- Q2 2014 net income of $1.4 billion, or

$1.82 per diluted share

- Q2 2014 core income of $1.4 billion, or

$1.79 per diluted share

- Q2 2014 record domestic oil production

of 278,000 barrels per day

Occidental Petroleum Corporation (NYSE:OXY) announced net income

for the second quarter of 2014 of $1.4 billion ($1.82 per diluted

share), compared with $1.3 billion ($1.64 per diluted share) for

the second quarter of 2013. Core income was $1.4 billion ($1.79 per

diluted share) for the second quarter of 2014, compared with $1.3

billion ($1.58 per diluted share) for the second quarter of

2013.

In announcing the results, Stephen I. Chazen, President and

Chief Executive Officer, said, "For the fourth consecutive quarter,

we have delivered strong domestic oil production growth, with

increases coming from both our Permian and California assets.

Domestic oil production was 278,000 barrels per day for the second

quarter of 2014. Excluding the effect from the Hugoton sale,

domestic oil production increased 21,000 barrels per day from the

second quarter of 2013 with our Permian Resources business growing

its oil production by over 21 percent. For the first half of 2014,

our cash flow from operations was $5.6 billion. Capital

expenditures, net of contributions from partners, were $4.7 billion

and we purchased approximately 16.6 million shares of our

stock.”

QUARTERLY

RESULTS

Oil and

Gas

Domestic core earnings were $1.1 billion pre-tax or $679 million

after-tax for the second quarter of 2014, compared to $1.0 billion

pre-tax or $635 million after-tax for the second quarter of 2013.

The current quarter domestic results reflected higher realized

prices across all products and higher oil volumes, partially offset

by higher operating costs and higher DD&A. The increase in

operating costs was due to increased maintenance activities and

higher costs for CO2, steam and power, which are influenced by

crude oil and natural gas prices. International core earnings were

$1.1 billion pre-tax or $576 million after-tax for the second

quarter of 2014, compared to $1.2 billion pre-tax or $641 million

after-tax for the second quarter of 2013. The current quarter

international results reflected lower oil volumes, partially offset

by higher oil prices and lower operating costs.

For the second quarter of 2014, total company average daily oil

and gas production volumes, excluding the Hugoton production,

averaged 736,000 barrels of oil equivalent (BOE), compared with

753,000 BOE in the second quarter of 2013. The sale of Hugoton

assets closed on April 30, 2014. Hugoton production averaged 6,000

BOE per day and 19,000 BOE per day for the second quarter of 2014

and 2013, respectively. Domestic average daily production increased

by 13,000 BOE to 464,000 BOE in the second quarter of 2014 compared

to 451,000 BOE in the second quarter of 2013. Domestic average oil

production increased by 21,000 barrels per day, primarily from

California and Permian Resources. International average daily

production decreased to 272,000 BOE in the second quarter of 2014

from 302,000 BOE in second quarter of 2013. The decrease primarily

resulted from insurgent activities in Colombia, continued field and

port strikes in Libya and lower cost recovery barrels in Iraq.

Total company average daily sales volumes decreased to 735,000 BOE

in the second quarter of 2014 from 745,000 BOE in the second

quarter of 2013, mainly due to the timing of liftings.

Worldwide realized crude oil prices increased by 3 percent to

$100.38 per barrel for the second quarter of 2014 compared with

$97.91 per barrel for the second quarter of 2013 and improved

slightly compared to the first quarter of 2014. Worldwide NGL

prices increased by 10 percent to $42.82 per barrel in the second

quarter of 2014, compared with $38.78 per barrel in the second

quarter of 2013, but decreased by 7 percent compared with $46.05 in

the first quarter of 2014. Domestic natural gas prices increased 12

percent in the second quarter of 2014 to $4.28 per MCF, compared

with $3.82 in the second quarter of 2013, and fell by 6 percent

compared with the first quarter of 2014.

Chemical

Chemical core earnings for the second quarter of 2014 were $133

million, compared to $144 million in the second quarter of 2013,

excluding the $131 million gain on the sale of our investment in

Carbocloro. The decrease in second quarter of 2014 earnings

reflected lower caustic soda prices driven by new chlor-alkali

capacity in the industry and higher natural gas costs, partially

offset by higher vinyl margins resulting from improvement in the

U.S. construction markets.

