KINGSPORT, Tenn., July 28,

2014 - Eastman Chemical Company (NYSE:EMN) today announced

earnings from continuing operations, excluding non-core or

non-recurring items, of $1.92 per diluted share for second quarter

2014 versus $1.80 per diluted share for second quarter 2013.

Reported earnings from continuing operations were $1.92 per diluted

share for second quarter 2014 versus $1.69 per diluted share for

second quarter 2013. For detail of the excluded items and

reconciliation to reported company and segment earnings, see Tables

3 and 4.

"We delivered solid results across our portfolio

in the second quarter despite a number of challenges," said Mark

Costa, chairman and CEO. "We continue to focus on growth through

Eastman-specific actions, including serving growing markets with

capacity additions, improving our mix with higher-value products,

and disciplined capital allocation. As a result, Eastman remains

well positioned for a fifth consecutive year of strong earnings

growth." See the second paragraph under "Outlook" for the items

excluded from annual earnings comparisons.

|

(In millions, except per share amounts) |

2Q2014 |

2Q2013 |

Sales

revenue

|

$2,460 |

$2,440 |

Earnings

per diluted share from continuing

operations*

|

$1.92 |

$1.69 |

Earnings

per diluted share from continuing operations

excluding non-core or non-recurring items**

|

$1.92 |

$1.80 |

Net cash

provided by operating activities

|

$419 |

$362 |

*For a description of

earnings from discontinued operations, see Table

1.

**For reconciliation to reported company and

segment earnings, see Tables 3 and 4.

Corporate

results 2Q 2014 versus 2Q 2013

Sales revenue was $2.5 billion, a slight increase

compared with second quarter 2013. Operating earnings for second

quarter 2014 were $436 million compared with $428 million for

second quarter 2013. Excluding the items described in Tables 3 and

4, second-quarter 2014 operating earnings were $441 million

compared with $454 million for second quarter 2013, with the

decline primarily due to lower Specialty Fluids & Intermediates

segment earnings. The previously announced unplanned shutdown at

the Kingsport, Tenn., facility negatively impacted second-quarter

2014 operating earnings by approximately $10 million.

Segment results 2Q 2014

versus 2Q 2013

Additives & Functional

Products - Sales revenue increased primarily due to higher

sales volume for coatings product lines attributed to strengthened

demand, particularly in key end markets. Excluding non-core or

non-recurring items, operating earnings declined slightly primarily

due to higher raw material and energy costs, particularly for

propane, partially offset by higher sales volume.

Adhesives & Plasticizers

- Sales revenue increased primarily due to higher sales

volume more than offsetting lower selling prices. Higher sales

volume for adhesives resins was mostly attributed to stronger

end-market demand and customer inventory destocking that negatively

impacted second quarter 2013. Higher sales volume for plasticizers

was primarily attributed to the timing of substitution of phthalate

plasticizers with Eastman non-phthalate plasticizers. Lower selling

prices were primarily due to continued competitive pressure

attributed to increased adhesives resins supply and weakened

plasticizers demand in Asia Pacific and Europe. Excluding non-core

or non-recurring items in second quarter 2013, operating earnings

increased primarily due to higher sales volume, higher capacity

utilization that resulted in lower unit costs, and lower operating

costs that included targeted cost reductions, partially offset by

lower selling prices.

Advanced Materials

- Sales revenue increased slightly as higher sales volume

for premium products such as interlayers with acoustic properties

and Eastman TritanTM copolyester

was mostly offset by lower sales volume for core products such as

Flexvue® coated

films. Excluding non-core or non-recurring items in the

second quarter 2013, operating earnings for second quarter 2014

were relatively unchanged compared to second quarter 2013, as lower

raw material and energy costs and improved product mix were offset

by costs of the unplanned shutdown at the Kingsport site and other

costs.

Fibers - Sales

revenue increased due to higher selling prices and sales of acetate

flake to Eastman's China acetate tow joint venture more than

offsetting lower acetate tow sales volume. The lower acetate

tow sales volume was primarily due to additional industry capacity

including the acetate tow joint venture. Operating earnings

increased as higher selling prices, sales of acetate flake to the

China joint venture, and lower raw material and energy costs more

than offset lower acetate tow sales volume and higher operating

costs. The higher operating costs were the result of lower capacity

utilization that resulted in higher unit costs and costs related to

the unplanned shutdown at the Kingsport site.

