Yen Extends Slide As Sentiment Improves On Oil Price Rebound

22 December 2014 - 8:28PM

RTTF2

The Japanese yen extended its decline against its major rivals

in early European deals on Monday, as a rebound in oil prices

supported investor sentiment.

Brent crude futures rose above $62 a barrel in Asian deals after

Saudi Oil Minister Ali Al-Naimi on Sunday said at the 10th Arab

Energy Conference in Abu Dhabi that he's confident the oil market

will recover and fossil fuel will remain the main source of energy

for decades to come.

Blaming the recent fall in oil prices on speculators, he pledged

that Saudi Arabia, the world's largest oil producer, would not cut

production to prop up prices even if non-OPEC nations cut

output.

Most Asian stocks are trading higher, tracking gains on Wall

Street Friday and on bounce in oil prices.

The Bank of Japan on Friday maintained the annual pace of

increase in the monetary base at about JPY 80 trillion. Governor

Haruhiko Kuroda voiced confidence the bank will meet its inflation

target despite a recent plunge in oil prices.

In its Monthly Report on Recent Economic and Financial

Developments, the Bank of Japan noted that Japan's economy has

continued to recover moderately as a trend as the effects of the

decline in demand following the sales tax hike have been waning on

the whole.

The bank raised its assessment of exports and industrial

production.

The yen slipped to 119.88 against the greenback, its lowest

since December 10. At last week's close, the pair was quoted at

119.46. The next possible support for the yen is seen around the

121.5 zone.

The yen also dropped to a 6-day low of 147.02 against the euro,

4-day low of 122.15 against the franc and near a 2-week low of

187.53 against the pound. The yen ended Friday's trading at 146.10

against the euro, 121.37 against the franc and 186.64 against the

pound. Next key support for the yen may be found around 148.00

against the euro, 124.00 against the franc and 190.00 against the

pound.

The yen reversed from early high of 97.08 against the aussie and

a 4-day high of 92.07 against the kiwi, sliding to 97.67 and 92.85,

respectively. The yen is likely to find support around 98.8 against

the aussie and 93.6 against the kiwi.

The yen hit 103.47 against the loonie for the first time since

December 11. The loonie-yen pair traded at 102.91 at last week's

close. Further weakness may take the yen to a support of around the

104.00 area.

Looking ahead, Eurozone flash consumer sentiment index for

December and U.S. existing home sales for November are due in the

New York session.

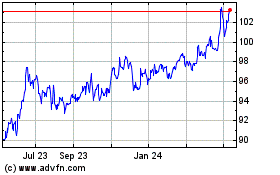

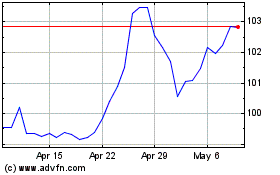

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024