RockTenn (NYSE:RKT) today reported earnings for the quarter ended

June 30, 2014 of $1.82 per diluted share and adjusted earnings of

$1.97 per diluted share.

| |

|

|

|

|

| |

Three Months |

Three Months |

Nine Months |

Nine Months |

| |

Ended |

Ended |

Ended |

Ended |

| |

June 30, |

June 30, |

June 30, |

June 30, |

| |

2014 |

2013 |

2014 |

2013 |

| |

|

|

|

|

| Earnings per diluted

share |

$1.82 |

$1.91 |

$4.46 |

$7.55 |

| |

|

|

|

|

| Alternative fuel mixture credit tax reserve

adjustment |

― |

― |

― |

(3.47) |

| Restructuring and other costs and operating

losses and transition costs due to plant closures |

0.13 |

0.25 |

0.42 |

0.55 |

| Acquisition inventory step-up |

0.02 |

― |

0.02 |

― |

| |

|

|

|

|

| Adjusted earnings per diluted

share |

$1.97 |

$2.16 |

$4.90 |

$4.63 |

Third Quarter Results

- Net sales of $2,531 million for the third quarter of fiscal

2014 increased $83 million compared to the third quarter of fiscal

2013 primarily as a result of the Tacoma Mill and specialty display

acquisitions completed in May 2014 and December 2013, respectively,

and higher selling prices. Segment income of $263 million decreased

$12 million compared to the prior year quarter primarily due to

increased commodity and other costs which exceeded the impact of

higher selling prices, productivity improvements and income

from the acquisitions.

- RockTenn's restructuring and other costs and operating losses

and transition costs due to plant closures for the third quarter of

fiscal 2014 were $0.13 per diluted share after-tax. These costs

primarily consisted of $9 million of pre-tax integration and

acquisition costs and $5 million of pre-tax facility closure

charges associated with previously closed facilities.

Chief Executive Officer's Statement

RockTenn Chief Executive Officer, Steve Voorhees, stated, "Our

team delivered another quarter of solid operating results as

measured by our adjusted earnings per share of $1.97 and free cash

flow per share of $2.82. Over the last 12 months credit

agreement EBITDA has increased to $1.6 billion, a 19% increase

compared to last year and free cash flow has increased by $3.24 to

$12.39 per share, a 35% increase, both of which reflect the

continued strong operating performance of our team. Our balance

sheet continues to provide us with the ability to make sound

capital allocation decisions and continue to generate attractive

free cash flow returns."

Segment Results

Mill and Converting Tons Shipped

Corrugated Packaging segment shipments of approximately

1,962,000 tons increased 2.1% or approximately 40,000 tons compared

to the prior year. In the quarter, we took approximately 89,000

tons of major maintenance and capital outage downtime. Consumer

Packaging segment shipments of approximately 394,000 tons decreased

0.5% or approximately 2,000 tons compared to the prior year

quarter.

Corrugated Packaging Segment

Corrugated Packaging segment net sales increased $55 million to

$1,774 million and segment income decreased $16 million to $180

million in the third quarter of fiscal 2014 compared to the prior

year quarter. The increased sales are primarily related to the

Tacoma Mill acquisition and higher selling prices whose impact on

segment income was more than offset by higher commodity and other

costs. Segment income in the third quarter of fiscal 2014 included

the recognition of a $9 million gain related to the recording of

additional value of spare parts at our containerboard mills

acquired in the Smurfit-Stone acquisition. Segment income in the

third quarter of fiscal 2013 included an $11.4 million benefit

related to the restructuring and extension of our Jacksonville

recycled containerboard mill's steam supply contract.

Corrugated Packaging segment EBITDA margin was 17.4% for the

third quarter of fiscal 2014 down 70 basis points from the prior

year quarter.

Consumer Packaging Segment

Consumer Packaging segment net sales increased $15 million to

$497 million in the third quarter of fiscal 2014 compared to the

prior year quarter due to higher selling prices. Segment income of

$60 million in the third quarter of fiscal 2014 was impacted

primarily by the higher selling prices which were more than offset

by the impact of lower volumes and higher commodity costs and other

items. Consumer Packaging segment EBITDA margin was 16.5% for the

third quarter of fiscal 2014 down slightly compared to the prior

year quarter.

Merchandising Displays Segment

Merchandising Displays segment net sales increased $59 million

over the prior year third quarter to $225 million primarily due to

higher volumes and the impact of a specialty display acquisition

completed in December 2013. Segment income increased $4 million in

the third quarter of fiscal 2014 compared to the prior year quarter

primarily due to the impact of higher volumes which were partially

offset by higher commodity and other items including higher costs

associated with supporting and onboarding new

business. Merchandising Displays segment EBITDA margin was

11.3% for the third quarter of fiscal 2014 down 70 basis points

from the prior year quarter.

Recycling Segment

Recycling segment net sales decreased $38 million over the prior

year third quarter to $85 million primarily due to lower volumes

and recovered fiber prices as a result of soft global markets and

seven collection facility closures during the past year. Segment

income was relatively flat in the third quarter of fiscal 2014

compared to the prior year quarter primarily as the impact of lower

volumes and market conditions were partially offset by the impact

of cost structure improvements.

Cash Provided From Operating, Financing and Investing

Activities

Cash from operations was $218 million in the third quarter of

fiscal 2014 after pension and postretirement funding more than

expense of $131 million compared to cash from operations of $270

million in the prior year quarter after pension and postretirement

funding more than expense of $45 million. Due primarily to

the $341 million associated with the May 16, 2014 acquisition of

the Tacoma Mill, Net Debt (as defined) increased $312 million in

the June quarter to $2.95 billion and at June 30, 2014, our

Leverage Ratio (as defined) was 1.90 times. Total debt was

$2.99 billion at June 30, 2014. Additionally during the quarter, we

invested $151 million in capital expenditures, returned $25 million

in dividends to our shareholders and repurchased $21 million of

common stock.

Conference Call

We will host a conference call to discuss our results of

operations for the third quarter of fiscal 2014 and other topics

that may be raised during the discussion at 9:00 a.m., Eastern

Time, on July 30, 2014. The conference call will be webcast live

with an accompanying slide presentation, along with a copy of this

press release, at www.rocktenn.com.