Midstream, Marketing

and Other

Midstream core earnings were $219 million for the second quarter

of 2014, compared with $48 million for the second quarter of 2013.

The increase in earnings reflected improved marketing and trading

performance.

Non-Core

Items

The second quarter of 2014 included a net non-core income

benefit of $27 million, which included a $341 million after-tax

gain from the sale of Hugoton oil and gas assets, a $300 million

after-tax charge for the impairment of certain non-producing

domestic oil and gas acreage and on-going costs related to the

California spin-off. The non-core items in the second quarter of

2013 provided a net income benefit of $46 million.

SIX-MONTH

RESULTS

Net income for the first six months of 2014 was $2.8 billion

($3.58 per diluted share), compared with $2.7 billion ($3.32 per

diluted share) for the same period in 2013. Core income for the

first six months of 2014 was $2.8 billion ($3.54 per diluted

share), compared with $2.6 billion ($3.27 per diluted share) for

the same period in 2013.

Oil and

Gas

Domestic core earnings were $2.1 billion pre-tax or $1.4 billion

after-tax for the first six months of 2014, compared to $1.9

billion pre-tax or $1.2 billion after-tax for the first six months

of 2013. The increase in domestic core earnings reflected higher

realized prices across all products and higher oil volumes,

partially offset by higher costs for CO2, steam and power and

higher DD&A. International core earnings were $2.2 billion

pre-tax or $1.1 billion after-tax for the first six months of 2014,

compared to $2.2 billion pre-tax or $1.2 billion after-tax for the

first six months of 2013. International core earnings reflected

lower Middle East/North Africa volumes, partially offset by lower

operating costs.

Oil and gas production volumes, excluding Hugoton production,

for the first six months of 2014 averaged 731,000 BOE per day,

compared with 749,000 BOE per day for the first six months of 2013.

Domestic daily production averaged 460,000 BOE and 455,000 BOE for

the first six months of 2014 and 2013, respectively. Average

domestic oil production increased by 15,000 barrels per day in the

first six months of 2014, compared to the first six months of 2013.

Average international daily production volumes decreased to 271,000

BOE for the first six months of 2014 from 294,000 BOE for the first

six months of 2013. The decrease was primarily due to insurgent

activities in Colombia, continued field and port strikes in Libya

and lower cost recovery barrels in Iraq. Total company daily sales

volumes averaged 726,000 BOE in the first six months of 2014,

compared with 736,000 BOE for 2013. Sales volumes were lower than

production volumes due to the timing of liftings in Middle

East/North Africa.

Worldwide realized crude oil prices rose by 2 percent to $99.70

per barrel for the first six months of 2014, compared with $97.99

per barrel for the first six months of 2013. Worldwide NGL prices

increased by 12 percent to $44.43 per barrel for the first six

months of 2014, compared with $39.52 per barrel for the first six

months of 2013. Domestic gas prices increased by 29 percent to

$4.43 per MCF for the first six months of 2014, compared to $3.44

per MCF for the first six months of 2013.

Chemical

Chemical core earnings were $269 million for the first six

months of 2014, compared with $303 million for the same period of

2013, excluding the $131 million gain on the sale of our investment

in Carbocloro. The lower earnings reflected lower caustic soda

prices, driven by new chlor-alkali capacity in the industry and

higher natural gas costs, partially offset by higher vinyl margins

and volume improvements across most products.

Midstream, Marketing

and Other

Midstream core earnings were $389 million for the first six

months of 2014, compared with $263 million for the same period of

2013. The increase in earnings reflected improved marketing and

trading performance.

About

Oxy

Occidental Petroleum Corporation is an international oil and gas

exploration and production company with operations in the United

States, Middle East/North Africa and Latin America regions.

Occidental is one of the largest U.S. oil and gas companies, based

on equity market capitalization. Occidental’s midstream and

marketing segment gathers, processes, transports, stores, purchases

and markets hydrocarbons and other commodities in support of

Occidental’s businesses. Occidental’s wholly owned subsidiary

OxyChem manufactures and markets chlor-alkali products and vinyls.

Occidental is committed to safeguarding the environment, protecting

the safety and health of employees and neighboring communities and

upholding high standards of social responsibility in all of the

company's worldwide operations.

