Osisko Gold Royalties (the "Company" or "Osisko") (TSX:OR) reported today the

second quarter net earnings of $1,645,276,000 ($36.69 per share), including a

gain of $1,647,526,000 ($36.74 per share) from discontinued operations. For the

year-to-date, the Company generated net earnings of $1,669,517,000 ($37.60 per

share), including net earnings from discontinued operations of $1,675,263,000

($37.73 per share).

Basis of Presentation

The Company has been formed following the agreement between Osisko Mining

Corporation, Agnico Eagle Mines Limited ("Agnico Eagle") and Yamana Gold Inc

("Yamana"). For financial reporting purposes, the Company is considered to be a

continuation of Osisko Mining Corporation and as at the closing of the

transaction, all its shareholders became shareholders of Osisko Gold Royalties.

The results are presented in accordance with International Financial Reporting

Standards ("IFRS") and reflect a 10 to 1 share consolidation that occurred on

June 16, 2014. On that date, the Company completed a transaction which resulted

in the acquisition of the majority of its assets by Agnico Eagle and Yamana.

Osisko shareholders received the following consideration from Agnico Eagle and

Yamana:

i. $2.09 in cash;

ii. 0.26471 of a Yamana share; and

iii.0.07264 of an Agnico Eagle share;

Osisko retained the following main assets as part of the transaction:

i. Cash of $157 million;

ii. 5% net smelter royalty ("NSR) on the Canadian Malartic mine;

iii.2% NSR on the Upper Beaver and Kirkland Lake properties;

iv. 2% NSR on the Hammond Reef Project and other Canadian exploration

projects;

v. Mexican exploration properties; and

vi. Portfolio of publicly traded securities in exploration companies.

For continuing activity, the financial results consist of the exploration

activities in Mexico and USA, the variation in the equity portfolio held, an

estimated allocation of general and administration costs, and the corporate

activities of Osisko Gold Royalties from June 16, 2014 to June 30, 2014.

Osisko Gold Royalties

During the period between June 16 and June 30, 2014, the Company has:

i. Received 958 ounces of gold and 962 ounces of silver under the terms of

the Canadian Malartic Royalty Agreement;

ii. Invested $1.0 million in a private placement of Nighthawk Gold Corp.;

iii.Continued grassroots exploration efforts on its Mexican properties;

On July 25, 2014, announced a transaction with NioGold Mining for the

subscription of 14,000,000 flow-through shares at $0.35 per share, and the

payment of $150,000 for the acquisition of NioGold's right to buy-back certain

royalties on its properties. The transaction is expected to close in early

August 2014.

Sean Roosen, Chair and CEO, commenting on the quarter activities: "We had an

extremely active quarter as we negotiated and concluded the friendly transaction

with Agnico Eagle and Yamana for the sale of Osisko Mining Corporation. We also

focused on establishing Osisko Gold Royalties' new business activities. We have

an outstanding platform to grow our royalty business with our flagship 5%

royalty on Canadian Malartic".

Financial Position

The Company completed the quarter with a strong balance sheet. Cash resources

totaled $156.7 million, net working capital stood at $155.6 million. The Company

is debt-free and totally unhedged.

Discontinued Operations

For the second quarter, gold production at Canadian Malartic up to June 15,

2014, totaled 109,425 ounces, and for the year-to-date 249,454 ounces. Under the

ownership of Osisko Mining Corporation, the Company produced 1.3 million ounces.

The discontinued operations include a gain of $1,744,115,000, from the deemed

disposition of the net assets of the Canadian Malartic mine and other Canadian

exploration projects.

About Osisko Gold Royalties Ltd

Osisko is a gold-focused royalty and stream company whose cornerstone asset is a

5% NSR royalty on the Canadian Malartic Gold Mine, located in Malartic, Quebec.

The Company also holds a 2% NSR royalty on the Upper Beaver, Kirkland Lake and

Hammond Reef gold exploration projects in Northern Ontario.

Osisko's head office is located at 1100 Avenue des Canadiens-de-Montreal, Suite

300, Montreal, Quebec, H3B 2S2.

Forward-looking statements

Certain statements contained in this press release may be deemed

"forward-looking statements". All statements in this release, other than

statements of historical fact, that address events or developments that Osisko

expects to occur, are forward looking statements. Forward looking statements are

statements that are not historical facts and are generally, but not always,

identified by the words "expects", "plans", "anticipates", "believes",

"intends", "estimates", "projects", "potential", "scheduled" and similar

expressions, or that events or conditions "will", "would", "may", "could" or

"should" occur including, without limitation, the performance of the assets of

Osisko and any acquired assets the potential of Osisko, the satisfaction of

conditions to the completion of the transactions described herein, and the

realization of the anticipated benefits of the transactions described herein.