Investors who wish to participate in the webcast via

teleconference should dial 888-790-4710 (inside the U.S.) or

773-756-0961 (outside the U.S.) at least 15 minutes prior to the

start of the call and enter the passcode ROCKTENN. Replays of

the call will be available through August 13, 2014 and can be

accessed at 866-351-2785 (U.S. callers) and 203-369-0055 (outside

the U.S.).

About RockTenn

RockTenn (NYSE:RKT) is one of North America's leading providers

of packaging solutions and manufacturers of containerboard and

paperboard. RockTenn's 26,000 employees are committed to exceeding

their customers' expectations – every time. The Company operates

locations in the United States, Canada, Mexico, Chile and

Argentina. For more information, visit www.rocktenn.com.

Cautionary Statements

Statements in this release that do not relate strictly to

historical facts are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are based on our current expectations,

beliefs, plans or forecasts and use words such as will, estimate,

anticipate, project, intend, or expect, or refer to future time

periods, and include statements made in this report regarding,

among other things, our belief that our balance sheet provides us

with the ability to make sound capital allocation decisions and

continue to generate attractive free cash flow returns. These

statements are subject to certain risks and uncertainties including

with respect to our expectations regarding economic, competitive

and market conditions generally; expected volumes and price levels

of purchases by customers; fiber and energy costs; costs associated

with facility closures; competitive conditions in our businesses;

and possible adverse actions of our customers, our competitors and

suppliers. These expectations are based on assumptions that

management believes are reasonable; however, undue reliance should

not be placed on these forward-looking statements because these

risks and uncertainties could cause actual results to differ

materially from those contained in any forward-looking statements.

There are many other factors and uncertainties that impact these

forward-looking statements that we cannot predict accurately,

including our ability to achieve benefits from the Smurfit-Stone

acquisition, including synergies, performance improvements and

successful implementation of capital projects. Further, our

business is subject to a number of general risks that would affect

any such forward-looking statements including, among others,

decreases in demand for our products; increases in energy, raw

materials, shipping and capital equipment costs; reduced supply of

raw materials; fluctuations in selling prices and volumes; intense

competition; the potential loss of certain key customers; changes

in environmental and other governmental regulation; and adverse

changes in general market and industry conditions. These risks are

more particularly described in our filings with the Securities and

Exchange Commission, including under the caption

"Business―Forward-Looking Information" and "Risk Factors" in our

Annual Report on Form 10-K for the fiscal year ended September 30,

2013. The information contained in this release speaks as of the

date hereof and we do not undertake any obligation to update this

information as future events unfold.

