Luxembourg, August 1,

2014 - ArcelorMittal (referred to as "ArcelorMittal" or

the "Company") (MT (New York, Amsterdam, Paris, Luxembourg), MTS

(Madrid)), the world's leading integrated steel and mining company,

today announced results[1] for the

three and six month periods ended June 30, 2014.

Highlights:

-

Health and safety: LTIF rate[2] of

0.87x in 2Q 2014 as compared to 0.90x in 2Q 2013

-

EBITDA[3] of $1.8

billion (including a $0.1 billion US litigation charge[4]) in 2Q

2014, a 9% improvement as compared to 2Q 2013 on an underlying

basis[5]; with

notable improvements in Europe (EBITDA +41% vs. 2Q 2013) and ACIS

(EBITDA +23% vs. 2Q 2013)

-

Net income of $0.1 billion in 2Q 2014 as

compared to a net loss of $0.8 billion in 2Q 2013

-

Steel shipments of 21.5Mt, an increase of 2.5%

as compared to 2Q 2013

-

16.6 Mt own iron ore production as compared to

15.0 Mt in 2Q 2013; 10.5 Mt shipped and reported at market

prices[6] as compared

to 8.2 Mt in 2Q 2013

-

Net debt[7] of $17.4

billion as of June 30, 2014 a decrease of $1.1 billion during the

quarter due to release of working capital ($0.9 billion) and

M&A proceeds ($0.2 billion)[8]

Key developments:

- Progress on ACIS turnaround

evident in improved Kazakhstan and Ukraine performance

- Franchise steel business

development: Cold mill complex at VAMA advanced automotive steel

plant in China has been inaugurated

- Calvert plant currently running

at 83% utilization; ArcelorMittal Tubarão blast furnace No.3

restarted in July 2014

- Agreement signed with BHP

Billiton to acquire its stake in the Mount Nimba iron ore project

in Guinea

Outlook and guidance framework:

- The previously announced 2014

guidance framework remains valid. The iron ore price has, however,

been lower than anticipated and this underlying assumption has been

adjusted to $105/t for the full year 2014 (from $120/t previously)

implying a second-half average of $100/t. All other

components of the framework remain unchanged

- As a result, the Company now

expects 2014 EBITDA in excess of $7.0 billion, assuming:

a) Steel shipments increase by approximately 3% in 2014 as compared

to 2013

b) Marketable iron ore shipments increase by approximately 15% in

2014 as compared to 2013

c) The iron ore price averages approximately $105/t (for 62% Fe CFR

China) during 2014

d) An improvement in steel margins despite the weather related

impacts on NAFTA segment's first-half performance

- Net interest expense is expected

to be approximately $1.6 billion for 2014

- Capital expenditure is expected

to be approximately $3.8-4.0 billion for 2014

- The Company maintains its medium

term net debt target of $15 billion

Financial highlights (on the

basis of IFRS1):

| (USDm) unless otherwise shown |

2Q 14 |

1Q 14 |

2Q 13 |

1H 14 |

1H 13 |

| Sales |

20,704 |

19,788 |

20,197 |

40,492 |

39,949 |

| EBITDA |

1,763 |

1,754 |

1,700 |

3,517 |

3,265 |

| Operating

income |

832 |

674 |

352 |

1,506 |

756 |

| Net income

/ (loss) attributable to equity holders of the parent |

52 |

(205) |

(780) |

(153) |

(1,125) |

| Basic

income / (loss) per share (USD) |

0.03 |

(0.12) |

(0.44) |

(0.09) |

(0.65) |

|

|

|

|

|

|

| Own iron

ore production (Mt) |

16.6 |

14.8 |

15.0 |

31.4 |

28.1 |

| Iron ore

shipments at market price (Mt) |

10.5 |

9.3 |

8.2 |

19.8 |

15.5 |

| Crude steel

production (Mt) |

23.1 |

23.0 |

22.5 |

46.1 |

44.9 |

| Steel

shipments (Mt) |

21.5 |

21.0 |

20.9 |

42.4 |

41.4 |

|

EBITDA/tonne (USD/t)[9] |

82 |

84 |

81 |

83 |

79 |

Commenting, Mr. Lakshmi N. Mittal, ArcelorMittal

Chairman and CEO, said:

"The second quarter and first half results reflect

the anticipated improvement in steel shipments and margins,

supporting an underlying EBITDA improvement compared with last

year. The expansion of our iron ore business is also on

track, although

increased iron ore shipments were offset by the lower than

anticipated iron ore price, which has led us to revise our EBITDA

guidance for the full year.

Looking ahead, indicators in both Europe and the

US, which together account for two thirds of our shipments,

continue to be positive and we have increased our steel demand

forecasts for both markets. ArcelorMittal continues to focus

on delivering on its strategy of reducing costs, investing in our

franchise businesses and reducing net debt."

Second quarter 2014 earnings

analyst conference call

ArcelorMittal management will host a conference

call for members of the investment community to discuss the second

quarter period ended June 30, 2014 on:

|

Date |

US Eastern time |

London |

CET |

| Friday

August 1, 2014 |

9.30am |

2.30pm |

3.30pm |

|

|

|

|

| The dial in

numbers: |

|

|

|

Location |

Toll free dial in numbers |

Local dial in numbers |

Participant |

| UK

local: |

0800 051

5931 |

+44 (0)203

364 5807 |

11966151# |

| USA

local: |

+1 866 719

2729 |

+1

240 645 0345 |

11966151# |

|

France: |

0800

9174780 |

+33 17071

2916 |

11966151# |

|

Germany: |

0800 965

6288 |

+49 692

7134 0801 |

11966151# |

| Spain: |

90 099

4930 |

+34

911 143436 |

11966151# |

|

Luxembourg: |

800

26908 |

+352 27 86

05 07 |

11966151# |

|

|

|

|

| A replay

of the conference call will be available for one week by

dialing: |

|

Number |

Language |

Access code |

|

| +49

(0) 1805 2043 089 |

English |

446824# |

|

The conference call will include a brief question

and answer session with senior management. The presentation will be

available via a live video webcast on www.arcelormittal.com.

Forward-Looking

Statements

This document may contain forward-looking

information and statements about ArcelorMittal and its

subsidiaries. These statements include financial projections and

estimates and their underlying assumptions, statements regarding

plans, objectives and expectations with respect to future

operations, products and services, and statements regarding future

performance. Forward-looking statements may be identified by the

words "believe," "expect," "anticipate," "target" or similar

expressions. Although ArcelorMittal's management believes that the

expectations reflected in such forward-looking statements are

reasonable, investors and holders of ArcelorMittal's securities are

cautioned that forward-looking information and statements are

subject to numerous risks and uncertainties, many of which are

difficult to predict and generally beyond the control of

ArcelorMittal, that could cause actual results and developments to

differ materially and adversely from those expressed in, or implied

or projected by, the forward-looking information and statements.

These risks and uncertainties include those discussed or identified

in the filings with the Luxembourg Stock Market Authority for the

Financial Markets (Commission de Surveillance du Secteur Financier)

and the United States Securities and Exchange Commission (the

"SEC") made or to be made by ArcelorMittal, including

ArcelorMittal's Annual Report on Form 20-F for the year ended

December 31, 2013 filed with the SEC. ArcelorMittal undertakes no

obligation to publicly update its forward-looking statements,

whether as a result of new information, future events, or

otherwise.

About

ArcelorMittal

ArcelorMittal is the world's leading steel and

mining company, with a presence in more than 60 countries and an

industrial footprint in over 20 countries. Guided by a philosophy

to produce safe, sustainable steel, we are the leading supplier of

quality steel in the major global steel markets including

automotive, construction, household appliances and packaging, with

world-class research and development and outstanding distribution

networks.

Through our core values of sustainability, quality

and leadership, we operate responsibly with respect to the health,

safety and wellbeing of our employees, contractors and the

communities in which we operate.

For us, steel is the fabric of life, as it is at

the heart of the modern world from railways to cars and washing

machines. We are actively researching and producing steel-based

technologies and solutions that make many of the products and

components we use in our everyday lives more energy-efficient.

We are one of the world's largest producers of

iron ore and metallurgical coal and our mining business is an

essential part of our growth strategy. With a geographically

diversified portfolio of iron ore and coal assets, we are

strategically positioned to serve our network of steel plants and

the external global market. While our steel operations are

important customers, our supply to the external market is

increasing as we grow.