Forward-Looking

Statements

Portions of this press release contain

forward-looking statements and involve risks and uncertainties that

could materially affect expected results of operations, liquidity,

cash flows and business prospects. Actual results may differ from

anticipated results, sometimes materially, and reported results

should not be considered an indication of future performance.

Factors that could cause results to differ include, but are not

limited to: global commodity pricing fluctuations; supply and

demand considerations for Occidental's products;

higher-than-expected costs; the regulatory approval environment;

reorganization or restructuring of Occidental's operations,

including any delay of, or other negative developments affecting,

the spin-off of California Resources Corporation; not successfully

completing, or any material delay of, field developments, expansion

projects, capital expenditures, efficiency projects, acquisitions

or dispositions; lower-than-expected production from development

projects or acquisitions; exploration risks; general economic

slowdowns domestically or internationally; political conditions and

events; liability under environmental regulations including

remedial actions; litigation; disruption or interruption of

production or manufacturing or facility damage due to accidents,

chemical releases, labor unrest, weather, natural disasters, cyber

attacks or insurgent activity; failure of risk management; changes

in law or regulations; or changes in tax rates. Words such as

“estimate,” “project,” “predict,” “will,” “would,” “should,”

“could,” “may,” “might,” “anticipate,” “plan,” “intend,” “believe,”

“expect,” “aim,” “goal,” “target,” “objective,” “likely” or similar

expressions that convey the prospective nature of events or

outcomes generally indicate forward-looking statements. You should

not place undue reliance on these forward-looking statements, which

speak only as of the date of this release. Unless legally required,

Occidental does not undertake any obligation to update any

forward-looking statements, as a result of new information, future

events or otherwise. Material risks that may affect Occidental's

results of operations and financial position appear in Part I, Item

1A “Risk Factors” of the 2013 Form 10-K. Occidental posts or

provides links to important information on its website at

www.oxy.com.

For further analysis of Occidental's quarterly performance,

please visit the website: www.oxy.com

Attachment 1 SUMMARY OF SEGMENT NET SALES AND

AFTER-TAX EARNINGS Second

Quarter Six Months ($ millions, except per-share

amounts)

2014 2013

2014

2013

SEGMENT NET SALES Oil and Gas

$ 4,807 $

4,721

$ 9,483 $ 9,161 Chemical

1,242 1,187

2,462 2,362 Midstream, Marketing and Other

530 269

965 722 Eliminations

(304 ) (215

)

(547 ) (411 ) Net Sales

$ 6,275 $ 5,962

$ 12,363

$ 11,834

SEGMENT EARNINGS - AFTER-TAX

Oil and Gas Domestic

$ 720 $ 635

$

1,394 $ 1,201 Foreign

576 641

1,128 1,177

Exploration

(36 ) (56 )

(68 ) (29 )

1,260 1,220

2,454

2,349 Chemical

84 172

170 271 Midstream, Marketing

and Other (a)

160 46

278 192

1,504 1,438

2,902 2,812 Unallocated Corporate Items

Interest expense, net

(15 ) (29 )

(34 )

(59 ) Income taxes

73 84

153 160 Other

(130 ) (166 )

(202 )

(227 )

Income from Continuing Operations (a)

1,432 1,327

2,819 2,686 Discontinued operations, net

(1 ) (5 )

2

(9 )

NET INCOME (a) $ 1,431 $

1,322

$ 2,821 $ 2,677

BASIC EARNINGS PER COMMON SHARE Income from continuing

operations

$ 1.83 $ 1.65

$ 3.58 $ 3.33

Discontinued operations, net

- (0.01 )

- (0.01 )

$ 1.83 $

1.64

$ 3.58 $ 3.32

DILUTED EARNINGS PER COMMON SHARE Income from continuing

operations

$ 1.82 $ 1.64

$ 3.58 $ 3.33

Discontinued operations, net

- -

- (0.01 )

$ 1.82 $

1.64

$ 3.58 $ 3.32

AVERAGE

COMMON SHARES OUTSTANDING BASIC

782.6 804.9

786.9

804.8 DILUTED

782.9 805.4

787.3 805.3

(a) Net income and income from continuing

operations represent amounts attributable to Common Stock, after

deducting non-controlling interest of $3 million and $5 million for

the second quarter and first six months of 2014, respectively.

Midstream segment earnings are presented net of these

non-controlling interest amounts.