| |

| ROCK-TENN

COMPANY |

| CONDENSED CONSOLIDATED

STATEMENTS OF INCOME |

|

(UNAUDITED) |

| (IN MILLIONS, EXCEPT

PER SHARE AMOUNTS) |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

FOR THE THREE MONTHS ENDED |

FOR THE NINE MONTHS ENDED |

| |

June 30, |

June 30, |

June 30, |

June 30, |

| |

2014 |

2013 |

2014 |

2013 |

| |

|

|

|

|

| |

|

|

|

|

| NET SALES |

$ 2,530.9 |

$ 2,448.3 |

$ 7,287.1 |

$ 7,060.3 |

| |

|

|

|

|

| Cost of Goods Sold |

2,041.3 |

1,951.6 |

5,922.5 |

5,768.9 |

| |

|

|

|

|

| |

|

|

|

|

| Gross Profit |

489.6 |

496.7 |

1,364.6 |

1,291.4 |

| Selling, General and Administrative

Expenses |

245.3 |

243.9 |

725.6 |

704.3 |

| Restructuring and Other Costs, net |

13.3 |

23.5 |

45.1 |

52.0 |

| |

|

|

|

|

| |

|

|

|

|

| Operating Profit |

231.0 |

229.3 |

593.9 |

535.1 |

| Interest Expense |

(23.9) |

(25.6) |

(71.1) |

(81.9) |

| Loss on Extinguishment of Debt |

-- |

-- |

-- |

(0.3) |

| Interest Income and Other Income (Expense),

net |

0.1 |

(1.8) |

(0.9) |

(1.9) |

| Equity in Income of Unconsolidated

Entities |

4.1 |

1.2 |

7.3 |

2.9 |

| |

|

|

|

|

| |

|

|

|

|

| INCOME BEFORE INCOME

TAXES |

211.3 |

203.1 |

529.2 |

453.9 |

| |

|

|

|

|

| Income Tax (Expense) Benefit |

(76.9) |

(61.4) |

(200.7) |

100.3 |

| |

|

|

|

|

| |

|

|

|

|

| CONSOLIDATED NET INCOME |

134.4 |

141.7 |

328.5 |

554.2 |

| |

|

|

|

|

| |

|

|

|

|

| Less: Net Income Attributable to

Noncontrolling Interests |

(1.1) |

(1.6) |

(2.7) |

(3.4) |

| |

|

|

|

|

| |

|

|

|

|

| NET INCOME ATTRIBUTABLE TO

ROCK-TENN COMPANY SHAREHOLDERS |

$ 133.3 |

$ 140.1 |

$ 325.8 |

$ 550.8 |

| |

|

|

|

|

| |

|

|

|

|

| Computation of diluted earnings

per share under the two-class method (in millions, except per share

data): |

| |

|

|

|

|

| Net income attributable to Rock-Tenn

Company shareholders |

$ 133.3 |

$ 140.1 |

$ 325.8 |

$ 550.8 |

| Less: Distributed and

undistributed income available to participating

securities |

-- |

-- |

(0.1) |

(0.1) |

| Distributed and undistributed income

available to Rock-Tenn Company shareholders |

$ 133.3 |

$ 140.1 |

$ 325.7 |

$ 550.7 |

| |

|

|

|

|

| Diluted weighted average shares

outstanding |

73.0 |

73.2 |

73.1 |

73.0 |

| |

|

|

|

|

| Diluted earnings per share |

$ 1.82 |

$ 1.91 |

$ 4.46 |

$ 7.55 |

| |

| |

| ROCK-TENN

COMPANY |

| SEGMENT

INFORMATION |

|

(UNAUDITED) |

| (IN

MILLIONS) |

| |

|

|

|

|

| |

|

|

|

|

| |

FOR THE THREE MONTHS ENDED |

FOR THE NINE MONTHS ENDED |

| |

June 30, |

June 30, |

June 30, |

June 30, |

| |

2014 |

2013 |

2014 |

2013 |

| |

|

|

|

|

| NET SALES: |

|

|

|

|

| |

|

|

|

|

| Corrugated Packaging |

$ 1,774.2 |

$ 1,719.3 |

$ 5,077.8 |

$ 4,917.3 |

| Consumer Packaging |

497.0 |

482.1 |

1,458.4 |

1,403.2 |

| Merchandising Displays |

225.1 |

166.4 |

622.7 |

490.4 |

| Recycling |

85.4 |

123.6 |

275.1 |

381.1 |

| Intersegment Eliminations |

(50.8) |

(43.1) |

(146.9) |

(131.7) |

| |

|

|

|

|

| TOTAL NET SALES |

$ 2,530.9 |

$ 2,448.3 |

$ 7,287.1 |

$ 7,060.3 |

| |

|

|

|

|

| SEGMENT INCOME: |

|

|

|

|

| Corrugated Packaging |

$ 179.8 |

$ 196.1 |

$ 470.6 |

$ 441.3 |

| Consumer Packaging |

59.6 |

59.1 |

166.5 |

164.5 |

| Merchandising Displays |

21.4 |

17.2 |

57.7 |

41.7 |

| Recycling |

2.1 |

2.0 |

5.0 |

9.8 |

| |

|

|

|

|

| TOTAL SEGMENT

INCOME |

$ 262.9 |

$ 274.4 |

$ 699.8 |

$ 657.3 |

| |

|

|

|

|

| Restructuring and Other Costs, net |

(13.3) |

(23.5) |

(45.1) |

(52.0) |

| Non-Allocated Expenses |

(14.5) |

(20.4) |

(53.5) |

(67.3) |

| Interest Expense |

(23.9) |

(25.6) |

(71.1) |

(81.9) |

| Loss on Extinguishment of Debt |

-- |

-- |

-- |

(0.3) |

| Interest Income and Other Income (Expense),

net |

0.1 |

(1.8) |

(0.9) |

(1.9) |

| |

|

|

|

|

| INCOME BEFORE INCOME

TAXES |

$ 211.3 |

$ 203.1 |

$ 529.2 |

$ 453.9 |

| |

| |

| ROCK-TENN

COMPANY |

| CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS |

|

(UNAUDITED) |

| (IN

MILLIONS) |

| |

|

|

|

|

| |

FOR THE THREE MONTHS

ENDED |

FOR THE NINE MONTHS ENDED |

| |

June 30, |

June 30, |

June 30, |

June 30, |

| |

2014 |

2013 |

2014 |

2013 |

| |

|

|

|

|

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

|

| Consolidated net income |

$ 134.4 |

$ 141.7 |

$ 328.5 |

$ 554.2 |

| |

|

|

|

|

| Adjustments to reconcile consolidated net

income to net cash provided by operating activities: |

|

|

|

|

| Depreciation and amortization |

146.7 |

132.4 |

433.3 |

409.7 |

| Deferred income tax expense

(benefit) |

61.8 |

53.4 |

172.2 |

(115.3) |

| Loss on extinguishment of debt |

-- |

-- |

-- |

0.3 |

| Share-based compensation expense |

9.8 |

13.0 |

29.4 |

35.7 |

| Loss (Gain) on disposal of plant and

equipment and other, net |

1.6 |

0.9 |

(0.7) |

(4.6) |

| Equity in income of unconsolidated

entities |

(4.1) |

(1.2) |

(7.3) |

(2.9) |

| Pension and other postretirement funding

more than expense |

(130.8) |

(45.0) |

(217.3) |

(87.5) |

| Impairment adjustments and other non-cash

items |

1.9 |

9.1 |

7.8 |

15.2 |

| Changes in operating assets and

liabilities, net of acquisitions: |

|

|

|

|

| Accounts receivable |

(39.6) |

(46.4) |

104.0 |

(41.3) |

| Inventories |

16.0 |

(17.2) |

(22.1) |

(64.2) |

| Other assets |

6.5 |

-- |

(27.4) |

(34.7) |

| Accounts payable |

(39.7) |

(1.0) |

(45.5) |

34.0 |

| Income taxes |

19.2 |

4.9 |

4.8 |

(8.8) |

| Accrued liabilities and other |

34.3 |

25.4 |

(10.6) |

32.8 |

| |

|

|

|

|

| NET CASH PROVIDED BY OPERATING

ACTIVITIES |

218.0 |

270.0 |

749.1 |

722.6 |

| INVESTING ACTIVITIES: |

|

|

|

|

| Capital expenditures |

(150.6) |

(113.1) |

(377.7) |

(307.1) |

| Cash paid for purchase of businesses, net of

cash acquired |

(340.7) |

(6.2) |

(400.7) |

(6.2) |

| Return of capital from unconsolidated

entities |

6.4 |

0.2 |

6.8 |

0.8 |

| Proceeds from the sale of subsidiaries |

3.0 |

-- |

6.8 |

-- |

| Proceeds from sale of property, plant and

equipment |

6.5 |

4.6 |

19.8 |

11.9 |

| Proceeds from property, plant and equipment

insurance settlement |

1.5 |

2.0 |

4.9 |

7.7 |

| |

|

|

|

|

| NET CASH USED FOR INVESTING

ACTIVITIES |

(473.9) |

(112.5) |

(740.1) |

(292.9) |

| FINANCING ACTIVITIES: |

|

|

|

|

| Additions to revolving credit facilities |

60.1 |

40.4 |

202.9 |

94.9 |

| Repayments of revolving credit

facilities |

(46.2) |

(20.4) |

(199.7) |

(72.2) |

| Additions to debt |

420.0 |

31.0 |

592.7 |

226.2 |

| Repayments of debt |

(120.3) |

(196.6) |

(450.0) |

(620.4) |

| Commercial card program |

0.8 |

-- |

0.8 |

-- |

| Debt issuance costs |

(0.2) |

(0.2) |

(0.4) |

(1.8) |

| Cash paid for debt extinguishment costs |

-- |

-- |

-- |

(0.1) |

| Issuances of common stock, net of related

minimum tax withholdings |

0.9 |

1.6 |

(12.9) |

1.0 |

| Purchases of common stock |

(20.8) |

-- |

(73.8) |

-- |

| Excess tax benefits from share-based

compensation |

0.4 |

0.6 |

14.9 |

4.8 |

| (Repayments to) advances from unconsolidated

entity |

(4.8) |

0.6 |

(2.8) |

0.9 |

| Cash dividends paid to shareholders |

(25.1) |

(21.6) |

(76.0) |

(53.7) |

| Cash distributions to noncontrolling

interests |

(1.2) |

(1.6) |

(1.5) |

(3.9) |

| |

|

|

|

|

| NET CASH PROVIDED BY (USED FOR)

