First Trust MLP and Energy Income Fund Increases its Monthly Common Share Distribution to $0.1134 Per Share for January

23 December 2014 - 8:44AM

Business Wire

First Trust MLP and Energy Income Fund (the “Fund”) (NYSE: FEI)

has increased its regularly scheduled monthly common share

distribution to $0.1134 per share from $0.1117 per share. The

distribution will be payable on January 15, 2015, to shareholders

of record as of January 6, 2015. The ex-dividend date is expected

to be January 2, 2015. The monthly distribution information for the

Fund appears below.

First Trust MLP and

Energy Income Fund (FEI):

Distribution per share: $0.1134 Distribution Rate based on

the December 19, 2014 NAV of $22.53: 6.04% Distribution Rate based

on the December 19, 2014 closing market price of $20.76: 6.55%

Increase from previous distribution of $0.1117: 1.52%

It is anticipated that, due to the tax treatment of cash

distributions made by master limited partnerships (“MLPs”) in which

the Fund invests, a portion of the distributions the Fund makes to

Common Shareholders may consist of a tax-deferred return of

capital. The final determination of the source and tax status of

all distributions paid in 2015 will be made after the end of

2015.

The Fund is a non-diversified, closed-end management investment

company that seeks to provide a high level of total return with an

emphasis on current distributions paid to common shareholders. The

Fund seeks to provide its common shareholders with a vehicle to

invest in a portfolio of cash-generating securities, with a focus

on investing in publicly traded MLPs and MLP-related entities in

the energy sector and energy utilities industries. Under normal

market conditions, the Fund invests at least 85% of its Managed

Assets in equity and debt securities of MLPs, MLP-related entities

and other energy sector and energy utilities companies. To generate

additional income, the Fund expects to write (or sell) covered call

options.

First Trust Advisors L.P., the Fund’s investment advisor, along

with its affiliate, First Trust Portfolios L.P., are privately-held

companies which provide a variety of investment services, including

asset management and financial advisory services, with collective

assets under management or supervision of approximately $105

billion as of November 30, 2014, through unit investment trusts,

exchange-traded funds, closed-end funds, mutual funds and separate

managed accounts.

Energy Income Partners, LLC (“EIP”) serves as the Fund’s

investment sub-advisor and provides advisory services to a number

of investment companies and partnerships for the purpose of

investing in MLPs and other energy infrastructure securities. EIP

is one of the early investment advisors specializing in this area.

As of November 30, 2014, EIP managed or supervised approximately

$5.9 billion in client assets.

Past performance is no assurance of future results. Investment

return and market value of an investment in the Fund will

fluctuate. Shares, when sold, may be worth more or less than their

original cost.

Principal Risk Factors: Investment and Market Risk, Market

Discount from Net Asset Value, Management Risk and Reliance on Key

Personnel, Potential Conflicts of Interest Risk, Investment

Concentration Risk, Commodity Pricing Risk, Supply and Demand Risk,

Depletion and Exploration Risk, Regulatory Risk, Interest Rate

Risk, Acquisition or Reinvestment Risk, Affiliated Party Risk,

Catastrophe Risk, Terrorism/Market disruption Risk, MLP Risks,

Industry Specific Risk, Cash Flow Risk, MLP and Deferred Tax Risk,

Tax Law Change Risk, Non-U.S. Securities Risk, Delay in Investing

the Proceeds, Equity Securities Risk, Canadian Income Equities

Risk, Debt Securities Risk, Below Investment Grade Securities Risk,

Leverage Risk, Derivatives Risk, Covered Call Options Risk,

Portfolio Turnover Risk, Competition Risk, Restricted Securities

Risk, Liquidity Risk, Valuation Risk, Non-Diversification,

Anti-Takeover Provisions, Inflation Risk, Certain Affiliations,

Secondary Market for the Fund’s common Shares. The risks of

investing in the Fund are spelled out in the shareholder reports

and other regulatory filings.

The Fund’s daily closing New York Stock Exchange price and net

asset value per share as well as other information can be found at

www.ftportfolios.com or by calling 1-800-988-5891.

First Trust MLP and Energy Income FundPress Inquiries:Jane

Doyle, 630-765-8775orAnalyst Inquiries:Jeff Margolin,

630-915-6784orBroker Inquiries:Jeff Margolin, 630-915-6784

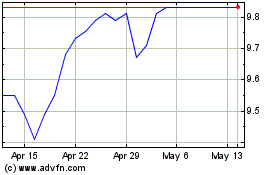

First Trust MLP and Ener... (NYSE:FEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

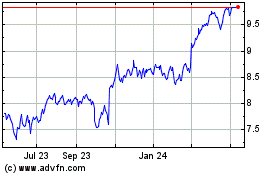

First Trust MLP and Ener... (NYSE:FEI)

Historical Stock Chart

From Apr 2023 to Apr 2024