Attachment 2 SUMMARY OF SEGMENT

PRE-TAX EARNINGS Second Quarter Six Months ($ millions)

2014 2013

2014 2013

SEGMENT EARNINGS - PRE-TAX

Oil and Gas Domestic

$ 1,132 $ 997

$

2,190 $ 1,886 Foreign

1,096 1,173

2,188 2,246

Exploration

(46 ) (70 )

(92 ) (112 )

2,182 2,100

4,286

4,020 Chemical

133 275

269 434 Midstream, Marketing

and Other (a)

219 48

389 263

2,534 2,423

4,944 4,717 Unallocated Corporate Items

Interest expense, net

(15 ) (29 )

(34 )

(59 ) Income taxes

(957 ) (901 )

(1,889

) (1,745 ) Other

(130 ) (166 )

(202 ) (227 )

Income from

Continuing Operations (a) 1,432 1,327

2,819 2,686

Discontinued operations, net

(1 ) (5 )

2 (9 )

NET INCOME (a)

$ 1,431 $ 1,322

$ 2,821

$ 2,677

(a) Net income and income from continuing

operations represent amounts attributable to Common Stock, after

deducting non-controlling interest of $3 million and $5 million for

the second quarter and first six months of 2014, respectively.

Midstream segment earnings are presented net of these

non-controlling interest amounts.

Attachment 3 SIGNIFICANT TRANSACTIONS AND EVENTS

AFFECTING EARNINGS Occidental's results of operations

often include the effects of significant transactions and events

affecting earnings that vary widely and unpredictably in nature,

timing and amount. Therefore, management uses a measure called

"core results," which excludes those items. This non-GAAP measure

is not meant to disassociate those items from management's

performance, but rather is meant to provide useful information to

investors interested in comparing Occidental's earnings performance

between periods. Reported earnings are considered representative of

management's performance over the long term. Core results is not

considered to be an alternative to operating income reported in

accordance with generally accepted accounting principles.

Second Quarter 2014 ($ millions) PRE-TAX

ReportedIncome

SignificantItems

CoreResults

Oil and Gas Domestic $ 1,132 $ (535 )

(a)

$ 1,068 471

(b)

Foreign 1,096 1,096 Exploration (46 ) (46 ) 2,182

2,118 Chemical 133 133 Midstream, Marketing and Other

219 219 Corporate Interest expense (15 ) (15 ) Other (130 )

17

(c)

(113 ) Taxes (957 ) 19 (938 ) Income from

continuing operations 1,432 (28 ) 1,404 Discontinued operations,

net (1 ) 1 - Net Income $ 1,431

$ (27 ) $ 1,404

Second Quarter 2014

($ millions) AFTER-TAX

ReportedIncome

SignificantItems

CoreResults

Oil and Gas Domestic $ 720 $ (341 )

(a)

$ 679 300

(b)

Foreign 576 576 Exploration (36 ) (36 ) 1,260 1,219

Chemical 84 84 Midstream, Marketing and Other 160 160

Corporate Interest expense (15 ) (15 ) Other (130 ) 13

(c)

(117 ) Unallocated taxes 73 73 Income from

continuing operations 1,432 (28 ) 1,404 Discontinued operations,

net (1 ) 1 - Net Income $ 1,431

$ (27 ) $ 1,404 Diluted Earnings Per Common

Share $ 1.82 $ 1.79 (a) Hugoton sale gain. (b)

Asset impairments. (c) Spin-off and other costs.

Attachment 4 SIGNIFICANT TRANSACTIONS AND EVENTS

AFFECTING EARNINGS Second Quarter 2013 ($

millions) PRE-TAX

ReportedIncome

SignificantItems

CoreResults

Oil and Gas Domestic $ 997 $ 997 Foreign 1,173 1,173 Exploration

(70 ) (70 ) 2,100 2,100 Chemical 275 $ (131 )

(a)

144 Midstream, Marketing and Other 48 48 Corporate

Interest expense (29 ) (29 ) Other (166 ) 55

(b)

(111 ) Taxes (901 ) 25 (876 ) Income from

continuing operations 1,327 (51 ) 1,276 Discontinued operations,

net (5 ) 5 - Net Income $ 1,322

$ (46 ) $ 1,276

Second Quarter 2013

($ millions) AFTER-TAX

ReportedIncome

SignificantItems

CoreResults

Oil and Gas Domestic $ 635 $ 635 Foreign 641 641 Exploration

(56 ) (56 ) 1,220 1,220 Chemical 172 $ (85 )

(a)

87 Midstream, Marketing and Other 46 46 Corporate

Interest expense (29 ) (29 ) Other (166 ) 34

(b)

(132 ) Unallocated taxes 84 84 Income from

continuing operations 1,327 (51 ) 1,276 Discontinued operations,

net (5 ) 5 - Net Income $ 1,322

$ (46 ) $ 1,276 Diluted Earnings Per Common

Share $ 1.64 $ 1.58 (a) Carbocloro sale gain.