Although Osisko believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are not

guarantees of future performance and actual results may differ materially from

those in forward looking statements. Factors that could cause the actual results

to differ materially from those in forward-looking statements include, gold

prices, Osisko's royalty interest, access to skilled consultants, results of

mining operation, exploration and development activities, with production and

development stage mining operations, uninsured risks, regulatory changes,

defects in title, availability of personnel, materials and equipment, timeliness

of government or court approvals, actual performance of facilities, equipment

and processes relative to specifications and expectations, unanticipated

environmental impacts on operations market prices, the results of efforts to

satisfy the conditions, including regulatory approvals, continued availability

of capital and financing and general economic, market or business conditions.

These factors are discussed in greater detail in Schedule I to the management

information circular of Osisko Mining Corporation which created Osisko and which

is filed on SEDAR and also provide additional general assumptions in connection

with these statements. Osisko cautions that the foregoing list of important

factors is not exhaustive. Investors and others who base themselves on the

forward looking statements contained herein should carefully consider the above

factors as well as the uncertainties they represent and the risk they entail.

Osisko believes that the expectations reflected in those forward-looking

statements are reasonable, but no assurance can be given that these expectations

will prove to be correct and such forward-looking statements included in this

press release should not be unduly relied upon. These statements speak only as

of the date of this press release. Osisko undertakes no obligation to publicly

update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise, other than as required by applicable

law.

Osisko Gold Royalties Ltd

Consolidated Statements of Income (Loss)

For the three and six months ended June 30, 2014 and 2013

(Unaudited)

---------------------------------------------------------------------------

(tabular amounts expressed in thousands of Canadian dollars, except per

share amounts)

Three months ended Six months ended

June 30, June 30,

--------------------------------------------

2014 2013(1) 2014 2013(1)

--------------------------------------------

($) ($) ($) ($)

Expenses

General and administrative (403) (228) (674) (491)

Exploration and evaluation (1,830) (2,037) (3,734) (4,415)

Write-off of property, plant

and equipment (1,015) (5,587) (2,831) (6,219)

--------------------------------------------

Operating loss (3,248) (7,852) (7,239) (11,125)

Interest income 506 313 1,076 658

Foreign exchange gain (loss) (2) 16 3 19

Share of income (loss) of

associates 210 (623) (96) (744)

Other gains (losses) 43 (3,176) 280 (5,101)

--------------------------------------------

Loss before income taxes (2,491) (11,322) (5,976) (16,293)

Income tax recovery (expense) 241 (23) 230 (46)

--------------------------------------------

Net loss from continuing

operations (2,250) (11,345) (5,746) (16,339)

Net earnings (loss) from

discontinued operations 1,647,526 (481,417) 1,675,263 (459,007)

--------------------------------------------

Net earnings (loss) 1,645,276 (492,762) 1,669,517 (475,346)

--------------------------------------------

--------------------------------------------

Net loss per sharefrom

continuing operations

Basic and diluted (0.05) (0.26) (0.13) (0.37)

Net earnings (loss) per share

Basic and diluted 36.69 (11.28) 37.60 (10.89)

Weighted average number of

common shares

outstanding (in thousands)

Basic and diluted 44,845 43,670 44,402 43,660

(1) Comparative information has been reclassed to reflect the estimated

allocation of continuing activities

Osisko Gold Royalties Ltd

Consolidated Statements of Cash Flows

For the three and six months ended June 30, 2014 and 2013

(Unaudited)

----------------------------------------------------------------------------

(tabular amounts expressed in thousands of Canadian dollars)

Three months ended Six months ended

June 30, June 30,

----------------------------------------

2014 2013(2) 2014 2013(2)

----------------------------------------

($) ($) ($) ($)

Operating activities

Net earnings (loss) from continuing

operations (2,250) (11,345) (5,746) (16,339)

Adjustments for:

Interest income (506) (313) (1,076) (658)