FINANCING ACTIVITIES |

263.6 |

(166.2) |

(5.8) |

(424.3) |

| Effect of exchange rate changes on cash and

cash equivalents |

0.1 |

(0.3) |

0.4 |

(0.3) |

| INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS |

7.8 |

(9.0) |

3.6 |

5.1 |

| Cash and cash equivalents at beginning of

period |

32.2 |

51.3 |

36.4 |

37.2 |

| |

|

|

|

|

| Cash and cash equivalents at

end of period |

$ 40.0 |

$ 42.3 |

$ 40.0 |

$ 42.3 |

| SUPPLEMENTAL DISCLOSURE OF

CASH FLOW INFORMATION: |

|

|

|

|

| Cash paid during the period for: |

|

|

|

|

| Income taxes, net of refunds |

$ (4.0) |

$ 3.1 |

$ 10.6 |

$ 15.3 |

| Interest, net of amounts

capitalized |

6.3 |

8.4 |

49.4 |

60.4 |

| |

| ROCK-TENN

COMPANY |

| CONDENSED CONSOLIDATED

BALANCE SHEETS |

|

(UNAUDITED) |

| (IN

MILLIONS) |

| |

|

|

| |

June 30, |

September 30, |

| |

2014 |

2013 |

| ASSETS |

| CURRENT ASSETS: |

|

|

| Cash and cash equivalents |

$ 40.0 |

$ 36.4 |

| Restricted cash |

8.9 |

9.3 |

| Accounts receivable (net of allowances of

$24.1 and $26.8) |

1,080.0 |

1,134.9 |

| Inventories |

964.8 |

937.9 |

| Other current assets |

280.7 |

297.9 |

| |

|

|

| TOTAL CURRENT

ASSETS |

2,374.4 |

2,416.4 |

| |

|

|

| Property, plant and equipment at cost: |

|

|

| Land and buildings |

1,258.3 |

1,203.1 |

| Machinery and equipment |

6,977.5 |

6,467.8 |

| Transportation equipment |

15.7 |

13.8 |

| Leasehold improvements |

25.0 |

24.7 |

| |

8,276.5 |

7,709.4 |

| Less accumulated depreciation and

amortization |

(2,463.4) |

(2,154.7) |

| Net property, plant and equipment |

5,813.1 |

5,554.7 |

| Goodwill |

1,914.1 |

1,862.1 |

| Intangibles, net |

685.0 |

699.4 |

| Other assets |

184.1 |

200.8 |

| |

|

|

| TOTAL ASSETS |

$ 10,970.7 |

$ 10,733.4 |

| LIABILITIES AND

EQUITY |

| CURRENT LIABILITIES: |

|

|

| Current portion of debt |

$ 63.1 |

$ 2.9 |

| Accounts payable |

787.1 |

802.1 |

| Accrued compensation and benefits |

210.4 |

249.0 |

| Other current liabilities |

206.9 |

189.4 |

| |

|

|

| TOTAL CURRENT

LIABILITIES |

1,267.5 |

1,243.4 |

| |

|

|

| Long-term debt due after one year |

2,923.3 |

2,841.9 |

| Pension liabilities, net of current

portion |

769.1 |

975.2 |

| Postretirement medical liabilities, net of

current portion |

118.1 |

118.3 |

| Deferred income taxes |

1,191.8 |

1,063.1 |

| Other long-term liabilities |

168.5 |

165.4 |

| Redeemable noncontrolling interests |

14.6 |

13.3 |

| |

|

|

| Total Rock-Tenn Company shareholders'

equity |

4,517.4 |

4,312.3 |

| Noncontrolling interests |

0.4 |

0.5 |

| Total Equity |

4,517.8 |

4,312.8 |

| |

|

|

| TOTAL LIABILITIES AND

EQUITY |

$ 10,970.7 |

$ 10,733.4 |

| |

| Rock-Tenn Company

Quarterly Statistics |

| |

|

|

|

|

|

| Key Financial

Statistics |

| (In Millions, Unless

Otherwise Specified) |

| |

|

|

|

|

|

| |

1st Quarter |

2nd Quarter |

3rd Quarter |

4th Quarter |

Fiscal Year |

| |

|

|

|

|

|

| Net Income Attributable to Rock-Tenn

Company Shareholders |

|

|

|

|

| 2012 |

$ 76.7 |

$ 31.9 |

$ 58.2 |

$ 82.3 |

$ 249.1 |

| 2013 |

86.0 |

324.7 |

140.1 |

176.5 |

727.3 |

| 2014 |

109.7 |

82.8 |

133.3 |

|

|

| |

|

|

|

|

|

| Diluted Earnings per

Share |

|

|

|

|

|

| 2012 |

$ 1.06 |

$ 0.44 |

$ 0.81 |

$ 1.14 |

$ 3.45 |

| 2013 |

1.18 |

4.45 |

1.91 |

2.40 |

9.95 |

| 2014 |

1.50 |

1.13 |

1.82 |

|

|

| |

|

|

|

|

|

| Depreciation &

Amortization |

|

|

|

|

|

| 2012 |

$ 132.7 |

$ 132.6 |

$ 131.4 |

$ 137.6 |

$ 534.3 |

| 2013 |

138.1 |

139.2 |

132.4 |

142.5 |

552.2 |

| 2014 |

143.2 |

143.4 |

146.7 |

|

|

| |

|

|

|

|

|

| Capital Expenditures |

|

|

|

|

|

| 2012 |

$ 81.6 |

$ 120.6 |

$ 146.1 |

$ 104.1 |

$ 452.4 |

| 2013 |

92.0 |

102.0 |

113.1 |

133.3 |

440.4 |

| 2014 |

100.6 |

126.5 |

150.6 |

|

|

| |

|

|

|

|

|

| Mill System Operating

Rates |

|

|

|

|

|

| 2012 |

96.4% |

90.6% |

92.4% |

97.7% |

94.3% |

| 2013 |

97.6% |

96.1% |

98.2% |

97.1% |

97.2% |

| 2014 |

90.4% |

94.3% |

96.7% |

|

|

| |

| Rock-Tenn Company

Quarterly Statistics |

| |

|

|

|

|

|

|

|

|

|

| Segment Operating

Statistics |

| (Sales and Income In

Millions, Shipments in Thousands of Tons Unless Otherwise

Specified) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

1st Quarter |

|

2nd Quarter |

|

3rd Quarter |

|

4th Quarter |

|

Fiscal Year |

| Corrugated Packaging Segment Net

Sales |

|

|

|

|

|

|

|

|

|

| 2012 |

$ 1,522.2 |

|

$ 1,504.7 |

|

$ 1,545.3 |

|

$ 1,597.2 |

|

$ 6,169.4 |

| 2013 |

1,589.8 |

|

1,608.2 |

|

1,719.3 |

|

1,744.4 |

|

6,661.7 |

| 2014 |

1,651.9 |

|

1,651.7 |

|

1,774.2 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Corrugated Packaging Intersegment Net

