MEG Energy Corp. (TSX:MEG) today reported second quarter 2014 operational and

financial results. Highlights include:

-- Record cash flow from operations of $261.7 million;

-- Record quarterly production of 68,984 barrels per day (bpd), nearly 18

per cent higher than the first quarter and 115 per cent higher than the

second quarter of 2013, all while factoring in the impact of planned

maintenance on Phases 1 and 2;

-- Christina Lake Phase 2B reaching design capacity seven months after

first oil production;

-- 2014 production guidance increased eight per cent to 65,000 to 70,000

bpd, reflecting strong operational performance;

-- Completion of the Phase 1 and 2 plant turnaround, with inspections and

maintenance confirming assets are in good operating condition.

"Exceptional operating performance and higher realized pricing drove record cash

flow in the quarter," said Bill McCaffrey, MEG President and Chief Executive

Officer. "This step change in our cash flow represents the beginning of a new

chapter for MEG. Internal cash flow is now poised to be the major contributor to

our future capital funding plans, with this past quarter being an important

milestone."

Cash flow from operations in the second quarter of 2014 reached a record $261.7

million ($1.16 per share, diluted) compared to $79.2 million ($0.35 per share,

diluted) for the same period of 2013. The increase in cash flow from operations

was primarily due to higher production volumes and increased netbacks per

barrel.

MEG's production during the second quarter of 2014 increased nearly 115 per cent

to 68,984 bpd compared to second quarter 2013 production of 32,144 bpd. For the

first six months of 2014, production approximately doubled to 63,842 bpd

compared to 32,337 bpd in the first half of 2013. Quarterly and year-to-date

production volumes in both comparative periods were impacted by planned

maintenance.

"Phase 2B reached planned production volumes seven months after first oil, just

prior to the Phase 1 and 2 plant turnaround," said McCaffrey. "We are looking to

a strong second half and have raised our production guidance to 65,000 to 70,000

barrels per day for the year."

Second quarter 2014 non-energy operating costs were $9.64 per barrel, down from

$10.00 per barrel in the second quarter of 2013, including costs for planned

maintenance. Net operating costs were $14.49 per barrel for the second quarter

of 2014 compared to $8.85 per barrel in the second quarter of 2013. This

reflects lower non-energy operating costs offset by increased natural gas costs

and lower electricity sales revenues from the company's cogeneration facilities.

MEG's steam-oil ratio declined to 2.4 in the second quarter of 2014 from 2.5 in

the first quarter, reflecting the performance of RISER in Phases 1 and 2 as well

as the ramp-up of Phase 2B.

Average bitumen price realizations increased approximately 17% in the second

quarter of 2014 compared to the previous quarter and were approximately 35%

higher than price realizations in the second quarter of 2013. Continued

logistics enhancements, including increased crude-by-rail transportation,

pipelines connecting the U.S. mid-continent to the U.S. Gulf Coast and refinery

modifications in the U.S. Midwest contributed to improved pricing. The

anticipated completion of the Flanagan-Seaway pipeline system in the second half

of 2014 is expected to further enhance transportation logistics and pricing.

Operating earnings, which are adjusted for items that are not indicative of

operating performance, were $111.1 million ($0.49 per share, diluted) in the

second quarter of 2014 compared to $13.6 million ($0.06 per share, diluted) in

the same period of 2013, reflecting the same factors that impacted cash flow

from operations.

Net income was $249.0 million ($1.11 per share, diluted) in the second quarter

of 2014, compared to a net loss of $62.3 million ($0.28 per share, diluted) in

the second quarter of 2013.

Operational and Financial Highlights

The following table summarizes selected operational and financial information

for the three and six months ended June 30. Dollar values are in Canadian

dollars unless otherwise noted.

