Perseus Mining Limited: Activity Report for June 2014 Quarter

29 July 2014 - 8:40AM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Perseus Mining Limited ("Perseus" or the "Company") (TSX:PRU)(ASX:PRU) reports

on its activities for the three month period ended June 30, 2014 (the

"Quarter"). An executive summary is provided below. However, full details of

activities in the June Quarter, including reconciled production and all-in site

cash costs, are included in the Company's June 2014 Quarterly Activity Report

released to the market on July 29, 2014. The full report is available for

download from www.perseusmining.com, www.asx.com.au and www.sedar.com.

Edikan Operations

-- Operating efficiency at Edikan continued to improve during the Quarter,

particularly in terms of gold recovery and mill run time (excluding down

time caused by abnormal events);

-- Gold production totalled 42,543ozs, 86,330ozs and 180,519ozs for the

Quarter, Half Year and full financial year respectively;

-- Production costs and all-in site costs were impacted by unscheduled

processing downtime and repairs to fire damage and as a result,

production and all-in site costs averaged US$1,150/oz and US$1,324/oz

for the Quarter respectively;

-- 45,767ozs of gold were sold during the Quarter at an average sales price

of US$1,333/oz;

EGM Production and Cost Guidance

-- Production and cost guidance for the EGM for the forthcoming six months

to 31 December 2014 ("December 2014 Half Year") and the financial year

ending 30 June 2015 ("FY2015") are as follows:

FY 2015 Production and Cost Guidance

----------------------------------------------------------------------------

Parameter Units December 2014 June 2015 FY2015

Half Year Half Year

----------------------------------------------------------------------------

Gold Production Ounces 95,000-105,000 115,000-125,000 210,000-230,000

All-In Site

Cash Costs US$/oz 1,160-1280 1,050-1,150 1,100-1,200

----------------------------------------------------------------------------

-- This forecast represents a material improvement in gold production in

FY2015 relative to FY2014 which is expected to be driven largely by

improved head grade of ore processed in the second six months of FY2015

as high grade ore is mined from the AG pits.

Exploration - Edikan

-- High grade drill intercepts recorded from a 37 drill hole programme on

the Bokitsi South deposit confirm the potential for high grade mill feed

to be mined earlier than envisaged in the current Edikan Life of Mine

Plan;

Development - Sissingue Gold Project, Cote d'Ivoire

-- Metallurgical test work and preliminary economic assessment of

alternative project configurations and flow sheets has been completed

and a selection of the preferred process route for detailed feasibility

assessment is imminent;

Corporate

-- VAT refunds totalling GH cents47.6M (USD15.8M) including GH cents30.0M

during the Quarter and GH cents17.6M subsequent to the end of Quarter,

have been received from the Ghanaian government;

-- Available cash and bullion of $48.7M as at 30 June 2014 (excluding

$10.0M of funds in escrow and GH cents17.6M VAT receivable received

after end of the Quarter);

-- 125,000ozs of gold sold forward at an average price of US$1,468/oz,

valued at US$19.0M at year end.

Program for the September 2014 Quarter

Edikan Gold Mine

-- Produce gold at a total all-in site cash cost that is in line with Half

Year guidance;

-- Continue to fine-tune plant metallurgical performance and maximise SAG

mill throughput;

-- Continue training of operating and maintenance staff;

-- Continue drilling to delineate potential higher grade mill feed at

Mampong South-west, approximately 1 km south of the Abnabna pit, and

exploration targets on the Agyakusu licence; and

-- Continue to implement business improvement initiatives across all

departments of the EGM.

Sissingue Gold Mine Development Project

-- Update Feasibility Study for the SGP based on preferred development

configuration and flow sheet;

-- Re-convene discussions with the Ivorian government about a Mining

Convention covering the revised SGP; and

-- Continue exploration for Mineral Resources on Mahale exploration licence

and the Sissingue exploitation permit.

Jeffrey A Quartermaine, Managing Director and Chief Executive Officer

Caution Regarding Forward-Looking Information: This report contains

forward-looking information which is based on the assumptions, estimates,

analysis and opinions of management made in light of its experience and its

perception of trends, current conditions and expected developments, as well as

other factors that management of the Company believes to be relevant and

reasonable in the circumstances at the date that such statements are made, but

which may prove to be incorrect. Assumptions have been made by the Company

regarding, among other things: the price of gold, continuing commercial

production at the Edikan Gold Mine without any major disruption, development of

a mine at Tengrela, the receipt of required governmental approvals, the accuracy

of capital and operating cost estimates, the ability of the Company to operate

in a safe, efficient and effective manner and the ability of the Company to

obtain financing as and when required and on reasonable terms. Readers are

cautioned that the foregoing list is not exhaustive of all factors and

assumptions which may have been used by the Company. Although management

believes that the assumptions made by the Company and the expectations

represented by such information are reasonable, there can be no assurance that

the forward-looking information will prove to be accurate. Forward-looking

information involves known and unknown risks, uncertainties, and other factors

which may cause the actual results, performance or achievements of the Company

to be materially different from any anticipated future results, performance or

achievements expressed or implied by such forward-looking information. Such

factors include, among others, the actual market price of gold, the actual

results of current exploration, the actual results of future exploration,

changes in project parameters as plans continue to be evaluated, as well as

those factors disclosed in the Company's publicly filed documents. The Company

believes that the assumptions and expectations reflected in the forward-looking

information are reasonable. Assumptions have been made regarding, among other

things, the Company's ability to carry on its exploration and development

activities, the timely receipt of required approvals, the price of gold, the

ability of the Company to operate in a safe, efficient and effective manner and

the ability of the Company to obtain financing as and when required and on

reasonable terms. Readers should not place undue reliance on forward-looking

information. Perseus does not undertake to update any forward-looking

information, except in accordance with applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Perseus Mining Limited

Jeff Quartermaine

Managing Director

+61 8 6144 1700

jeff.quartermaine@perseusmining.com (Perth)

Perseus Mining Limited

Nathan Ryan

Investor Relations

+61 (0) 420 582 887

nathan.ryan@nwrcommunications.com.au (Melbourne)

www.perseusmining.com

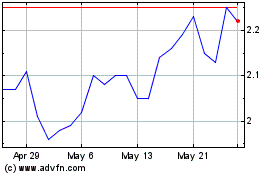

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Mar 2024 to Apr 2024

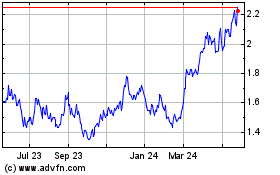

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Apr 2023 to Apr 2024