Sales |

|

|

|

|

|

|

|

|

|

| 2012 |

$ 32.3 |

|

$ 30.4 |

|

$ 29.4 |

|

$ 30.2 |

|

$ 122.3 |

| 2013 |

28.6 |

|

28.9 |

|

27.2 |

|

30.9 |

|

115.6 |

| 2014 |

29.7 |

|

36.5 |

|

34.9 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Corrugated Packaging Segment

Income |

|

|

|

|

|

|

|

|

|

| 2012 |

$ 109.7 |

(1) |

$ 75.3 |

(2) |

$ 73.5 |

(3) |

$ 112.7 |

(4) |

$ 371.2 |

| 2013 |

137.6 |

|

107.6 |

|

196.1 |

|

237.5 |

|

678.8 |

| 2014 |

157.7 |

|

133.1 |

|

182.3 |

(5) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Return On Sales |

|

|

|

|

|

|

|

|

|

| 2012 |

7.2% |

(1) |

5.0% |

(2) |

4.8% |

(3) |

7.1% |

(4) |

6.0% |

| 2013 |

8.7% |

|

6.7% |

|

11.4% |

|

13.6% |

|

10.2% |

| 2014 |

9.5% |

|

8.1% |

|

10.3% |

(5) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Corrugated Packaging Segment

Shipments (6) |

|

|

|

|

|

|

|

|

|

| 2012 |

1,842.3 |

|

1,826.5 |

|

1,884.5 |

|

1,964.1 |

|

7,517.4 |

| 2013 |

1,869.6 |

|

1,860.0 |

|

1,922.2 |

|

1,921.7 |

|

7,573.5 |

| 2014 |

1,803.8 |

|

1,809.5 |

|

1,961.8 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Corrugated Container Shipments - BSF

(7) |

|

|

|

|

|

|

|

|

|

| 2012 |

18.8 |

|

18.9 |

|

19.2 |

|

19.5 |

|

76.4 |

| 2013 |

19.0 |

|

18.7 |

|

19.5 |

|

19.1 |

|

76.3 |

| 2014 |

18.4 |

|

18.2 |

|

18.8 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Corrugated Container Per

Shipping Day - MMSF (7) |

|

|

|

|

|

|

|

|

| 2012 |

312.8 |

|

295.4 |

|

305.5 |

|

308.7 |

|

305.5 |

| 2013 |

310.7 |

|

302.5 |

|

304.9 |

|

302.4 |

|

305.1 |

| 2014 |

301.5 |

|

288.8 |

|

298.2 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| (1) Excludes $0.4 million of

inventory step-up expense. |

| (2) Excludes $6.7 million of

operating losses at the then recently closed Matane, Quebec

containerboard mill. |

| (3) Excludes $0.2 million of

inventory step-up expense. |

| (4) Excludes $0.2 million of

inventory step-up expense. |

| (5) Excludes $2.5 million of

inventory step-up expense. |

| (6) Corrugated Packaging Segment

Shipments are expressed as a tons equivalent which includes

external and intersegment tons shipped from our Corrugated mills

plus Corrugated Container Shipments converted from BSF to tons.

Excludes container shipments in Asia. |

| (7) MMSF - millions of square

feet and BSF - billions of square feet and is included in the

Corrugated Packaging Segment Shipments on a converted basis.