(b) Employment charges related to

post-employment benefits for the Company's former Chairman and

termination of certain other employees and consulting

arrangements.

Attachment 5 SIGNIFICANT

TRANSACTIONS AND EVENTS AFFECTING EARNINGS Six Months

2014 ($ millions) PRE-TAX

ReportedIncome

SignificantItems

CoreResults

Oil and Gas Domestic $ 2,190 $ (535 )

(a)

$ 2,126 471

(b)

Foreign 2,188 2,188 Exploration (92 ) (92 ) 4,286

4,222 Chemical 269 269 Midstream, Marketing and Other

389 389 Corporate Interest expense (34 ) (34 ) Other (202 )

17

(c)

(185 ) Taxes (1,889 ) 19 (1,870 ) Income from

continuing operations 2,819 (28 ) 2,791 Discontinued operations,

net 2 (2 ) - Net Income $ 2,821

$ (30 ) $ 2,791

Six Months 2014 ($

millions) AFTER-TAX

ReportedIncome

SignificantItems

CoreResults

Oil and Gas Domestic $ 1,394 $ (341 )

(a)

$ 1,353 300

(b)

Foreign 1,128 1,128 Exploration (68 ) (68 ) 2,454

2,413 Chemical 170 170 Midstream, Marketing and Other

278 278 Corporate Interest expense (34 ) (34 ) Other (202 )

13

(c)

(189 ) Unallocated taxes 153 153 Income from

continuing operations 2,819 (28 ) 2,791 Discontinued operations,

net 2 (2 ) - Net Income $ 2,821

$ (30 ) $ 2,791 Diluted Earnings Per Common

Share $ 3.58 $ 3.54 (a) Hugoton sale gain. (b)

Asset impairments. (c) Spin-off and other costs.

Attachment 6 SIGNIFICANT TRANSACTIONS AND EVENTS

AFFECTING EARNINGS Six Months 2013 ($

millions) PRE-TAX

ReportedIncome

SignificantItems

CoreResults

Oil and Gas Domestic $ 1,886 $ 1,886 Foreign 2,246 2,246

Exploration (112 ) (112 ) 4,020 4,020 Chemical

434 $ (131 )

(a)

303 Midstream, Marketing and Other 263 263 Corporate

Interest expense (59 ) (59 ) Other (227 ) 55

(b)

(172 ) Taxes (1,745 ) 25 (1,720 ) Income from

continuing operations 2,686 (51 ) $ 2,635 Discontinued operations,

net (9 ) 9 - Net Income $ 2,677

$ (42 ) $ 2,635

Six Months 2013 ($

millions) AFTER-TAX

ReportedIncome

Significant Items

CoreResults

Oil and Gas Domestic $ 1,201 $ 1,201 Foreign 1,177 1,177

Exploration (29 ) (29 ) 2,349 2,349 Chemical

271 $ (85 )

(a)

186 Midstream, Marketing and Other 192 192 Corporate

Interest expense (59 ) (59 ) Other (227 ) 34

(b)

(193 ) Unallocated taxes 160 160 Income from

continuing operations 2,686 (51 ) 2,635 Discontinued operations,

net (9 ) 9 - Net Income $ 2,677

$ (42 ) $ 2,635 Diluted Earnings Per Common

Share $ 3.32 $ 3.27 (a) Carbocloro sale gain.

(b) Employment charges related to

post-employment benefits for the Company's former Chairman and

termination of certain other employees and consulting

arrangements.