In 2013, ArcelorMittal had revenues of $79.4

billion and crude steel production of 91.2 million tonnes, while

own iron ore production reached 58.4 million tonnes.

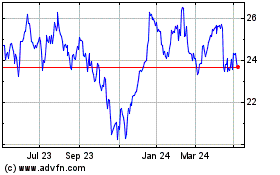

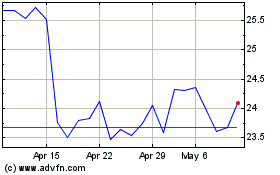

ArcelorMittal is listed on the stock exchanges of

New York (MT), Amsterdam (MT), Paris (MT), Luxembourg (MT) and on

the Spanish stock exchanges of Barcelona, Bilbao, Madrid and

Valencia (MTS).

For more information about ArcelorMittal please

visit: www.arcelormittal.com.

Enquiries

|

ArcelorMittal Investor

Relations |

|

|

|

|

Europe |

|

|

|

Tel:

+352 4792 2652 |

|

Americas |

|

|

|

Tel: +1 312

899 3985 |

|

Retail |

|

|

|

Tel:

+352 4792 3198 |

|

SRI |

|

|

|

Tel:

+44 207 543 1128 |

|

Bonds/Credit |

|

|

|

Tel:

+33 1 71 92 10 26 |

|

|

|

|

|

|

ArcelorMittal Corporate

Communications |

|

|

E-mail:

press@arcelormittal.com

Tel: +352 4792 5000 |

| Sophie

Evans |

|

|

Tel: +44

203 214 2882 |

| Laura

Nutt |

|

|

Tel: +44

207 543 1125 |

| France |

Image 7:

Sylvie Dumaine |

|

|

Tel: +33 1

53 70 94 17 |

| United

Kingdom |

Maitland

Consultancy: Martin Leeburn |

|

|

Tel: +44 20

7379 5151 |

Corporate responsibility and

safety performance

Health and safety - Own personnel and contractors

lost time injury frequency rate2

Health and safety performance, based on own

personnel figures and contractors lost time injury frequency (LTIF)

rate, increased to 0.87x in the second quarter of 2014 ("2Q 2014")

as compared to 0.85x for the first quarter of 2014 ("1Q 2014") and

decreased as compared to 0.90x for the second quarter of 2013 ("2Q

2013"). During 2Q 2014, significant improvement in the Brazil

segment performance relative to 1Q 2014 was offset by a

deterioration in the Mining segment performance.

Health and safety performance was relatively flat

at 0.86x in the first six months of 2014 ("1H 2014") as compared to

0.85x for the first six months of 2013 ("1H 2013"), with

improvements within the Mining, NAFTA and ACIS segments, offset by

deterioration in the Europe segment.

The Company's effort to improve the group's Health

and Safety record continues. Whilst the LTIF target of 0.75x is

maintained for 2014, the Company is focused on both further

reducing the rate of severe injuries and preventing fatalities.

Own personnel and contractors - Frequency rate

|

Lost time injury frequency rate |

2Q 14 |

1Q 14 |

2Q 13 |

1H 14 |

1H 13 |

| Mining |

0.84 |

0.26 |

0.61 |

0.54 |

0.63 |

|

|

|

|

|

|

| NAFTA |

0.88 |

1.00 |

1.21 |

0.95 |

1.09 |

| Brazil |

0.47 |

0.98 |

0.77 |

0.72 |

0.71 |

| Europe |

1.25 |

1.19 |

1.05 |

1.23 |

1.11 |

| ACIS |

0.51 |

0.54 |

0.76 |

0.51 |

0.60 |

| Total

Steel |

0.87 |

0.96 |

0.96 |

0.92 |

0.91 |

|

|

|

|

|

|

| Total

(Steel and Mining) |

0.87 |

0.85 |

0.90 |

0.86 |

0.85 |

Key corporate responsibility highlights for 2Q

2014

-

ArcelorMittal 2013 corporate responsibility

report, 'Steel: stakeholder value at every stage', was released on

April 22, 2014.

-

More than 200,000 employees and contractors

marked ArcelorMittal's 8th edition of its annual global Health and

Safety Day; events focussed on the theme of 'stop, think and act

safely - in practice".

-

ArcelorMittal Liberia has agreed to the

first-ever environmental management plan for the East Nimba Nature

Reserve. The plan was defined together with the Liberian Forestry

Development Authority, Fauna and Flora International, Conservation

International, the Co-Management Committee, USAID/PROSPER and

members of the local communities.

-

For the 3rd consecutive year, ArcelorMittal

Mexico has been awarded by the Mexican Philanthropy Centre as a

socially responsible company, recognizing the Company's proven

commitment and voluntary public engagement towards its employees,

investors, customers, authorities and society in general. These

programmes benefit more than 14,000 people every year.

-

ArcelorMittal Brazil donated 70,000 tonnes of

carbon credits to Brazil's Environmental Ministry to compensate for

greenhouse gas emissions during the football World Cup; those

credits were generated by the two Clean Development Mechanism

projects developed at ArcelorMittal Brazil to improve energy

efficiency of the steelmaking process.

Analysis of results for the six months ended

June 30, 2014 versus results for the six months ended June 30,

2013

ArcelorMittal's net loss for 1H 2014 was $0.2

billion, or $0.09 loss per share, as compared to net loss for 1H

2013 of $1.1 billion, or $0.65 loss per share.

Total steel shipments for 1H 2014 were 2.5% higher

at 42.4 million metric tonnes as compared with 41.4 million metric

tonnes for 1H 2013.

Sales for 1H 2014 increased by 1.4% to $40.5

billion as compared with $39.9 billion for 1H 2013, primarily due

to higher steel shipments (+2.5%) and marketable iron ore shipments

(+28.4%), offset in part by lower average steel selling prices

(-1.6%) and lower seaborne iron ore prices (-19%).

In recent years the Company's maintenance

practices have enabled an increase in the useful lives of plant and

equipment. As a result of this development, the Company has

determined that it is appropriate to extend the useful lives

resulting in a lower charge to the income statement. The full

detailed review of useful lives of the assets was largely completed

during 2Q 2014. Accordingly, depreciation of $2.0 billion for 1H

2014 was lower as compared to $2.3 billion for 1H 2013. The Company

expects the full year 2014 depreciation charge to be approximately

$3.8-4.0 billion as compared to $4.7 billion in both 2012 and

2013.

Impairment charges for 1H 2014 were nil.

Impairment charges for 1H 2013 were $39 million, primarily relating

to the closure of the organic coating and tin plate lines in

Florange (Europe).

Restructuring charges for 1H 2014 were nil.

Restructuring charges for 1H 2013 were $173 million, including $137

million of cost incurred for the long term idling of the Florange

liquid phase (including voluntary separation scheme costs, site

rehabilitation/safeguarding costs, and take or pay

obligations).

Operating income for 1H 2014 was $1.5 billion as

compared with operating income of $756 million for 1H 2013.

Operating results for 1H 2014 were negatively impacted by a $90

million charge following the settlement of US antitrust litigation.

Operating results for 1H 2013 were positively impacted by a $47

million fair valuation gain relating to the acquisition of an

additional ownership interest in DJ Galvanizing in Canada and $92

million related to "Dynamic Delta Hedge" (DDH) income. The DDH

income recorded in 1Q 2013 was the final instalment of such income.

This gain on the unwinding of a currency hedge related to raw

materials purchases was initially recorded in equity in 4Q 2008,

and as of 1Q 2013 was fully recorded in the income statement.

Income from investments, associates, joint

ventures and other investments in 1H 2014 was $154 million, as

compared to a loss of $42 million in 1H 2013. Income in 1H 2014

includes the annual dividend received from Erdemir, improved

performance of Spanish investees as well as the share of profits of

Calvert operations[10]. Losses

incurred during 1H 2013 related primarily to the payment of

contingent consideration related to the Gonvarri Brasil acquisition

in 2008 and weaker performance of European associates during the

year.

Net interest expense (including interest expense

and interest income) was lower at $809 million for 1H 2014, as

compared to $949 million for 1H 2013, on account of savings

incurred following repayment of the EUR and USD bonds in June 2013

and the EUR and USD convertibles in April and May of 2014. The

Company expects full year 2014 net interest expense of

approximately $1.6 billion.