Write-off of property, plant and

equipment 1,015 5,587 2,831 6,219

Share of (income) loss of

associates (210) 623 96 744

Net loss (gain) on available-for-

sale financial assets 665 (140) 426 851

Net loss (gain) on financial

assets at

fair value through profit and loss (36) 32 (34) 1,105

Impairment on available-for-sale

financial assets - 3,284 - 3,284

Income tax expense (recovery) (241) 23 (230) 46

Other non-cash gain (672) - (672) -

----------------------------------------

(2,235) (2,249) (4,405) (4,748)

Change in non-cash working capital

items 1,575 77 1,222 411

----------------------------------------

Net cash flows used in

operating activities from continuing

operations (660) (2,172) (3,183) (4,337)

Net cash flows provided by

operating activities from

discontinued operations 21,676 58,119 116,066 122,762

----------------------------------------

Net cash flows provided by operating

activities 21,016 55,947 112,883 118,425

----------------------------------------

Investing activities

Acquisition of investments (1,000) - (1,000) -

Proceeds on disposal of investments - 1,045 50 1,045

Exploration and evaluation (169) (1,324) (831) (3,284)

Interest received 433 313 1,003 658

----------------------------------------

Net cash flows used in (provided by)

investing activities from continuing

operations (736) 34 (778) (1,581)

Net cash flows used in

investing activities from

discontinued operations (45,702) (26,626) (77,735) (66,944)

----------------------------------------

Net cash flows used in investing

activities (46,438) (26,592) (78,513) (68,525)

----------------------------------------

Financing activities

Issuance of common shares, net of

share issue expenses 155,336 775 158,267 1,383

----------------------------------------

Net cash flows provided by financing

activities from continuing

operations 155,336 775 158,267 1,383

----------------------------------------

Net cash flows used in

financing activities from

discontinued operations (182,201) (15,002) (197,301) (29,026)

----------------------------------------

Net cash flows provided by (used in)

financing activities (26,865) (14,227) (39,034) (27,643)

----------------------------------------

Increase (decrease) in cash and cash

equivalents (52,287) 15,128 (4,664) 22,257

Cash and cash equivalents -

beginning of period 209,028 100,358 161,405 93,229

----------------------------------------

Cash and cash equivalents - end of

period 156,741 115,486 156,741 115,486

----------------------------------------

----------------------------------------

(2) Comparative information has been reclassed to reflect the estimated

allocation of continuing activities

Osisko Gold Royalties Ltd

Consolidated Balance Sheets

(Unaudited)

----------------------------------------------------------------------------

(tabular amounts expressed in thousands of Canadian dollars)

June 30,December 31,

2014 2013

-------------------------

($) ($)

Assets

Current assets

Cash and cash equivalents 156,741 161,405

Restricted cash - 560

Accounts receivable 178 24,552

Inventories 5 79,247

Prepaid expenses and other assets 209 24,260

-------------------------

157,133 290,024

Non-current assets

Restricted cash - 48,490

Investments in associates 3,461 3,557

Other investments 13,169 8,998

Property, plant and equipment 2,154 1,870,932

Deferred income taxes 13,370 -

-------------------------

189,287 2,222,001

-------------------------

-------------------------

Liabilities

Current liabilities

Accounts payable and accrued liabilities 1,545 78,967

Current portion of long-term debt - 71,794

Provisions and other liabilities - 6,913

-------------------------

1,545 157,674

Non-current liabilities

Long-term debt - 245,157

Provisions and other liabilities - 18,499

Deferred income and mining taxes - 69,603

-------------------------

1,545 490,933

-------------------------

Equity attributable to Osisko Gold Royalties

shareholders

Share capital 1 2,060,810

Warrants - 20,575

Contributed surplus - 75,626

Equity component of convertible debentures - 8,005

Accumulated other comprehensive income 2,561 16

Retained earnings (deficit) 185,180 (433,964)

-------------------------

187,742 1,731,068

-------------------------

189,287 2,222,001

-------------------------

-------------------------

FOR FURTHER INFORMATION PLEASE CONTACT:

John Burzynski

Senior Vice President New Business Development

(416) 363-8653

jburzynski@osiskogr.com

Sylvie Prud'homme

Director of Investor Relations

(514) 940-0670

sprudhomme@osiskogr.com

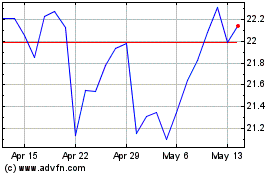

Osisko Gold Royalties (TSX:OR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Osisko Gold Royalties (TSX:OR)

Historical Stock Chart

From Apr 2023 to Apr 2024