Excludes container shipments in Asia. |

| |

|

|

|

|

|

| Rock-Tenn Company Quarterly

Statistics |

|

|

|

|

|

| |

|

|

|

|

|

| Segment Operating

Statistics |

|

|

|

|

|

| (Sales and Income In

Millions, Shipments in Thousands of Tons Unless Otherwise

Specified) |

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

1st Quarter |

2nd Quarter |

3rd Quarter |

4th Quarter |

Fiscal Year |

| Consumer Packaging Segment Net

Sales |

|

|

|

|

|

| 2012 |

$ 464.9 |

$ 484.1 |

$ 473.9 |

$ 496.4 |

$ 1,919.3 |

| 2013 |

452.8 |

468.3 |

482.1 |

495.5 |

1,898.7 |

| 2014 |

472.1 |

489.3 |

497.0 |

|

|

| |

|

|

|

|

|

| Consumer Packaging Intersegment Net

Sales |

|

|

|

|

|

| 2012 |

$ 6.9 |

$ 6.1 |

$ 5.3 |

$ 7.6 |

$ 25.9 |

| 2013 |

5.1 |

5.4 |

5.2 |

9.4 |

25.1 |

| 2014 |

5.7 |

5.3 |

6.9 |

|

|

| |

|

|

|

|

|

| Consumer Packaging Segment

Income |

|

|

|

|

|

| 2012 |

$ 62.0 |

$ 64.5 |

$ 69.7 |

$ 81.0 |

$ 277.2 |

| 2013 |

54.9 |

50.5 |

59.1 |

66.8 |

231.3 |

| 2014 |

57.6 |

49.3 |

59.6 |

|

|

| |

|

|

|

|

|

| Return on Sales |

|

|

|

|

|

| 2012 |

13.3% |

13.3% |

14.7% |

16.3% |

14.4% |

| 2013 |

12.1% |

10.8% |

12.3% |

13.5% |

12.2% |

| 2014 |

12.2% |

10.1% |

12.0% |

|

|

| |

|

|

|

|

|

| Consumer Packaging Segment Shipments

(1) |

|

|

|

|

|

| 2012 |

370.3 |

377.6 |

384.0 |

382.2 |

1,514.1 |

| 2013 |

368.5 |

380.1 |

396.2 |

403.0 |

1,547.8 |

| 2014 |

378.1 |

386.0 |

394.3 |

|

|

| |

|

|

|

|

|

| Consumer Packaging Converting

Shipments - BSF (2) |

|

|

|

|

|

| 2012 |

5.0 |

5.2 |

5.1 |

5.2 |

20.5 |

| 2013 |

4.9 |

5.2 |

5.3 |

5.3 |

20.7 |

| 2014 |

5.0 |

5.3 |

5.2 |

|

|

| |

|

|

|

|

|

| Consumer Packaging Converting Per

Shipping Day - MMSF (2) |

|

|

|

|

|

| 2012 |

83.5 |

81.0 |

80.6 |

83.1 |

82.0 |

| 2013 |

81.0 |

83.9 |

82.3 |

84.3 |

82.9 |

| 2014 |

82.0 |

83.6 |

83.3 |

|

|

| |

|

|

|

|

|

| (1) Consumer Packaging Segment

Shipments are expressed as a tons equivalent which includes

external and intersegment tons shipped from our Consumer mills plus

Consumer Packaging Converting Shipments converted from BSF to

tons. The shipment data excludes gypsum paperboard liner tons

shipped by Seven Hills Paperboard LLC, our unconsolidated joint

venture, since it is not consolidated. |

| (2) MMSF - millions of square

feet and BSF - billions of square feet and is included in the

Consumer Packaging Segment Shipments on a converted basis. |

| |

| Rock-Tenn Company

Quarterly Statistics |

| |

|

|

|

|

|

|

| Segment Operating

Statistics |

| (Sales and Income In

Millions, Shipments in Thousands of Tons Unless Otherwise

Specified) |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

1st Quarter |

2nd Quarter |

|

3rd Quarter |

4th Quarter |

Fiscal Year |

| Merchandising Displays Segment Net

Sales |

|

|

|

|

|

|

| 2012 |

$ 159.1 |

$ 168.0 |

|

$ 158.5 |

$ 170.4 |

$ 656.0 |

| 2013 |

161.9 |

162.1 |

|

166.4 |

184.2 |

674.6 |

| 2014 |

184.6 |

213.0 |

|

225.1 |

|

|

| |

|

|

|

|

|

|

| Merchandising Displays Intersegment

Net Sales |

|

|

|

|

|

|

| 2012 |

$ 3.7 |

$ 3.8 |

|

$ 3.7 |

$ 3.4 |

$ 14.6 |

| 2013 |

4.2 |

3.9 |

|

4.2 |

4.8 |

17.1 |

| 2014 |

4.4 |

4.6 |

|

3.7 |

|

|

| |

|

|

|

|

|

|

| Merchandising Displays Segment

Income |

|

|

|

|

|

|

| 2012 |

$ 18.3 |

$ 20.0 |

|

$ 14.1 |

$ 17.9 |

$ 70.3 |

| 2013 |

11.8 |

12.7 |

|

17.2 |

22.7 |

64.4 |

| 2014 |

19.3 |

17.3 |

(1) |

21.4 |

|

|

| |

|

|

|

|

|

|

| Return on Sales |

|

|

|

|

|

|

| 2012 |

11.5% |

11.9% |

|

8.9% |

10.5% |

10.7% |

| 2013 |

7.3% |

7.8% |

|

10.3% |

12.3% |

9.5% |

| 2014 |

10.5% |

8.1% |

(1) |

9.5% |

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Recycling Segment Net

Sales |

|

|

|

|

|

|

| 2012 |

$ 171.0 |

$ 172.3 |

|

$ 170.0 |

$ 137.2 |

$ 650.5 |

| 2013 |

126.8 |

130.7 |

|

123.6 |

113.0 |

494.1 |

| 2014 |

99.6 |

90.1 |

|

85.4 |

|

|

| |

|

|

|

|

|

|

| Recycling Intersegment Net

Sales |

|

|

|

|

|

|

| 2012 |

$ 6.6 |

$ 5.9 |

|

$ 6.1 |

$ 6.2 |

$ 24.8 |

| 2013 |

6.3 |

6.2 |

|

6.5 |

6.9 |

25.9 |

| 2014 |

5.8 |

4.1 |

|

5.3 |

|

|

| |

|

|

|

|

|

|

| Recycling Segment

Income |

|

|

|

|

|

|

| 2012 |

$ 3.5 |

$ 4.2 |

|

$ 2.2 |

$ (2.8) |

$ 7.1 |

| 2013 |

4.3 |

3.5 |

|

2.0 |

4.6 |

14.4 |

| 2014 |

0.1 |

2.8 |

|

2.1 |

|

|

| |

|

|

|

|

|

|

| Return on Sales |

|

|

|

|

|

|

| 2012 |

2.0% |

2.4% |

|

1.3% |

(2.0)% |

1.1% |

| 2013 |

3.4% |

2.7% |

|

1.6% |

4.1% |

2.9% |

| 2014 |

0.1% |

3.1% |

|

2.5% |

|

|

| |

|

|

|

|

|

|

| Fiber Reclaimed and

Brokered |

|

|

|

|

|

|

| 2012 |

2,064.5 |

1,996.9 |

|

2,039.7 |

2,014.5 |

8,115.6 |

| 2013 |

1,945.0 |

1,802.5 |

|

1,819.2 |

1,826.6 |

7,393.3 |

| 2014 |

1,562.5 |

1,564.0 |

|

1,573.6 |

|

|

| |

|

|

|

|

|

|

| (1) Excludes $0.3 million of

inventory step-up expense. |

Non-GAAP Financial Measures and

Reconciliations

We have included financial measures that are not prepared in

accordance with GAAP. Any analysis of non-GAAP financial

measures should be used only in conjunction with results presented

in accordance with GAAP. Below, we define the non-GAAP

financial measures, provide a reconciliation of each non-GAAP

financial measure to the most directly comparable financial measure

calculated in accordance with GAAP, and discuss the reasons that we

believe this information is useful to management and may be useful

to investors. These measures may differ from similarly

captioned measures of other companies in our industry. The

following non-GAAP measures are not intended to be substitutes for

GAAP financial measures and should not be used as such.

Net Debt

We have defined the non-GAAP measure "Net Debt" to include the

aggregate debt obligations reflected in our consolidated balance

sheet, less the hedge adjustments resulting from fair value

interest rate derivatives or swaps, if any, and less the balance of

our cash and cash equivalents.