Foreign exchange and other net financing

costs[11] were $707

million for 1H 2014 as compared to costs of $685 million for 1H

2013. Foreign exchange and other net financing costs for 1H 2014

include a payment following the termination of the Senegal

greenfield project[12] and

non-cash gains and losses on convertible bonds, and hedging

instruments which matured during the quarter. Foreign exchange and

other net financing costs for 1H 2013 were negatively affected by a

8% devaluation of Brazilian Real

versus USD which impacted loans

and payables denominated in foreign currency.

ArcelorMittal recorded an income tax expense of $217 million for 1H

2014, as compared to an income tax expense of $196 million for 1H

2013.

Non-controlling interests for 1H 2014 were a

charge of $80 million, as compared to a charge of $9 million for 1H

2013. Non-controlling interests charges for 1H 2014 primarily

relate to minority shareholders' share of net income recorded in

ArcelorMittal Mines Canada.

Analysis of results for 2Q

2014 versus 1Q 2014 and 2Q 2013

ArcelorMittal recorded net income for 2Q 2014 of

$52 million, or $0.03 earnings per share, as compared to a net loss

of $0.2 billion, or $0.12 loss per share for 1Q 2014, and a net

loss of $0.8 billion, or $0.44 loss per share for 2Q 2013.

Total steel shipments for 2Q 2014 were 21.5

million metric tonnes, as compared with 21.0 million metric tonnes

for 1Q 2014 and 20.9 million metric tonnes for 2Q 2013.

Sales for 2Q 2014 were $20.7 billion as compared

to $19.8 billion in 1Q 2014 and $20.2 billion for 2Q 2013. The

increase as compared to 1Q 2014 was due to improved steel shipments

(+2.3%), marginally higher average steel selling prices (+0.9%),

and seasonally higher market priced iron ore shipments (+12.5%),

offset in part by lower iron ore reference prices (-15%). Sales in

2Q 2014 was higher as compared to 2Q 2013 due to improved steel

shipments (+2.5%); and higher marketable iron ore shipments

(+28.8%), offset in part by lower average steel selling prices

(-1.2%) and lower iron ore references prices (-18.5%).

Following increases in the useful lives of plant

and equipment (as discussed above), depreciation was lower at $931

million for 2Q 2014 as compared to $1,080 million for 1Q 2014 and

$1,136 million for 2Q 2013.

Impairment charges for 2Q 2014 and 1Q 2014 were

nil. Impairment charges for 2Q 2013 were $39 million, primarily

relating to the closure of the organic coating and tin plate lines

in Florange (Europe).

Restructuring charges for 2Q 2014 and

1Q 2014 were nil. Restructuring charges for 2Q 2013 were $173

million, including $137 million of costs incurred for the long term

idling of the Florange liquid phase (including voluntary separation

scheme costs, site rehabilitation/safeguarding costs, and take or

pay obligations).

Operating income for 2Q 2014 was $832 million, as

compared to operating income of $674 million for 1Q 2014 and

operating income of $352 million for 2Q 2013. Operating results for

2Q 2014 included a $90 million charge following the settlement of

US antitrust litigation.

Income from investments, associates, joint

ventures and other investments in 2Q 2014 was $118 million as

compared to income in 1Q 2014 of $36 million, and a loss of $24

million in 2Q 2013. Income from investments, associates,

joint ventures and other investments in 2Q 2014 included annual

dividend received from Erdemir, improved performance from some

European investees as well as the share of profits of Calvert

operations. Income in 1Q 2014 was primarily the result of improved

performance of Spanish entities. Losses incurred during 2Q

2013 related primarily to the payment of contingent consideration

from the Gonvarri Brasil acquisition in 2008.

Net interest expense (including interest expense

and interest income) in 2Q 2014 was $383 million, as compared to

$426 million for 1Q 2014 and $471 million for 2Q 2013. The decrease

in 2Q 2014 was due to savings incurred following the repayment of

the EUR and USD bonds in June 2013, and the convertibles upon their

maturity in April and May of 2014.

Foreign exchange and other net financing costs

were $327 million for 2Q 2014 as compared to $380 million for 1Q

2014 and $530 million for 2Q 2013. Foreign exchange and other net

financing costs for 2Q 2014 include non-cash gains and losses on

convertible bonds, and hedging instruments which matured during the

quarter. Foreign exchange and other net financing costs for 1Q 2014

included a provision in relation to the termination of the Senegal

greenfield project. Foreign exchange and other net financing costs

for 2Q 2013 were negatively affected by a 9%

devaluation of Brazilian Real versus

USD which impacted loans and payables

denominated in foreign currency.

ArcelorMittal recorded an income tax expense of

$156 million for 2Q 2014, as compared to an income tax expense of

$61 million and $99 million for 1Q 2014 and 2Q 2013,

respectively.

Non-controlling interests for 2Q 2014 were a

charge of $32 million, as compared to a charge of $48 million for

1Q 2014 and a charge of $8 million for 2Q 2013. Non-controlling

interests charges for 2Q 2014 primarily related to minority

shareholders' share of net income recorded in ArcelorMittal Mines

Canada, partially offset by losses generated in ArcelorMittal South

Africa.

Capital expenditure

projects

The following tables summarize the Company's

principal growth and optimization projects involving significant

capital expenditures.

Completed projects in most recent quarters

|

Segment |

Site |

Project |

Capacity / particulars |

Actual completion |

| Mining |

ArcelorMittal Mines Canada |

Expansion project |

Increase concentrator capacity by 8mt/ year (16 to 24mt/

year) |

2Q 2013 (a) |

Ongoing(b) projects

|

Segment |

Site |

Project |

Capacity / particulars |

Forecast completion |

| Mining |

Liberia |

Phase 2 expansion project |

Increase production capacity to 15mt/ year (high grade sinter

feed) |

2015 (c) |

| NAFTA |

ArcelorMittal Dofasco (Canada) |

Construction of a heavy gauge galvanizing line#6 to optimise

galvanizing operations |

Optimize cost and increase shipment of galvanized products by

0.3mt / year |

2015 (e) |

| Brazil |

ArcelorMittal Vega Do Sul (Brazil) |

Expansion project |

Increase hot dipped galvanizing (HDG) capacity by 0.6mt /

year and cold rolling (CR) capacity by 0.7mt / year |

On hold |

|

Brazil |

Monlevade

(Brazil) |

Wire rod

production expansion |

Increase

in capacity of finished products by 1.1mt / year |

2015

(f) |

|

Juiz de Fora (Brazil) |

Rebar and meltshop expansion |

Increase in rebar capacity by 0.4mt / year;

Increase in meltshop capacity by 0.2mt / year |

2015 (f) |

| Brazil |

Monlevade (Brazil) |

Sinter plant, blast furnace and meltshop |

Increase in liquid steel capacity by 1.2mt / year;

Sinter feed capacity of 2.3mt / year |

On hold (f) |

| Brazil |

Acindar (Argentina) |

New rolling mill |

Increase in rolling capacity by 0.4mt / year for bars for

civil construction |

2016 (g) |

Joint venture projects

|

Region |

Site |

Project |

Capacity / particulars |

Forecast completion |

| China |

Hunan Province |

VAMA auto steel JV[13] |

Capacity of 1.5mt pickling line, 0.9mt continuous annealing

line and 0.5mt of hot dipped galvanizing auto steel |

2H 2014 (h) |

| Canada |

Baffinland |

Early revenue phase |

Production capacity 3.5mt/ year (iron ore) |

2015 (d) |

a) Final capex for the AMMC expansion project was

$1.6 billion. The ramp-up of expanded capacity at AMMC hit a

run-rate of 24mt by year end 2013. Stretch opportunity to 30mtpa

concentrate through debottlenecking of existing operations has been

identified but remains subject to board approval.

b) Ongoing projects refer to projects for which construction has

begun (excluding various projects that are under development), or

have been placed on hold pending improved operating

conditions.

c) The Phase 2 expansion of the Liberia project to a production

capacity of 15 million tonnes per annum sinter feed is underway.

The first sinter feed production is expected at the end of 2015.

