Yen Drops As Weak Inflation Raises Hope Of Further BoJ Stimulus

26 December 2014 - 9:22PM

RTTF2

The Japanese yen fell against some of its major opponents on

Friday in quiet trading, as Japan's consumer prices inflation

slowed more than expected on lower oil prices in November and

industrial production declined unexpectedly from the prior

month.

Consumer prices rose 2.4 percent year-over-year in November

following the 2.9 percent growth in the previous month, figures

from the Ministry of Internal Affairs and Communication said. This

was slower than the 2.5 percent increase expected by

economists.

Data from Japan's Ministry of Economy, Trade and Industry showed

that Japan's industrial production declined by 0.6 percent

month-over-month in November, defying expectations for a 0.8

percent increase. This followed a 0.4 percent rise in the previous

month. This was the first decline in three months.

Retail sales rose 0.4 percent year-on-year in November, less

than the 1.1 percent growth expected by economists, a separate data

showed. In October, sales had advanced 1.4 percent.

The weak data cast doubts on whether BOJ could meet its pledge

of accelerating inflation to 2 percent in the next fiscal year,

beginning in April 2015.

Japan's Prime Minister Shinzo Abe is planning for about 3.5

trillion yen in fresh stimulus, reports said on Wednesday, as he

faces growing challenging to escape from recession.

The package is expected to be approved by Prime Minister Shinzo

Abe's cabinet on Saturday.

The yen eased to 187.23 versus the pound and 120.37 against the

greenback, from an early high of 186.91 and a 2-day high of 120.14,

respectively. The next possible support for the yen is seen around

122.00 against the greenback and 190.00 against the pound.

The yen inched down to 97.79 against the aussie, after having

advanced to 97.57 in early deals. If the yen extends decline, it is

likely to target support around the 98.4 level.

The Japanese currency declined to a 2-day low of 93.20 against

the NZ dollar, down from an early high of 92.93. The yen may find

downside target around the 95.00 mark.

The yen reversed from an early session's high of 103.42 against

the loonie, dropping to 103.64. Next key support for the yen may be

found near the 105.00 region.

On the flip side, the yen advanced to 146.62 against the euro

and 121.95 against the franc. Further gains may lead the yen to

resistance levels of around 145.00 against the euro and 121.00

against the franc.

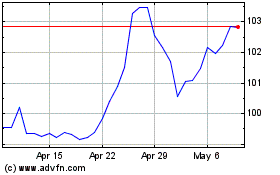

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

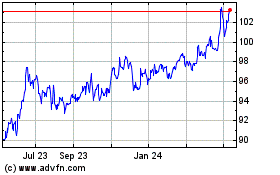

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024