============================================================================

Three months ended Six months ended

June 30 June 30

----------------------------------------------------------------------------

2014 2013 2014 2013

----------------------------------------------------------------------------

Bitumen production - bbls/d 68,984 32,144 63,842 32,337

Bitumen sales - bbls/d 70,849 32,175 64,504 32,284

Steam to oil ratio (SOR) 2.4 2.3 2.4 2.4

West Texas Intermediate (WTI) 102.99 94.22 100.84 94.30

US$/bbl

West Texas Intermediate (WTI) C$/bbl 112.31 96.42 110.62 95.82

Differential - WTI vs AWB - % 24.1% 27.1% 26.3% 34.7%

Bitumen realization - $/bbl 72.75 53.98 68.06 42.04

Net operating costs(1) - $/bbl 14.49 8.85 14.11 9.65

Non-energy operating costs - $/bbl 9.64 10.00 9.38 9.41

Cash operating netback(2) - $/bbl 51.45 41.93 47.89 29.94

Total cash capital investment(3) - 320,826 653,827 663,829 1,322,759

$000

Net income (loss)(4) - $000 248,954 (62,312) 145,513 (133,606)

Per share, diluted 1.11 (0.28) 0.65 (0.60)

Operating earnings (loss)(5) - $000 111,139 13,612 151,798 (23,100)

Per share, diluted(5) 0.49 0.06 0.68 (0.10)

Cash flow from operations(5) - $000 261,713 79,184 418,700 86,255

Per share, diluted(5) 1.16 0.35 1.86 0.39

Cash, cash equivalents and short-

term investments - $000 839,870 1,203,457 839,870 1,203,457

Long-term debt - $000 4,016,257 2,923,382 4,016,257 2,923,382

============================================================================

(1) Net operating costs include energy and non-energy operating costs, reduced

by power sales. Please refer to Cash Operating Netbacks discussed further under

the heading "RESULTS OF OPERATIONS" in the Company's second quarter MD&A.

(2) Cash operating netbacks are calculated by deducting the related diluent,

transportation, field operating costs and royalties from proprietary sales

volumes and power revenues, on a per barrel basis. Please refer to note 3 of the

Cash Operating Netbacks table within "RESULTS OF OPERATIONS" in the Company's

second quarter MD&A.

(3) Includes capitalized interest of $22.1 million and $41.6 million for the

three and six months ended June 30, 2014, respectively ($18.2 million and $31.8

million respectively, for the three months and six months ended June 30, 2013).

(4) Includes a foreign exchange gain of $144.1 million on conversion of the U.S.

dollar denominated debt for the three months ended June 30, 2014. Includes a

foreign exchange loss of $15.4 million on conversion of the U.S. dollar

denominated debt for the six months ended June 30, 2014. Includes foreign

exchange losses on conversion of U.S. dollar denominated debt of $100.9 million

and $150.1 million, respectively, for the three and six months ended June 30,

2013.

(5) Please refer to Non-IFRS Financial measures below.

A full version of MEG's Second Quarter 2014 Report to Shareholders, including

unaudited financial statements, is available at www.megenergy.com/investors and

at www.sedar.com.

A conference call will be held to review MEG's second quarter results at 7:30

a.m. Mountain Time (9:30 a.m. Eastern Time) on July 30, 2014. The U.S./Canada

toll-free conference call number is 1 866-223-7781. The international/local

conference call number is 416-340-2216.

Forward-Looking Information

This document may contain forward-looking information including but not limited

to: expectations of future production, revenues, expenses, cash flow, operating

costs, SORs, pricing differentials, reliability, profitability and capital

investments; estimates of reserves and resources; the anticipated reductions in

operating costs as a result of optimization and scalability of certain

operations; the anticipated capital requirements, timing for receipt of

regulatory approvals, development plans, timing for completion, commissioning

and start-up, capacities and performance of the Access Pipeline expansion, the

RISER initiative, the Stonefell Terminal, third party barging and rail

facilities, the future phases and expansions of the Christina Lake Project, the

Surmont Project and potential projects on the Growth Properties; and the

anticipated sources of funding for operations and capital investments. Such

forward-looking information is based on management's expectations and

assumptions regarding future growth, results of operations, production, future

capital and other expenditures (including the amount, nature and sources of

funding thereof), plans for and results of drilling activity, environmental

matters, business prospects and opportunities.