Stretch opportunity to 20mtpa including 5mtpa DSO has been

identified but remains subject to board approval. Phase 2 is

expected to require capex of $1.7 billion.

d) The Company's Board of Directors has approved the Early Revenue

Phase ("ERP") at Baffinland, which requires less capital investment

than the full project as originally proposed. Implementation

of the ERP is now underway and environmental approvals are in

place. The goal is to reach a 3.5mt per annum production rate

during the open water shipping season by the end of 2015. The

budget for the ERP is approximately $730 million and requires

upgrading of the road that connects the port in Milne Inlet to the

mine site.

e) During 3Q 2013, the Company restarted the construction of a

heavy gauge galvanizing line #6 (capacity 660ktpy) at

Dofasco. On completion of this project in 2015, the older and

smaller galvanizing line #2 (capacity 400ktpy) will be

closed. The project is expected to benefit EBITDA through

increased shipments of galvanized product (260ktpy), improved mix

and optimized costs. The line #6 will also incorporate

Advanced High Strength Steel (AHSS) capability and is the key

element in a broader program to improve Dofasco's ability to serve

customers in the automotive, construction, and industrial

markets.

f) During 2Q 2013, the Company restarted its Monlevade expansion

project in Brazil. The project is expected to be completed in two

phases with the first phase (investment in which has now been

approved) focused mainly on downstream facilities and consisting of

a new wire rod mill in Monlevade with additional capacity of 1,050

ktpy of coils with capex estimated at a total of $280 million; and

Juiz de Fora rebar capacity increase from 50 to 400ktpy (replacing

some wire rod production capacity) and meltshop capacity increase

by 200ktpy. This part of the overall investment is expected to be

finished in 2015. A decision whether to invest in Phase 2 of the

project, focusing on the upstream facilities in Monlevade (sinter

plant, blast furnace and meltshop), will be taken at a later

date.

g) During 3Q 2013, Acindar Industria Argentina de Aceros S.A.

(Acindar) announced its intention to invest $100 million in a new

rolling mill (with production capacity of 400ktpy of rebars from 6

to 32mm) in Santa Fe province, Argentina devoted to the

manufacturing of civil construction products. The new rolling mill

will also enable ArcelorMittal Acindar to optimize production at

its special bar quality (SBQ) rolling mill in Villa Constitución,

which in the future will only manufacture products for the

automotive and mining industries. The project is expected to take

up to 24 months to build, with operations expected to start in

2016.

h) Valin ArcelorMittal Automotive Steel ("VAMA"), a downstream

automotive steel joint venture between ArcelorMittal and Valin

Group, of which the Company owns 49%, will produce steel for

high-end applications in the automobile industry and supply

international automakers and first-tier Chinese car manufacturers

as well as their supplier networks for the rapidly growing Chinese

market. The project involves the construction of state of the art

pickling line tandem CRM (1.5mt), continuous annealing

line (0.9mt) and hot dipped galvanised line (0.5mt). Total

capital investment is $832 million (100% basis) with the first

automotive coil to be produced in 2H 2014.

Analysis of segment operations

Effective January 1, 2014, ArcelorMittal

implemented changes to its organizational structure to give it a

greater geographical focus. The principal benefits of the

changes are to reduce organizational complexity and layers;

simplification of processes; regional synergies and taking

advantage of the scale effect within the

regions.

As a result, the analysis of segment operations

presented in this earnings release has been prepared reflecting the

new organizational structure[14]. The

changes are only related to the allocation between the new

reporting segments of NAFTA, Brazil (Brazil and neighboring

countries), Europe and ACIS. There are no changes to the Group

total or to the Mining segment.

The NAFTA segment includes the Flat, Long and

Tubular operations of USA, Canada and Mexico. The Brazil segment

includes the Flat operations of Brazil, and the Long and Tubular

operations of Brazil and its neighboring countries including

Argentina, Costa Rica, Trinidad and Tobago and Venezuela. The

Europe segment comprises the Flat, Long and Tubular operations of

the European business, as well as Distribution Solution (AMDS). The

ACIS division is largely unchanged with the addition of some

Tubular operations. The Mining segment remains unchanged.

NAFTA

| (USDm) unless otherwise shown |

2Q 14 |

1Q 14 |

2Q 13 |

1H 14 |

1H 13 |

| Sales |

5,423 |

4,928 |

4,794 |

10,351 |

9,681 |

| EBITDA |

177 |

259 |

191 |

436 |

576 |

|

Depreciation |

170 |

189 |

188 |

359 |

383 |

| Operating

income |

7 |

70 |

3 |

77 |

193 |

|

|

|

|

|

|

| Crude steel

production (kt) |

6,153 |

6,256 |

5,720 |

12,409 |

12,099 |

| Steel

shipments (kt) |

5,790 |

5,613 |

5,433 |

11,403 |

10,998 |

| Average

steel selling price (US$/t)[15] |

856 |

840 |

841 |

848 |

838 |

NAFTA crude steel production decreased by 1.7% to

6.2 million tonnes in 2Q 2014 as compared to 1Q 2014 as a result of

the planned blast furnace reline at Indiana Harbor No.7 and

unplanned maintenance downtime at Cleveland.

Steel shipments in 2Q 2014 were 5.8 million

tonnes, an increase of 3.2% as compared to 1Q 2014, primarily

driven by a 3.8% increase in flat product steel shipment volumes,

reflecting improved demand following the severe weather disruption

in the United States in 1Q 2014, offset in part by 1.6% decline in

long product steel shipment volumes, primarily due to lower export

business from Mexico.

Sales in NAFTA were 10.0% higher at $5.4 billion

in 2Q 2014 as compared to 1Q 2014 due to higher steel shipments as

discussed above, and higher average steel selling prices (+1.9%).

Average steel selling prices for flat products increased by 1.0%

and for long products by 4.7%.

EBITDA in 2Q 2014 decreased to $177 million as

compared to $259 million in 1Q 2014. EBITDA in 2Q 2014

included a $90 million charge following the settlement of antitrust

litigation in the United States. Excluding this effect, EBITDA

would have been 3.3% higher than 1Q 2014. Operating results for 2Q

2014 continued to be negatively impacted by the residual costs

recorded in 2Q 2014 resulting from the severe weather disruption in

United States during 1Q 2014 as well as costs related to planned

and unplanned maintenance downtime. Going forward, the Company does

not expect to see any further impact from the severe weather

experienced during 1H 2014 on NAFTA performance.

As compared to 2Q 2013, EBITDA decreased by 7.2%.

Excluding the charge related to the settlement of the US antitrust

litigation, EBITDA would have been 40.0% higher on account of

higher steels shipments (+6.6%) and average steel selling prices

(+1.7%).

Brazil

| (USDm) unless otherwise shown |

2Q 14 |

1Q 14 |

2Q 13 |

1H 14 |

1H 13 |

| Sales |

2,431 |

2,356 |

2,618 |

4,787 |

5,080 |

| EBITDA |

414 |

425 |

533 |

839 |

900 |

|

Depreciation |

109 |

138 |

175 |

247 |

358 |

| Operating

income |

305 |

287 |

358 |

592 |

542 |

|

|

|

|

|

|

| Crude steel

production (kt) |

2,382 |

2,413 |

2,561 |

4,795 |

4,961 |

| Steel

shipments (kt) |

2,312 |

2,325 |

2,487 |

4,637 |

4,894 |

| Average

steel selling price (US$/t) |

934 |

895 |

959 |

914 |

942 |

Brazil segment crude steel production at 2.4

million tonnes in 2Q 2014 was comparable to 1Q 2014.

Steel shipments in 2Q 2014 were 2.3 million

tonnes. Flat product steel shipment volumes increased 5.4% in 2Q

2014 following operational issues during 1Q 2014 in the hot strip

mill in Tubarão, offset by lower long products steel shipment

volumes (down 5.8%), with lower exports from our Point Lisas

operating facility in Trinidad.

Sales increased by 3.2% to $2.4 billion in 2Q 2014

as compared to 1Q 2014. Sales were higher primarily on account of

higher average steel selling prices (+4.4%). Average steel selling

price for long products were higher by 5.5% driven in part by

forex, while prices for flat products marginally declined by

0.1%.

EBITDA in 2Q 2014 decreased by 2.4% to $414 million as compared to

$425 million in 1Q 2014, and decreased by 22.3% as compared to $533

million in 2Q 2013. EBITDA in Q2 2014 was lower than 1Q 2014

primarily due to additional costs associated with the preparation

for the planned re-start of ArcelorMittal Tubarão blast furnace

No.3 in the third quarter of 2014. The long product business

performance remained relatively stable

EBITDA in 2Q 2014 was lower compared to 2Q 2013 by

22.3%, primarily due to lower steel shipment volumes (-7.0%) and

additional costs incurred in 2Q 2014 following the re-start of

ArcelorMittal Tubarão blast furnace No.3 discussed above.