Specialty Fluids &

Intermediates - Sales revenue declined partly due to

a decrease in sales volume resulting from the first-quarter

weather-related outage at the Longview, Texas site and the

second-quarter unplanned shutdown at the Kingsport site. Sales

revenue was also negatively impacted by lower sales volume for

intermediates product lines resulting from increased use of

intermediates in the manufacture of higher-value downstream

derivatives in other segments. Selling prices and sales volume for

acetyl-based product lines increased compared to second quarter

2013. Excluding non-core or non-recurring items, operating earnings

decreased primarily due to lower sales volume, higher raw material

and energy costs, particularly for propane, and costs of the

unplanned shutdown at the Kingsport site.

Cash Flow

Eastman generated $419 million in cash from

operating activities during second quarter 2014 primarily due to

strong net earnings. During the quarter, the company completed

the acquisition of the aviation turbine oil business from BP plc,

which is now a part of the Specialty Fluids & Intermediates

segment, and repurchased shares for a total of $100 million. In

addition, the company issued $500 million of 30-year public debt at

an interest rate of 4.65%, with proceeds to be used for general

corporate purposes.

Outlook

Commenting on the outlook for full year 2014,

Costa said, "We delivered solid earnings in the first half of the

year despite a number of headwinds. Looking forward, we remain

confident in our ability to generate strong year over year earnings

growth. As a result, we continue to expect 2014 earnings per share

to be between $6.70 and $7.00." Non-core and non-recurring items

are excluded from the earnings per share projection.

The earnings for 2013, 2012, 2011, 2010, and 2009

referenced in the second paragraph of this release are non-GAAP and

exclude the non-core or non-recurring items detailed, with

reconciliation to GAAP earnings, in the "Management's Discussion

and Analysis of Financial Condition and Results of Operations"

sections of the company's Annual Reports on Form 10-K for 2013,

2012, and 2011.

Eastman will host a conference call with industry

analysts on July 29, 2014 at 8:00 a.m. ET. To listen to the

live webcast of the conference call and view the accompanying

slides, go to www.investors.eastman.com, Events &

Presentations. To listen via telephone, the dial-in number is

913-312-0690, passcode number 1629560. A web replay, a replay

in downloadable MP3 format, and the accompanying slides will be

available at www.investors.eastman.com, Events &

Presentations. A telephone replay will be available

continuously from 11:00 a.m. ET, July 29, to 11:00 a.m. ET, August

5, at 888-203-1112 or 719-457-0820, passcode 1629560.

Forward-Looking

Statements: This news release includes forward-looking

statements concerning current expectations for future global and

regional economic conditions; company manufacturing capacity

additions, mix of products sold, and capital expenditures,

acquisitions, debt, dividends, and stock repurchases; non-core or

non-recurring costs, charges, income, and gains; and company and

segment revenue, earnings, and cash flow for full year

2014. Such expectations are based upon certain preliminary

information, internal estimates, and management assumptions,

expectations, and plans, and are subject to a number of risks and

uncertainties inherent in projecting future conditions, events, and

results. Actual results could differ materially from

expectations expressed in the forward-looking statements if one or

more of the underlying assumptions or expectations prove to be

inaccurate or are unrealized. Important factors that could cause

actual results to differ materially from such expectations are and

will be detailed in the company's filings with the Securities and

Exchange Commission, including the Form 10-Q filed for first

quarter 2014 available, and the Form 10-Q to be filed for second

quarter 2014 and to be available, on the Eastman web site at

www.eastman.com in the Investors, SEC filings section.

Eastman is a global specialty chemical company

that produces a broad range of products found in items people use

every day. With a portfolio of specialty businesses, Eastman works

with customers to deliver innovative products and solutions while

maintaining a commitment to safety and sustainability. Its

market-driven approaches take advantage of world-class technology

platforms and leading positions in attractive end-markets such as

transportation, building and construction and consumables. Eastman

focuses on creating consistent, superior value for all

stakeholders. As a globally diverse company, Eastman serves

customers in approximately 100 countries and had 2013 revenues of

approximately $9.4 billion. The company is headquartered in

Kingsport, Tennessee, USA and employs approximately 14,000 people

around the world. For more information, visit www.eastman.com.

# # #

Contacts:

Media: Tracy Kilgore

423-224-0498 / tjkilgore@eastman.com

Investors: Greg Riddle

212-835-1620 / griddle@eastman.com

Q2 2014 Financial Tables

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Eastman Chemical Company via Globenewswire

HUG#1840850

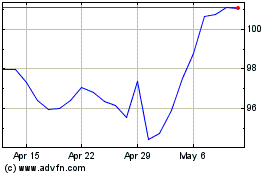

Eastman Chemical (NYSE:EMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

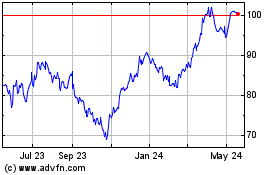

Eastman Chemical (NYSE:EMN)

Historical Stock Chart

From Apr 2023 to Apr 2024