Declared per Share $ 0.02 $ 0.02 $

0.04 $ 0.04

Encore Wire CorporationFrank J. Bilban,

972-562-9473Vice President & CFO

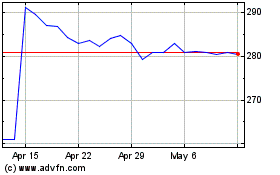

Encore Wire (NASDAQ:WIRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

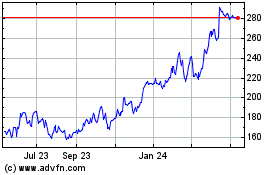

Encore Wire (NASDAQ:WIRE)

Historical Stock Chart

From Apr 2023 to Apr 2024