Europe

| (USDm) unless otherwise shown |

2Q 14 |

1Q 14 |

2Q 13 |

1H 14 |

1H 13 |

| Sales |

10,518 |

10,322 |

10,546 |

20,840 |

20,750 |

| EBITDA |

689 |

535 |

490 |

1,224 |

910 |

|

Depreciation |

355 |

455 |

490 |

810 |

978 |

|

Impairments |

- |

- |

24 |

- |

24 |

|

Restructuring charges |

- |

- |

164 |

- |

164 |

| Operating

income / (loss) |

334 |

80 |

(188) |

414 |

(256) |

|

|

|

|

|

|

| Crude steel

production (kt) |

10,941 |

10,899 |

10,531 |

21,840 |

20,950 |

| Steel

shipments (kt) |

10,191 |

10,009 |

10,011 |

20,200 |

19,538 |

| Average

steel selling price (US$/t) |

799 |

808 |

807 |

804 |

813 |

Europe segment crude steel production in 2Q 2014

at 10.9 million tonnes remained flat as compared to 1Q 2014.

Steel shipments in 2Q 2014 were 10.2 million

tonnes, an increase of 1.8% as compared to 1Q 2014. Flat product

steel shipment volumes increased 0.7% and long product steel

shipment volumes increased by 4.2%, both benefiting from

seasonality and improved underlying demand.

Sales increased by 1.9% to $10.5 billion in 2Q

2014, as compared to $10.3 billion in 1Q 2014, primarily due to

higher steel shipment volumes discussed above, offset in part by

lower average steel selling prices (-1.1%). Average steel selling

prices for flat products decreased by 0.9% and for long products by

2.2%.

EBITDA in 2Q 2014 increased by 28.8%, to $689

million, as compared to $535 million in 1Q 2014, mainly driven by

higher shipments and positive price / cost effects. EBITDA in 2Q

2014 was 40.6% higher than 2Q 2013, primarily reflecting improved

market conditions and the realized benefits of cost optimization

efforts.

The comparable operating performance for 2Q 2013

was impacted by restructuring charges of $164 million, primarily

associated with the long term idling of the Florange liquid phase

in France and impairment charges of $24 million primarily related

to the closure of the organic coating and tin plate lines in

Florange. There were no such impairment or restructuring

charges in 2Q 2014.

ACIS

| (USDm) unless otherwise shown |

2Q 14 |

1Q 14 |

2Q 13 |

1H 14 |

1H 13 |

| Sales |

2,300 |

2,007 |

2,151 |

4,307 |

4,303 |

| EBITDA |

156 |

109 |

127 |

265 |

150 |

|

Depreciation |

131 |

129 |

129 |

260 |

266 |

|

Impairments |

- |

- |

15 |

- |

15 |

|

Restructuring charges |

- |

- |

9 |

- |

9 |

| Operating

income / (loss) |

25 |

(20) |

(26) |

5 |

(140) |

|

|

|

|

|

|

| Crude steel

production (kt) |

3,600 |

3,413 |

3,681 |

7,013 |

6,926 |

| Steel

shipments (kt) |

3,306 |

3,187 |

3,087 |

6,493 |

6,205 |

| Average

steel selling price (US$/t) |

592 |

567 |

628 |

580 |

626 |

ACIS crude steel production increased by 5.5% in

2Q 2014 to 3.6 million tonnes as compared to 1Q 2014, primarily due

to higher production in Ukraine (1Q 2014 impacted by blast furnace

maintenance) and Kazakhstan, offset in part by lower production in

South Africa following the reline of the Newcastle blast furnace,

which commenced during the quarter.

Steel shipments in 2Q 2014 were 3.3 million

tonnes, an increase of 3.7% as compared to 1Q 2014, primarily due

to an increase in Kazakhstan (+22.8%) and Ukraine (+2.4%), offset

in part by lower steel shipment volumes in South Africa

(-6.8%).

Sales were $2.3 billion in 2Q 2014, an increase of

14.6% as compared to 1Q 2014. Sales in 2Q 2014 were positively

impacted by improved volumes and higher average steel selling

prices (+4.4%). Average steel selling prices improved by 7.1%

in Kazakhstan, by 2.6% in Ukraine and by 5.3% in South Africa.

EBITDA in 2Q 2014 increased by 42.4% to $156

million, as compared to $109 million in 1Q 2014, due to improved

performance in the CIS countries, offset by weaker South African

profitability due to weak economic growth and associated domestic

challenges, coupled with planned maintenance noted above.

EBITDA in 2Q 2014 increased by 22.5% to $156

million, as compared to $127 million in 2Q 2013, due to improved

steel shipments (+7.1%) and forex benefit offset in part by lower

average steel selling prices (-5.8%).

Mining

| |

2Q 14 |

1Q 14 |

2Q 13 |

1H 14 |

1H 13 |

|

Sales[16] |

1,383 |

1,256 |

1,351 |

2,639 |

2,550 |

| EBITDA |

388 |

433 |

432 |

821 |

865 |

|

Depreciation |

155 |

159 |

146 |

314 |

293 |

| Operating

income |

233 |

274 |

286 |

507 |

572 |

|

|

|

|

|

|

|

| Own iron ore production (a) (Mt) |

16.6 |

14.8 |

15.0 |

31.4 |

28.1 |

| Iron ore shipped externally and internally at market

price (b) (Mt) |

10.5 |

9.3 |

8.2 |

19.8 |

15.5 |

| Iron ore

shipment - cost plus basis (Mt) |

6.2 |

4.2 |

6.5 |

10.4 |

11.3 |

|

|

|

|

|

|

| Own coal production(a) (Mt) |

1.8 |

1.8 |

2.0 |

3.6 |

4.0 |

| Coal shipped externally and internally at market

price(b) (Mt) |

1.1 |

1.0 |

1.1 |

2.1 |

2.4 |

| Coal

shipment - cost plus basis (Mt) |

0.8 |

0.8 |

0.7 |

1.6 |

1.4 |

(a) Own iron ore and coal production not

including strategic long-term contracts

(b) Iron ore and coal shipments of market-priced based

materials include the Company's own mines, and share of production

at other mines, and exclude supplies under strategic long-term

contracts

Own iron ore production (not including supplies

under strategic long-term contracts) in 2Q 2014 was 16.6 million

metric tonnes, 11.7% higher than 14.8 million metric tonnes for 1Q

2014, primarily due to higher production from our Canadian mining

operations following severe winter conditions in 1Q 2014. Own iron

ore production in 2Q 2014 was 10.7% above 2Q 2013.

Shipments at market price increased by 12.5% to

10.5 million tonnes in 2Q 2014 as compared to 9.3 million tonnes in

1Q 2014, primarily driven by seasonally higher shipments from our

Canadian mining operations following the severe weather conditions

in 1Q 2014. Shipments at market price in 2Q 2014 were 28.8% higher

than 2Q 2013 primarily due to increased shipments in Canada

following successful commissioning and ramp-up of the expanded

concentrator during 2013.

Own coal production (not including supplies under

strategic long-term contracts) in 2Q 2014 was 1.8 million metric

tonnes, flat as compared to 1Q 2014 and lower than 2.0 million

metric tonnes for 2Q 2013.

EBITDA for 2Q 2014 was $388 million, 10.5% lower

as compared to $433 million in 1Q 2014, primarily due to lower

seaborne iron ore market prices, partially offset by seasonally

higher volumes and improved costs.

EBITDA for 2Q 2014 was lower at $388 million as compared to $432

million in 2Q 2013 due to lower seaborne iron ore market prices,

partially offset by higher market priced shipments.

Liquidity and Capital

Resources

For 2Q 2014, net cash provided by operating activities was $1,548

million, as compared to net cash used in operating activities of

$471 million in 1Q 2014.

Cash provided by operating activities in 2Q 2014

included a $856 million release of operating working capital as

compared to a $906 million investment of operating working capital

in 1Q 2014. Rotation days[17] decreased

during 2Q 2014 to 54 days from 61 days in 1Q 2014 due to

improvement in inventory, receivables and payables.

