Institutional investors are increasingly turning to real assets

to increase investment returns and manage macro-environment risks,

but would rethink allocations if interest rates rose significantly,

according to a new survey from BlackRock (NYSE:BLK).

The survey polled 201 executives on their attitudes and

allocations to real assets. It found 46 per cent of respondents had

increased allocations to real estate, infrastructure, commodities,

timber and farmland in the past three years, while 60 per cent

expect to do so in the next 18 months.

Matt Botein, Global Co-Head and CIO, BlackRock Alternative

Investors, commented: “Increasing life expectancies around the

world are causing institutions to seek longer-dated assets to match

their mounting liabilities. We believe real assets can

provide this match, while also delivering attractive yields in the

current environment. The growing number and magnitude of recent

real asset allocations clearly represents more than short-term,

tactical decisions. We believe real estate, infrastructure and

other real assets will become core to investors’ portfolios over

the next few years.”

Continued interest in real estate

Survey results show that real estate continues to gain traction

amongst investors, but sectorial and geographical distinction,

along with a clear definition of objectives, remains crucial to

rewarding risk exposure.

Real estate was the most common form of real asset investments -

96 per cent of respondents currently invest - with 59 per cent of

them opting for a conservative exposure to the asset class through

core equity. That said, many investors are also increasing

allocations to value-added equity (47 per cent) and opportunistic

equity strategies (34 per cent), which are more capital intensive

forms of real estate investing and have higher potential return

profiles.

Cautious about interest rates

Low rates have been a tailwind for real-asset investments.

Nearly half (47%) of respondents say that low interest rates

influence their investments. Almost two-thirds (62 per cent) said

they would rethink some of their allocations to real assets if a

‘significant’ rise in interest rates were to occur. This

sensitivity to interest rates varied by sector: 59 per cent of

respondents believed their real estate to be most sensitive to

rising rates, compared with 41 per cent and 33 per cent concerned

about infrastructure and commodities exposure respectively.

Marcus Sperber, Global Head of BlackRock Real Estate, commented:

“According to the survey results, the main draw of real assets

generally, and property in particular, has been the ability to

provide a stable income in this ultra-low yield environment.

Investors are becoming increasingly concerned about the impact of

central bank policies and the subsequent impact on interest rates

on property markets. This is leading the majority of respondents to

say that a significant rise in interest rates would cause them to

rethink some of their allocations to real assets. However, one of

BlackRock’s key 2015 themes is that nominal risk-free rates should

stay low for longer. Even if central banks tighten monetary policy,

we would anticipate property to continue to provide a good

protection against inflation, as these actions should be

accompanied by strong economic growth and improving employment

rates all of which are supportive of real asset fundamentals.”

Building opportunities in infrastructure

Infrastructure is comparatively less mature than other real

assets examined by the survey but a faster-growing category

with 66 per cent of respondents owning assets. A large number of

investors are interested in additional equity investments (72 per

cent) while the newly emerging institutional infrastructure debt

opportunity is already on the radar of many investors (38 per

cent). Of those that are expecting to increase allocations, 51 per

cent are at least somewhat interested in brownfield (existing)

projects compared to 23 per cent that are interested in newer

’greenfield’ projects.

Jim Barry, Global Head of BlackRock Infrastructure Investment

Group, said: “The message we hear repeatedly, all over the globe,

is that governments are looking to partner with private investors

to fund critical projects. The scale of the infrastructure need

globally presents great opportunities, in our opinion, for

investors who are looking for long- term income streams. While more

conservative strategies such as developed market brownfield

investments remain preferred by most investors, we saw significant

interest in emerging markets with 45% of respondents considering an

allocation in the next 18 months, perhaps reflecting increased

sophistication of investors already active in the asset class.”

Inflation protection

Inflation protection is one of the main the reasons investors

owned real assets. Of the respondents who are increasing investment

in infrastructure, 29% cite inflation protection as their

motivation.

Botein said, “Many institutional investors are exceptionally

overweight financial assets and underweight real

assets. Expected inflation tends to be priced into nominal

returns. Unexpected inflation is, however, exactly what one wants

to guard against. Put another way, the time to buy insurance is not

when one's house is on fire, but rather when fire is broadly

thought to be impossible. We believe that investors in real assets

today are generally able to obtain competitive returns while

benefitting from significant inflation protection."

The survey was commissioned by BlackRock and conducted by the

Economist Intelligence Unit in September 2014.

A copy of the report is available here.

About the survey

In September 2014, The Economist Intelligence Unit, on behalf of

BlackRock, conducted a global survey of 201 executives from

institutional investment organizations in 30 countries to ascertain

their level of interest in and strategies related to real-asset

investment.

In terms of geographic distribution, 80 respondents were located

in North America, 80 in Europe, the Middle East and Africa and 41

in Asia-Pacific. Approximately one-third of the organizations

represented in the survey have assets under management (AUM) of

more than $75bn, with a similar proportion reporting between $1bn

and $5bn.

About BlackRock

BlackRock is a leader in investment management, risk management

and advisory services for institutional and retail clients

worldwide. At September 30, 2014, BlackRock’s AUM was $4.525

trillion. BlackRock helps clients meet their goals and

overcome challenges with a range of products that include separate

accounts, mutual funds, iShares® (exchange-traded funds), and other

pooled investment vehicles. BlackRock also offers risk management,

advisory and enterprise investment system services to a broad base

of institutional investors through BlackRock

Solutions®. Headquartered in New York City, as of September

30, 2014, the firm had approximately 12,100 employees in more than

30 countries and a major presence in key global markets, including

North and South America, Europe, Asia, Australia and the Middle

East and Africa. For additional information, please visit the

Company’s website at www.blackrock.com

This material represents an assessment of the market environment

at a specific time and is not intended to be a forecast of future

events or a guarantee of future results. This information should

not be relied upon by the reader as research or investment advice.

The opinions expressed are as of December 3, 2014 and may change as

subsequent conditions vary. Investment strategies discussed may not

be suitable for all investors. Consult with your financial adviser

prior to making investment decisions.

©2014 BlackRock, Inc. All rights reserved. BLACKROCK,

BLACKROCK SOLUTIONS and iSHARES are registered and

unregistered trademarks of BlackRock, Inc., or its subsidiaries in

the United States and elsewhere. All other marks are the property

of their respective owners.

GMC - 0050

Media:Ed Sweeney,

646-231-0268Ed.Sweeney@BlackRock.comorStephen White,

+44-207-743-1299Stephen.White@BlackRock.com

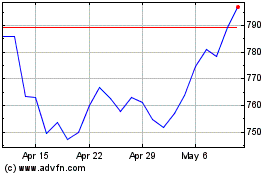

BlackRock (NYSE:BLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

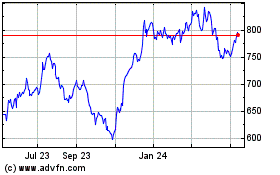

BlackRock (NYSE:BLK)

Historical Stock Chart

From Apr 2023 to Apr 2024