BHP Buyback on the Cards, Says JP Morgan -- Market Talk

25 July 2014 - 9:51AM

Dow Jones News

2320 GMT [Dow Jones] An increasingly cashed-up BHP Billiton Ltd.

(BHP.AU) is likely to announce plans for a buyback worth around

US$3 billion at its results next month, tips J.P. Morgan analyst

Lyndon Fagan. "An expected circa US$2.3 billion of excess capital

through FY15 should leave the company well placed to approve an

on-market PLC buy-back when it reports on Aug. 19," he says. Fagan

rules out the potential for a special dividend, citing its track

record of preferring buybacks. For peer Rio Tinto PLC (RIO), he

says management will likely have to wait until 2016 before any such

move, given the decline in iron-ore prices. Nevertheless, Fagan

expects BHP's capital management will likely be only 1% EPS

accretive, so continues to favor RIO on which he keeps an

overweight rating. He retains a neutral recommendation on BHP.

(rhiannon.hoyle@wsj.com; Twitter: @RhiannonHoyle)

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

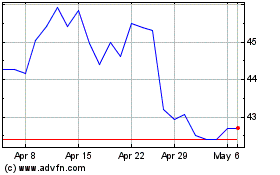

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

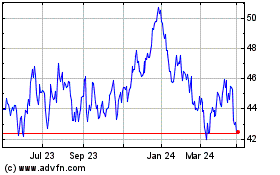

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024