Net cash used by other operating activities in 2Q

2014 was $384 million (including amongst others the Senegal

settlement payment, changes in other payables, such as employee

benefits and the adjustments of non-cash items such as income from

associates and forex gains partially offset by non-cash gains and

losses on convertible bonds, and hedging instruments which matured

during the quarter), as compared to net cash used by other

operating activities in 1Q 2014 of $393 million (including

adjustments of non-cash items such as income from associates and

forex and changes in other payables, such as employee benefits,

payment of provisions and VAT).

Net cash used in investing activities during 2Q

2014 was $607 million, as compared to $1,090 million in 1Q 2014.

Capital expenditure decreased to $774 million in 2Q 2014 as

compared to $875 million in 1Q 2014. The Company continues to

expect full year 2014 capital expenditure to be approximately

$3.8-4.0 billion.

Cash flow from other investing activities in 2Q

2014 of $167 million primarily included cash inflow from the

divestures of ATIC[18] group and

steel cord business[19]. Other

investing activities in 1Q 2014 of $215 million primarily included

$258 million associated with the AM/NS Calvert acquisition offset

in part by proceeds from the exercise of the second put option in

Hunan Valin13.

Net cash used in financing activities for 2Q 2014

was $1,675 million as compared to net cash provided by financing

activities of $557 million in 1Q 2014. Net cash used in financing

activities for 2Q 2014 primarily included debt repayment of $2.7

billion (primarily €1.25 billion for the 7.25% convertible bonds

due April 1, 2014 and $800 million for the 5.00% convertible bonds

due May 15, 2014), offset in part by a new bank loan of $1.0

billion.

Net cash provided by financing activities for 1Q

2014 included inflow of $1.3 billion relating to the proceeds from

the issuance of a €750 million 3.00% Notes due March 25, 2019,

under the Company's €3 billion wholesale Euro Medium Term Notes

Programme and proceeds from a new 3-year $300 million financing

provided by EDC (Export Development Canada), offset in part by the

early redemption of perpetual securities of $657 million. During 1Q

2014, the Company paid dividends of $57 million including dividends

to minority shareholders in ArcelorMittal Mines Canada and payments

to perpetual securities holders.

Net cash used in financing activities for 2Q 2013

included debt repayment of $3.3 billion (primarily €1.5 billion for

the 8.25% bond due 2013 and $1.2 billion for the 5.375% bond due

2013) and $290 million cash received related to the second and

final instalment of the previously announced investment by a

consortium led by POSCO and China Steel Corporation (CSC) to

acquire a joint venture interest in ArcelorMittal's Labrador Trough

iron ore mining and infrastructure assets in Quebec, Canada.

At June 30, 2014, the Company's cash and cash

equivalents (including restricted cash) and short-term investments

amounted to $4.4 billion as compared to $5.1 billion at March 31,

2014. Gross debt of $21.8 billion at June 30, 2014, decreased $1.7

billion as compared to March 31, 2014. As of June 30, 2014, net

debt was $17.4 billion as compared with $18.5 billion at March 31,

2014, primarily due to release in operating working capital ($0.9

billion) and M&A proceeds ($0.2 billion).

The Company had liquidity[20] of $10.4

billion at June 30, 2014, consisting of cash and cash equivalents

(including restricted cash and short-term investments) of $4.4

billion and $6.0 billion of available credit lines. On June 30,

2014, the average debt maturity was 6.2 years.

Key recent

developments

-

On July 29, 2014, ArcelorMittal and Billiton

Guinea B.V. ("BHP Billiton") signed a sale and purchase agreement

for the acquisition by ArcelorMittal of a 43.5% stake in Euronimba

Limited ("Euronimba"), which holds a 95% indirect interest in the

Mount Nimba iron ore project in Guinea ("Project"). The Project

comprises a 935 million tonne direct shipped ore resource with an

average grade of 63.1% Fe and is located approximately 40

kilometres from ArcelorMittal Liberia's mine and infrastructure

operations. ArcelorMittal has simultaneously entered into a sale

and purchase agreement with Compagnie Française de Mines et Métaux

(a member of the Areva group) for the acquisition of its 13% stake

in Euronimba. The closing of these two transactions would give

ArcelorMittal a 56.5% ownership of Euronimba. The remaining 43.5%

of Euronimba is owned by Newmont LaSource S.A.S. ("Newmont").

As part of the transaction, ArcelorMittal has granted Newmont a

limited duration option which, if exercised, would result in

Newmont and ArcelorMittal owning equal stakes in Euronimba. The

transaction is subject to certain closing conditions, including

merger control clearance and certain approvals from the Government

of Guinea.

-

On July 4, 2014, ArcelorMittal issued €600

million of 2.875 per cent Notes due July 6, 2020 under its €3

billion wholesale Euro Medium Term Notes Programme. The

proceeds of the issuance will be used for general corporate

purposes.

-

On June 30, 2014, ArcelorMittal completed the

sale of its 78% stake in European port handling and logistics

company ATIC Services S.A. ("ATIC") to HES Beheer, having received

all necessary regulatory approvals. The transaction was

completed for an agreed price of EUR 155 million ($212 million).

The net proceeds received are $144 million being $212 million

cash proceeds minus cash held by ATIC. Additionally, $17

million debt held by ATIC has been transferred. The transaction is

consistent with ArcelorMittal's stated strategy of selective

divestment of non-core assets. The transaction was completed on

June 30, 2014.

-

On June 15, 2014, Valin ArcelorMittal Automotive

Steel Co (VAMA) opened its new advanced automotive steel plant in

China, beginning a new era of automotive manufacturing in the

country. VAMA, the joint venture between ArcelorMittal and

Hunan Iron & Steel Co. will produce state-of-the-art grade

steels for safe and cost-efficient lightweight design, superior

surface quality and coating technology, helping to meet rapid

growth in demand for advanced automotive steels in China. The

annual production capacity will be 1.5 million tons, including

800,000 tons of cold rolled coils, 200,000 tons of aluminium-coated

coils and 500,000 tons of hot-dip galvanised coils.

-

In June 2014, ArcelorMittal agreed to settle a

lawsuit brought in the U.S. District Court for the Northern

District of Illinois, alleging that ArcelorMittal and several large

U.S. steel competitors restricted the output of steel products

between 2005 and 2007. ArcelorMittal continues to strongly

deny any liability or wrongdoing and believes the claims are

without merit. In order to avoid further costs and distraction

of management resources, as well as to mitigate further risk,

ArcelorMittal agreed to a settlement of $90 million with the

plaintiff class.

-

ArcelorMittal can confirm that a settlement has

been reached with the State of Senegal in respect of the

arbitration that had been brought in connection with a 2007

agreement relating to an integrated iron ore mining and related

infrastructure project in Senegal.

-

On December 9, 2013, ArcelorMittal signed an

agreement with Kiswire Ltd. for the sale of its 50% stake in the

joint venture Kiswire ArcelorMittal Ltd in South Korea and certain

other entities of its steel cord business in the US, Europe and

Asia for a total consideration of $169 million. The net proceeds

received in 2Q 2014 are $39 million being $55 million received in

cash during the quarter minus cash held by steel cord business.

Additionally, $28 million of gross debt held by the steel cord

business has been transferred. The remaining $102 million from the

sale proceeds is expected to be received by 2Q 2015. The

transaction is subject to final working capital adjustments.

Outlook and guidance

The 2014 guidance framework remains valid. Reflecting the weaker

than expected iron ore price, this underlying assumption has been

adjusted to $105/t (from $120/t previously) implying a second-half

average of $100/t. All other components of the framework remain

unchanged. As a result, the Company now expects 2014 EBITDA in

excess of $7.0 billion. The key assumptions behind this framework

are discussed below.

Based on the current economic outlook,

ArcelorMittal continues to expect global apparent steel consumption

("ASC") to increase by approximately 3-3.5% in 2014. Steel demand

growth has been strong in Europe and we have upgraded our ASC

growth in 2014 to 3-4%. Despite the impact of severe weather in the

US on demand in 1Q 2014, data for 2Q 2014 has been strong and US

ASC growth in 2014 has also been upgraded to a forecast range of

5-6%. In China, we see signs of stabilization due to the

government's targeted stimulus, and expect steel demand in the

range of 3-3.5%. While risks remain to steel demand in the CIS and

other emerging markets including Brazil, the stronger fundamentals

in our key developed world markets continue to support our

expectation that steel shipments should increase by approximately

3% in 2014 as compared to 2013.