Our management uses Net Debt, along with other factors, to

evaluate our financial condition. We believe that Net Debt is an

appropriate supplemental measure of financial condition and may be

useful to investors because it provides a more complete

understanding of our financial condition before the impact of our

decisions regarding the appropriate use of cash and liquid

investments. Set forth below is a reconciliation of Net Debt to the

most directly comparable GAAP measures, Current Portion of Debt and

Long-term Debt Due After One Year for various periods.

| |

|

|

|

|

|

| (In Millions) |

June 30, |

Mar. 31, |

June 30, |

Mar. 31, |

June 30, |

| |

2014 |

2014 |

2013 |

2013 |

2012 |

| |

|

|

|

|

|

| Current Portion of Debt |

$63.1 |

$32.0 |

$54.1 |

$29.7 |

$257.7 |

| Long-Term Debt Due After One Year |

2,923.3 |

2,634.8 |

2,972.3 |

3,149.3 |

3,102.6 |

| Total Debt |

2,986.4 |

2,666.8 |

3,026.4 |

3,179.0 |

3,360.3 |

| Less: Hedge Adjustments Resulting From

Fair Value Interest Rate Derivatives or Swaps |

― |

― |

― |

― |

(0.2) |

| |

2,986.4 |

2,666.8 |

3,026.4 |

3,179.0 |

3,360.1 |

| Less: Cash and Cash

Equivalents |

(40.0) |

(32.2) |

(42.3) |

(51.3) |

(19.5) |

| Net Debt |

$2,946.4 |

$2,634.6 |

$2,984.1 |

$3,127.7 |

$3,340.6 |

| |

|

|

|

|

|

| Net Debt (Increase) Repayment - QTR |

$ (311.8) |

|

$143.6 |

|

|

| Net Debt (Increase) Repayment - LTM |

$37.7 |

|

$356.5 |

|

|

Cash Generated for Net Debt (Increase) Repayment,

Dividends, Acquisitions/Investments, Stock Repurchases and Pension

Funding in Excess of Expense (or Free Cash Flow)

We have defined the non-GAAP financial measure "Cash Generated

for Net Debt Repayment, Dividends, Acquisitions/Investments, Stock

Repurchases and Pension Funding in Excess of Expense", which we

also refer to as "free cash flow", to be the sum of the non-GAAP

measure Net Debt (Increase) Repayment and the following cash flow

statement line items: Cash dividends paid to shareholders,

Cash paid for the purchase of business, net of cash acquired plus

Investment in unconsolidated entities, Purchases of common stock

and Pension and other postretirement funding more than expense.

"Net Debt (Increase) Repayment" is the difference between Net Debt

at two points in time. Our management uses Cash Generated for Net

Debt (Increase) Repayment, Dividends, Acquisitions/Investments,

Stock Repurchases and Pension Funding in Excess of Expense, along

with other factors, to evaluate our performance. We believe

that this measure is an appropriate supplemental measure of

financial performance and may be useful to investors because it

provides a measure of cash generated for the benefit of

shareholders.

Set forth below is a calculation of Cash Generated for Net Debt

(Increase) Repayment, Dividends, Acquisitions/Investments, Stock

Repurchases and Pension Funding in Excess of Expense for the three

and twelve months ended June 30, 2014 and June 30, 2013 using

the various non-GAAP and GAAP measures referenced above (in

millions):

| |

|

|

| |

Three Months |

Three Months |

| |

Ended |

Ended |

| |

June 30, 2014 |

June 30, 2013 |

| |

|

|

| Net Debt (Increase) Repayment |

$ (311.8) |

$143.6 |

| Cash dividends paid to

shareholders |

25.1 |

21.6 |

| Cash paid for the purchase of business, net

of cash acquired plus Investment in unconsolidated

entities |

340.7 |

6.2 |

| Purchases of common stock |

20.8 |

― |

| Pension and postretirement funding more than

expense |

130.8 |

45.0 |

| Cash Generated for Net Debt (Increase)

Repayment, Dividends, Acquisition/Investments and Pension in Excess

of Expense |

$205.6 |

$216.4 |

| Average diluted shares outstanding |

73.0 |

73.2 |

| Cash Generated for Net Debt (Increase)

Repayment, Dividends, Acquisition /Investments and Pension in

Excess of Expense, Per Share |

$2.82 |

$2.96 |

| |

|

|

| |

|

|

| |

Twelve Months |

Twelve Months |

| |

Ended |

Ended |

| |

June 30, 2014 |

June 30, 2013 |

| |

|

|

| Net Debt Repayment |

$37.7 |

$356.5 |

| Cash dividends paid to

shareholders |

97.6 |

67.8 |

| Cash paid for the purchase of business, net

of cash acquired plus Investment in unconsolidated

entities |

400.9 |

11.3 |

| Purchases of common stock |

73.8 |

― |

| Pension and postretirement funding more than

expense |

296.9 |

230.6 |

| Cash Generated for Net Debt (Increase)

Repayment, Dividends, Acquisition/Investments and Pension in Excess

of Expense |

$906.9 |

$666.2 |

| Average diluted shares outstanding |

73.2 |

72.8 |

| Cash Generated for Net Debt (Increase)

Repayment, Dividends, Acquisition /Investments and Pension in

Excess of Expense, Per Share |

$12.39 |

$9.15 |

Segment EBITDA Margins

Our management uses "Segment EBITDA Margins", along with other

factors, to evaluate our segment performance against our

peers. Management believes that investors also use this

measure to evaluate our performance relative to our peers.