By its nature, such forward-looking information involves significant known and

unknown risks and uncertainties, which could cause actual results to differ

materially from those anticipated. These risks include, but are not limited to:

risks associated with the oil and gas industry (e.g. operational risks and

delays in the development, exploration or production associated with MEG's

projects; the securing of adequate supplies and access to markets and

transportation infrastructure; the availability of capacity on the electrical

transmission grid; the uncertainty of reserve and resource estimates; the

uncertainty of estimates and projections relating to production, costs and

revenues; health, safety and environmental risks; risks of legislative and

regulatory changes to, amongst other things, tax, land use, royalty and

environmental laws), assumptions regarding and the volatility of commodity

prices and foreign exchange rates; and risks and uncertainties associated with

securing and maintaining the necessary regulatory approvals and financing to

proceed with the continued expansion of the Christina Lake Project and the

development of the Corporation's other projects and facilities. Although MEG

believes that the assumptions used in such forward-looking information are

reasonable, there can be no assurance that such assumptions will be correct.

Accordingly, readers are cautioned that the actual results achieved may vary

from the forward-looking information provided herein and that the variations may

be material. Readers are also cautioned that the foregoing list of assumptions,

risks and factors is not exhaustive.

The forward-looking information included in this document is expressly qualified

in its entirety by the foregoing cautionary statements. Unless otherwise stated,

the forward-looking information included in this document is made as of the date

of this document and the Corporation assumes no obligation to update or revise

any forward-looking information to reflect new events or circumstances, except

as required by law. For more information regarding forward-looking information

see "Notice Regarding Forward Looking Information", "Regulatory Matters" and

"Risk Factors" within MEG's Annual Information Form dated March 5, 2014 (the

"AIF") along with MEG's other public disclosure documents. Copies of the AIF and

MEG's other public disclosure documents are available through the SEDAR website

(www.sedar.com) or by contacting MEG's investor relations department.

Non-IFRS Financial Measures

This document includes references to financial measures commonly used in the

crude oil and natural gas industry, such as operating earnings, cash flow from

operations and cash operating netback. These financial measures are not defined

by IFRS as issued by the International Accounting Standards Board and therefore

are referred to as non-IFRS measures. The non-IFRS measures used by MEG may not

be comparable to similar measures presented by other companies. MEG uses these

non-IFRS measures to help evaluate its performance. Management considers

operating earnings and cash operating netback to be important measures as they

indicate profitability relative to current commodity prices. Management uses

cash flow from operations to measure MEG's ability to generate funds to finance

capital expenditures and repay debt. These non-IFRS measures should not be

considered as an alternative to or more meaningful than net income (loss) or net

cash provided by (used in) operating activities, as determined in accordance

with IFRS, as an indication of MEG's performance. The non-IFRS operating

earnings and cash operating netback measures are reconciled to net income

(loss), while cash flow from operations is reconciled to net cash provided by

(used in) operating activities, as determined in accordance with IFRS, under the

heading "Non-IFRS Measurements" in MEG's Management's Discussion and Analysis

pertaining to the second quarter of 2014.

MEG Energy Corp. is focused on sustainable in situ oil sands development and

production in the southern Athabasca oil sands region of Alberta, Canada. MEG is

actively developing enhanced oil recovery projects that utilize SAGD extraction

methods. MEG's common shares are listed on the Toronto Stock Exchange under the

symbol "MEG."

FOR FURTHER INFORMATION PLEASE CONTACT:

MEG Energy Corp.

Investors

Helen Kelly

Director, Investor Relations

403-767-6206

helen.kelly@megenergy.com

MEG Energy Corp.

Media

Brad Bellows

Director, External Communications

403-212-8705

brad.bellows@megenergy.com

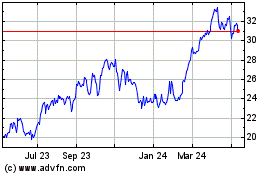

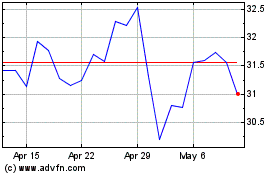

MEG Energy (TSX:MEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

MEG Energy (TSX:MEG)

Historical Stock Chart

From Apr 2023 to Apr 2024