Following the successful ramp up of expanded

capacity at ArcelorMittal Mines Canada, year-on-year increases in

market priced iron ore shipments are expected. This should underpin

a 15% expansion of marketable iron ore volumes for the Company in

2014 as compared to 2013.

The working assumption behind the revised 2014

EBITDA guidance is an average iron ore price of approximately

$105/t (for 62% Fe CFR China).

Due to improved industry utilization rates, and

the further contribution of the Company's Asset Optimization and

Management Gains cost optimization programs, steel margins are

expected to improve in 2014. This improvement is forecasted despite

the negative weather related impact on NAFTA performance at the

beginning of the year, which resulted in increased costs of

approximately $350 million in the 1H 2014.

Furthermore, the Company expects net interest

expense to be approximately $1.6 billion in 2014 as compared to

$1.8 billion in 2013 due primarily to lower average debt.

Capital expenditure is expected to be

approximately $3.8-4.0 billion, a slight increase over 2013, with

some of the expected spending from last year rolling into 2014 as

well as the continuation of the phase II Liberia project.

As previously communicated, the Company does not

intend to ramp-up any major steel growth capex or increase

dividends until the medium term $15 billion net debt target has

been achieved and market conditions improve.

ArcelorMittal Condensed

Consolidated Statements of Financial Position1

|

|

|

June 30, |

March 31, |

December 31, |

| In millions of U.S. dollars |

|

|

2014 |

2014 |

2013 |

| ASSETS |

|

|

|

|

|

| Cash and cash

equivalents including restricted cash |

|

|

4,404 |

5,061 |

6,232 |

| Trade accounts

receivable and other |

|

|

5,260 |

5,547 |

4,886 |

| Inventories |

|

|

18,627 |

18,888 |

19,240 |

| Prepaid expenses and

other current assets |

|

|

3,122 |

3,406 |

3,375 |

| Assets held for

sale[21] |

|

|

125 |

621 |

292 |

| Total Current

Assets |

|

|

31,538 |

33,523 |

34,025 |

|

|

|

|

|

|

| Goodwill and

intangible assets |

|

|

8,753 |

8,716 |

8,734 |

| Property, plant and

equipment |

|

|

50,835 |

50,876 |

51,364 |

| Investments in

associates and joint ventures |

|

|

6,948 |

6,907 |

7,195 |

| Deferred tax

assets |

|

|

8,972 |

9,075 |

8,938 |

| Other assets |

|

|

2,557 |

2,251 |

2,052 |

| Total Assets |

|

|

109,603 |

111,348 |

112,308 |

|

|

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS' EQUITY |

|

|

|

|

|

| Short-term debt and

current portion of long-term debt |

|

|

3,702 |

5,336 |

4,092 |

| Trade accounts payable

and other |

|

|

12,494 |

12,181 |

12,604 |

| Accrued expenses and

other current liabilities |

|

|

7,351 |

7,679 |

8,456 |

| Liabilities held for

sale21 |

|

|

42 |

194 |

83 |

| Total Current

Liabilities |

|

|

23,589 |

25,390 |

25,235 |

|

|

|

|

|

|

| Long-term debt, net of

current portion |

|

|

18,132 |

18,226 |

18,219 |

| Deferred tax

liabilities |

|

|

3,235 |

3,190 |

3,115 |

| Other long-term

liabilities |

|

|

12,423 |

12,478 |

12,566 |

| Total Liabilities |

|

|

57,379 |

59,284 |

59,135 |

|

|

|

|

|

|

| Equity attributable to

the equity holders of the parent |

|

|

48,923 |

48,735 |

49,793 |

| Non-controlling

interests |

|

|

3,301 |

3,329 |

3,380 |

| Total Equity |

|

|

52,224 |

52,064 |

53,173 |

| Total Liabilities and

Shareholders' Equity |

|

|

109,603 |

111,348 |

112,308 |

ArcelorMittal Condensed Consolidated Statement of

Operations1

| In millions of U.S. dollars |

Three months

ended |

Six months

ended |

| |

June 30,

2014 |

March 31, 2014 |

June

30,

2013 |

June 30, 2014 |

June 30, 2013 |

| Sales |

20,704 |

19,788 |

20,197 |

40,492 |

39,949 |

|

Depreciation |

(931) |

(1,080) |

(1,136) |

(2,011) |

(2,297) |

|

Impairment |

- |

- |

(39) |

- |

(39) |

|

Restructuring charges |

- |

- |

(173) |

- |

(173) |

|

Operating income |

832 |

674 |

352 |

1,506 |

756 |

| Operating

margin % |

4.0% |

3.4% |

1.7% |

3.7% |

1.9% |

|

|

|

|

|

|

| Income /

(loss) from associates, joint ventures and other investments |

118 |

36 |

(24) |

154 |

(42) |

| Net

interest expense |

(383) |

(426) |

(471) |

(809) |

(949) |

| Foreign

exchange and other net financing (loss) |

(327) |

(380) |

(530) |

(707) |

(685) |

|

Income / (loss) before taxes and

non-controlling interests |

240 |

(96) |

(673) |

144 |

(920) |

| Current

tax |

(95) |

(156) |

(149) |

(251) |

(210) |

| Deferred

tax |

(61) |

95 |

50 |

34 |

14 |

| Income tax

benefit / (expense) |

(156) |

(61) |

(99) |

(217) |

(196) |

|

Income / (loss) including non-controlling

interests |

84 |

(157) |

(772) |

(73) |

(1,116) |

|

Non-controlling interests |

(32) |

(48) |

(8) |

(80) |

(9) |

|

Net income / (loss) attributable to equity

holders of the parent |

52 |

(205) |

(780) |

(153) |

(1,125) |

|

|

|

|

|

|

| Basic

earnings (loss) per common share ($) |

0.03 |

(0.12) |

(0.44) |

(0.09) |

(0.65) |

| Diluted

earnings (loss) per common share ($) |

0.03 |

(0.12) |

(0.44) |

(0.09) |

(0.65) |

|

|

|

|

|

|

| Weighted

average common shares outstanding (in millions) |

1,791 |

1,790 |

1,788 |

1,791 |

1,769 |

| Adjusted

diluted weighted average common shares outstanding (in

millions) |

1,793 |

1,792 |

1,789 |

1,793 |

1,770 |

|

|

|

|

|

|

|

EBITDA |

1,763 |

1,754 |

1,700 |

3,517 |

3,265 |

| EBITDA

Margin % |

8.5% |

8.9% |

8.4% |

8.7% |

8.2% |

|

|

|

|

|

|

|

OTHER INFORMATION |

|

|

|

|

|

| Own iron

ore production (million metric tonnes)[22] |

16.6 |

14.8 |

15.0 |

31.4 |

28.1 |

| Crude steel

production (million metric tonnes) |

23.1 |

23.0 |

22.5 |

46.1 |

44.9 |

| Total

shipments of steel products (million metric tonnes) |

21.5 |

21.0 |

20.9 |

42.4 |

41.4 |

ArcelorMittal Condensed

Consolidated Statements of Cash flows1

| In millions of U.S. dollars |

Three months

ended |

Six months

ended |

|

June 30,

2014 |

March 31, 2014 |

June

30,

2013 |

June 30,

2014 |

June 30, 2013 |

| Operating

activities: |

|

|

|

|

|

| Net income / (loss)

attributable to equity holders of the parent |

52 |

(205) |

(780) |

(153) |

(1,125) |

| Adjustments to

reconcile net income /(loss) to net cash provided by

operations: |

|

|

|

|

|

| Non-controlling

interest |

32 |

48 |

8 |

80 |

9 |

| Depreciation and

impairment |

931 |

1,080 |

1,175 |

2,011 |

2,336 |

| Restructuring

charges |

- |

- |

173 |

- |

173 |

| Deferred income

tax |

61 |

(95) |

(50) |

(34) |

(14) |

| Change in operating

working capital[23] |

856 |

(906) |

1,272 |

(50) |

723 |

| Other operating

activities (net) |

(384) |

(393) |

561 |

(777) |

(45) |

| Net cash provided by

(used in) operating activities |

1,548 |

(471) |

2,359 |

1,077 |

2,057 |

| Investing

activities: |

|

|

|

|

|

| Purchase of property,

plant and equipment and intangibles |

(774) |

(875) |

(709) |

(1,649) |

(1,636) |

| Other investing

activities (net) |

167 |

(215) |

(8) |

(48) |

116 |

| Net cash used in

investing activities |

(607) |

(1,090) |

(717) |

(1,697) |

(1,520) |

| Financing

activities: |

|

|

|

|

|

| Net (payments)