Attachment 7 SUMMARY OF CAPITAL

EXPENDITURES AND DD&A EXPENSE Second Quarter Six

Months ($ millions)

2014 2013

2014 2013

CAPITAL

EXPENDITURES (a) $ 2,658 $ 2,210

$ 4,927 $ 4,280

DEPRECIATION, DEPLETION AND

AMORTIZATION OF ASSETS

$ 1,317 $ 1,303

$ 2,583

$ 2,562

(a) Includes 100 percent of the capital

for BridgeTex Pipeline, which is being consolidated in Oxy's

financial statements. Our partner contributes its share of the

capital. The Company's net capital expenditures after these

reimbursements and inclusion of our contributions for the Chemical

joint venture cracker were $2.5 billion and $2.2 billion for the

second quarter of 2014 and 2013, respectively, and $4.7 billion and

$4.2 billion for the six months ended June 30, 2014 and 2013,

respectively.

Attachment 8 SUMMARY OF OPERATING

STATISTICS - PRODUCTION Second Quarter Six Months

2014 2013

2014 2013

NET OIL, LIQUIDS AND GAS

PRODUCTION PER DAY United States Oil (MBBL) California

97 88

96 88 Permian Resources

40 33

38

34 Permian EOR

110 112

110 112 Midcontinent and Other

29 22

27

22 Total excluding Hugoton

276 255

271

256 Hugoton

2 6

4

6 Total

278 261

275 262

NGLs (MBBL) California

18 21

18 20 Permian Resources

12 11

11 10 Permian EOR

29 28

29 29

Midcontinent and Other

12 14

14 15 Total excluding Hugoton

71 74

72 74 Hugoton

1 3

2 3 Total

72 77

74 77 Natural Gas (MMCF) California

243 260

243 262 Permian Resources

120 121

117 126

Permian EOR

34 39

37 42 Midcontinent and Other

305 312

305

318 Total excluding Hugoton

702 732

702 748

Hugoton

16 60

35

60 Total

718 792

737 808

Latin America Oil (MBBL) - Colombia

19 28

24

29 Natural Gas (MMCF) - Bolivia

12 13

12 13

Middle East / North Africa Oil (MBBL) Dolphin

7 7

6 6 Oman

70 67

68 66 Qatar

69 75

68 67 Other

28 44

27 45

Total

174 193

169 184 NGLs (MBBL) Dolphin

7 7

7 7 Natural Gas (MMCF) Dolphin

144 145

138 139 Oman

40 56

40 56 Other

236 232

234

238 Total

420 433

412 433

Barrels of Oil Equivalent excluding Hugoton (MBOE)

736 753

731 749 Hugoton

6

19

12 19

Barrels of

Oil Equivalent (MBOE) 742 772

743 768

Attachment 9 SUMMARY OF OPERATING STATISTICS -

SALES Second Quarter Six Months

2014 2013

2014 2013

NET OIL, LIQUIDS AND GAS SALES PER DAY

United States Oil (MBBL)

278 261

275

262 NGLs (MBBL)

72 77

74 77 Natural Gas (MMCF)

720 795

738 810

Latin America Oil

(MBBL) - Colombia

24 26

28 28 Natural Gas

(MMCF) - Bolivia

12 13

12 13

Middle East /

North Africa Oil (MBBL) Dolphin

7 7

6 6 Oman

71 63

68 68 Qatar

66 80

69 66 Other

24 36

17

32 Total

168 186

160 172 NGLs

(MBBL) Dolphin

7 7

7 7 Natural Gas (MMCF)

420 433

412 433

Barrels of Oil

Equivalent excluding Hugoton (MBOE) 735 745

726 736 Hugoton

6 19

12 19

Barrels of Oil

Equivalent (MBOE) 741 764

738 755

Occidental Petroleum CorporationMelissa E. Schoeb

(media)melissa_schoeb@oxy.com713-366-5615orChristopher M. Degner

(investors)christopher_degner@oxy.com212-603-8185

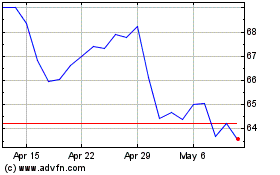

Occidental Petroleum (NYSE:OXY)

Historical Stock Chart

From Mar 2024 to Apr 2024

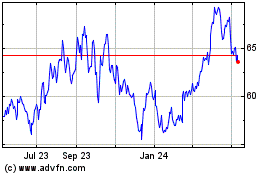

Occidental Petroleum (NYSE:OXY)

Historical Stock Chart

From Apr 2023 to Apr 2024