Set forth below is a reconciliation of Segment EBITDA margins to

the most directly comparable GAAP measures, Segment Income and

Segment Net Sales for the quarter ending June 30, 2014:

| |

|

|

|

|

|

|

| (In Millions, except percentages) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

Corrugated Packaging |

Consumer Packaging |

Merchandising Displays |

Recycling |

Corporate / Other |

Consolidated |

| |

|

|

|

|

|

|

| Segment Net Sales |

$1,774.2 |

$497.0 |

$225.1 |

$85.4 |

$ (50.8) |

$2,530.9 |

| Less: Trade Sales |

(67.5) |

— |

— |

— |

— |

(67.5) |

| Adjusted Segment Sales |

$1,706.7 |

$497.0 |

$225.1 |

$85.4 |

$ (50.8) |

$2,463.4 |

| |

|

|

|

|

|

|

| Segment Income (1) |

$182.3 |

$59.6 |

$21.4 |

$2.1 |

|

$265.4 |

| Depreciation and Amortization |

114.0 |

22.4 |

4.0 |

2.7 |

3.6 |

146.7 |

| EBITDA |

$296.3 |

$82.0 |

$25.4 |

$4.8 |

|

|

| |

|

|

|

|

|

|

| Segment EBITDA Margins |

17.4% |

16.5% |

11.3% |

5.6% |

|

|

| |

|

|

|

|

|

|

| (1) Corrugated Packaging

segment excludes $2.5 million of inventory step-up expense. |

Credit Agreement EBITDA and Total Funded

Debt

"Credit Agreement EBITDA" is calculated in accordance with the

definition contained in our Credit Facility. Credit Agreement

EBITDA is generally defined as Consolidated Net Income plus:

consolidated interest expense, income taxes of the consolidated

companies determined in accordance with GAAP, depreciation and

amortization expense of the consolidated companies determined in

accordance with GAAP, loss on extinguishment of debt and financing

fees, certain non-cash and cash charges incurred, including certain

restructuring and other costs, acquisition and integration costs,

charges and expenses associated with the write-up of inventory

acquired and other items.

"Total Funded Debt" is calculated in accordance with the

definition contained in our Credit Facility. Total Funded Debt

is generally defined as aggregate debt obligations reflected in our

balance sheet, less the hedge adjustments resulting from terminated

and existing fair value interest rate derivatives or swaps, if any,

less certain cash, plus additional outstanding letters of credit

not already reflected in debt and certain guarantees.

Our management uses Credit Agreement EBITDA and Total Funded

Debt to evaluate compliance with our debt covenants and borrowing

capacity available under our Credit Facility. Management

believes that investors also use these measures to evaluate our

compliance with our debt covenants and available borrowing

capacity. Borrowing capacity is dependent upon, in addition to

other measures, the "Credit Agreement Debt/EBITDA ratio" or the

"Leverage Ratio," which is defined as Total Funded Debt divided by

Credit Agreement EBITDA. As of the June 30, 2014 calculation,

our Leverage Ratio was 1.90 times. Our maximum permitted

Leverage Ratio under the Credit Facility at June 30, 2014 was 3.50

times.

Set forth below is a reconciliation of Credit Agreement EBITDA

for the twelve months ended June 30, 2014 and June 30, 2013, to the

most directly comparable GAAP measure, Consolidated Net

Income:

| |

|

|

| (In Millions) |

Twelve Months |

Twelve Months |

| |

Ended |

Ended |

| |

June 30, 2014 |

June 30, 2013 |

| |

|

|

| Consolidated Net Income |

$506.8 |

$637.6 |

| Interest Expense, net |

85.4 |

99.2 |

| Income Taxes |

279.2 |

(62.9) |

| Depreciation and Amortization |

575.8 |

547.3 |

| Additional Permitted Charges |

156.2 |

125.8 |

| Credit Agreement EBITDA |

$1,603.4 |

$1,347.0 |

| |

|

|

| Set forth below is a

reconciliation of Total Funded Debt to the most directly comparable

GAAP measures, Current portion of debt and Long-term debt due after

one year: |

| |

|

|

| (In Millions, except ratio) |

June 30, |

June 30, |

| |

2014 |

2013 |

| |

|

|

| Current Portion of Debt |

$63.1 |

$54.1 |

| Long-Term Debt Due After One Year |

2,923.3 |

2,972.3 |

| Total Debt |

2,986.4 |

3,026.4 |

| Plus: Letters of Credit, Guarantees and

Other Adjustments |

53.5 |

59.7 |

| Total Funded Debt |

$3,039.9 |

$3,086.1 |

| |

|

|

| Credit Agreement EBITDA for the Twelve Months

Ended |

$1,603.4 |

$1,347.0 |

| |

|

|

| Leverage Ratio |

1.90 |

2.29 |

Adjusted Net Income and Adjusted Earnings per Diluted

Share

We also use the non-GAAP measures "adjusted net income" and

"adjusted earnings per diluted share". Management believes

these non-GAAP financial measures provide our board of directors,

investors, potential investors, securities analysts and others with

useful information to evaluate the performance of the Company

because it excludes restructuring and other costs, net, and other

specific items that management believes are not indicative of the

ongoing operating results of the business. The Company and our

board of directors use this information to evaluate the Company's

performance relative to other periods. We believe that the

most directly comparable GAAP measures to adjusted net income and

adjusted earnings per diluted share are Net income attributable to

Rock-Tenn Company shareholders and Earnings per Diluted Share,

respectively. Set forth at the beginning of this press release

is a reconciliation of adjusted earnings per diluted share to

Earnings per diluted share. Set forth below is a reconciliation of

adjusted net income to Net income attributable to Rock-Tenn Company

shareholders:

| |

|

|

|

|

| |

Three Months |

Three Months |

Nine Months |

Nine Months |

| |

Ended |

Ended |

Ended |

Ended |

| |

June 30, |

June 30, |

June 30, |

June 30, |

| (In Millions) |

2014 |

2013 |

2014 |

2013 |

| |

|

|

|

|

| Net income attributable to Rock-Tenn

Company shareholders |

$133.3 |

$140.1 |

$325.8 |

$550.8 |

| |

|

|

|

|

| Alternative fuel mixture credit tax reserve

adjustment |

— |

— |

— |

(252.9) |

| Restructuring and other costs and operating

losses and transition costs due to plant closures |

8.7 |

18.0 |

30.4 |

39.9 |

| Acquisition inventory step-up |

1.6 |

— |

1.8 |

— |

| Loss on extinguishment of debt |

— |

— |

— |

0.2 |

| |

|

|

|

|

| Adjusted net

income |

$143.6 |

$158.1 |

$358.0 |

$338.0 |

CONTACT: RockTenn

John Stakel, SVP-Treasurer, 678-291-7901

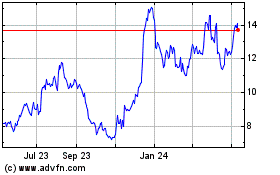

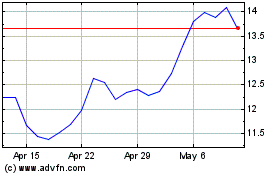

Rocket Companies (NYSE:RKT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rocket Companies (NYSE:RKT)

Historical Stock Chart

From Apr 2023 to Apr 2024