proceeds relating to payable to banks and long-term debt |

(1,659) |

1,286 |

(3,047) |

(373) |

(3,068) |

| Dividends paid |

(5) |

(57) |

(3) |

(62) |

(37) |

| Combined capital

offering |

- |

- |

- |

- |

3,978 |

| Payments for

subordinated perpetual securities |

- |

(657) |

- |

(657) |

- |

| Disposal /

(acquisition) of non-controlling interests |

- |

- |

290 |

- |

1,100 |

| Other financing

activities (net) |

(11) |

(15) |

(36) |

(26) |

(76) |

| Net cash (used in)

provided by financing activities |

(1,675) |

557 |

(2,796) |

(1,118) |

1,897 |

| Net (decrease)

increase in cash and cash equivalents |

(734) |

(1,004) |

(1,154) |

(1,738) |

2,434 |

| Cash and cash

equivalents transferred to assets held for sale |

38 |

(31) |

- |

7 |

- |

| Effect of exchange

rate changes on cash |

9 |

(136) |

61 |

(127) |

(85) |

| Change in cash and

cash equivalents |

(687) |

(1,171) |

(1,093) |

(1,858) |

2,349 |

Appendix 1: Geographical

shipments by products

|

(000'kt) |

2Q 14 |

1Q 14 |

2Q 13 |

1H 14 |

1H 13 |

| Flat |

4,699 |

4,528 |

4,306 |

9,227 |

8,847 |

| Long |

1,193 |

1,212 |

1,202 |

2,405 |

2,326 |

|

NAFTA |

5,790 |

5,613 |

5,433 |

11,403 |

10,998 |

| Flat |

948 |

899 |

1,100 |

1,847 |

2,139 |

| Long |

1,336 |

1,419 |

1,367 |

2,755 |

2,738 |

|

Brazil |

2,312 |

2,325 |

2,487 |

4,637 |

4,894 |

| Flat |

7,039 |

6,992 |

6,989 |

14,031 |

13,800 |

| Long |

3,123 |

2,997 |

2,991 |

6,120 |

5,686 |

|

Europe |

10,191 |

10,009 |

10,011 |

20,200 |

19,538 |

| CIS |

2,243 |

2,053 |

2,046 |

4,296 |

4,077 |

| Africa |

1,037 |

1,112 |

1,017 |

2,149 |

2,090 |

|

ACIS |

3,306 |

3,187 |

3,087 |

6,493 |

6,205 |

Appendix 2: Capital

expenditure[24]

|

(USDm) |

2Q 14 |

1Q 14 |

2Q 13 |

1H 14 |

1H 13 |

| NAFTA |

116 |

110 |

81 |

226 |

160 |

| Brazil |

106 |

135 |

54 |

241 |

122 |

| Europe |

209 |

309 |

175 |

518 |

473 |

| ACIS |

110 |

105 |

99 |

215 |

188 |

| Mining |

220 |

209 |

298 |

429 |

687 |

| Total |

774 |

875 |

709 |

1,649 |

1,636 |

Note: Table excludes others and

eliminations.

Appendix 3: Debt repayment

schedule as of June 30, 2014

|

Debt repayment schedule (USD

billion) |

2014 |

2015 |

2016 |

2017 |

2018 |

>2018 |

Total |

| Bonds |

0.6 |

2.2 |

1.9 |

2.8 |

2.2 |

8.5 |

18.2 |

| LT

revolving credit lines |

|

|

|

|

|

|

|

| - $3.6bn

syndicated credit facility |

- |

- |

- |

- |

- |

- |

- |

| - $2.4bn

syndicated credit facility |

- |

- |

- |

- |

- |

- |

- |

| Commercial

paper[25] |

0.1 |

- |

- |

- |

- |

- |

0.1 |

| Other

loans |

0.6 |

1.3 |

0.9 |

0.1 |

0.1 |

0.5 |

3.5 |

| Total gross

debt |

1.3 |

3.5 |

2.8 |

2.9 |

2.3 |

9.0 |

21.8 |

Appendix 4: Credit lines

available as of June 30, 2014

|

Credit lines available (USD

billion) |

|

|

|

Maturity |

Commitment |

Drawn |

Available |

| - $3.6bn

syndicated credit facility |

|

|

|

18/03/2016 |

3.6 |

0.0 |

3.6 |

| - $2.4bn

syndicated credit facility |

|

|

|

06/11/2018 |

2.4 |

0.0 |

2.4 |

| Total

committed lines[26] |

|

|

|

|

6.0 |

0.0 |

6.0 |

Appendix 5: EBITDA bridge

from 1Q 2014 to 2Q 2014

|

USD millions |

EBITDA 1Q 14 |

Volume & Mix - Steel (a) |

Volume & Mix - Mining (a) |

Price-cost - Steel (b) |

Price-cost - Mining (b) |

Non -Steel EBITDA (c) |

Other (d) |

EBITDA 2Q 14 |

| Group |

1,754 |

131 |

25 |

1 |

(70) |

(8) |

(70) |

1,763 |

a) The volume variance indicates the sales value

gain/loss through selling a higher/lower volume compared to the

reference period, valued at reference period contribution (selling

price-variable cost). The mix variance indicates sales value

gain/loss through selling different proportions of mix (product,

choice, customer, market including domestic/export), compared to

the reference period contribution.

b) The price-cost variance is a combination of the selling price

and cost variance. The selling price variance indicates the sales

value gain/loss through selling at a higher/lower price compared to

the reference period after adjustment for mix, valued with the

current period volumes sold. The cost variance indicates

increase/decrease in cost (after adjustment for mix, one-time

items, non-steel cost and others) compared to the reference period

cost. Cost variance includes the gain/loss through consumptions of

input materials at a higher price/lower price, movement in fixed

cost, changes in valuation of inventory due to movement in capacity

utilization etc.

c) Non-steel EBITDA variance primarily represents the gain/loss

through the sale of by-products and services.

d) Other primarily represents foreign exchange and in 2Q 2014 also

includes a $90 million charge following the settlement of antitrust

litigation in the United States.

[1] The financial information in this press

release has been prepared consistently with International Financial

Reporting Standards ("IFRS") as issued by the International

Accounting Standards Board ("IASB"). While the interim financial

information included in this announcement has been prepared in

accordance with IFRS applicable to interim periods, this

announcement does not contain sufficient information to constitute

an interim financial report as defined in International Accounting

Standards 34, "Interim Financial Reporting". The numbers in this

press release have not been audited. The financial information and

certain other information presented in a number of tables in this

press release have been rounded to the nearest whole number or the

nearest decimal. Therefore, the sum of the numbers in a column may

not conform exactly to the total figure given for that column. In

addition, certain percentages presented in the tables in this press

release reflect calculations based upon the underlying information

prior to rounding and, accordingly, may not conform exactly to the

percentages that would be derived if the relevant calculations were

based upon the rounded numbers. This press release also includes

certain non-GAAP financial measures.

[2] Lost time injury frequency rate equals lost

time injuries per 1,000,000 worked hours, based on own personnel

and contractors.

[3] EBITDA is defined as operating income plus

depreciation, impairment expenses and restructuring charges /

exceptional items.

[4] In June 2014, ArcelorMittal agreed to settle a

lawsuit brought in the U.S. District Court for the Northern

District of Illinois, alleging that ArcelorMittal and several large

U.S. steel competitors restricted the output of steel products

between 2005 and 2007. ArcelorMittal continues to strongly

deny any liability or wrongdoing and believes the claims are

without merit. In order to avoid further costs and distraction

of management resources, as well as to mitigate further risk,

ArcelorMittal agreed to a settlement of $90 million with the

plaintiff class.

[5] EBITDA in 2Q 2014 of $1,763 million included

the negative impact of $90 million following the settlement of US

antitrust litigation.

[6] Market priced tonnes represent amounts of iron

ore and coal from ArcelorMittal mines that could be sold to third

parties on the open market. Market priced tonnes that are not sold

to third parties are transferred from the Mining segment to the

Company's steel producing segments and reported at the prevailing

market price. Shipments of raw materials that do not constitute

market-priced tonnes are transferred internally and reported on a

cost-plus basis.