Australia, NZ Dollars Lower On Weak Commodity Prices; Yen Hit By China Data

20 January 2015 - 5:05PM

RTTF2

The Japanese yen, the Australia and New Zealand dollars weakened

against their major currencies in the Asian session on Tuesday amid

declines in commodity prices and better than expected Chinese GDP

growth data. Data from the National Bureau of Statistics showed

that China's gross domestic product, or GDP, grew 7.3 percent in

the fourth quarter from a year ago, the same rate as in the third

quarter. This was the weakest growth since the first quarter of

2009. However, the growth was stronger than the 7.2 percent rise

forecast by economists.

Separate data released by the statistical agency showed that

retail sales and industrial production growth exceeded

expectations, while fixed asset investment rose in line with

expectations in the 12 month period ended December.

Meanwhile, commodity prices also traded lower, as lower copper

and oil prices dragged down resource stocks.

The International Monetary Fund downgraded its global growth

outlook as positive effects of lower oil prices and depreciation of

the euro and yen are more than offset by persistent negative

forces.

Data from the New Zealand Institute of Economic Research's

Quarterly Survey of Business Opinion showed New Zealand business

confidence stabilized in the three-month period to December, as

optimism, activity, hiring and a slew of other indicators rebounded

after easing in the previous six months.

In Asian market, the Australia's benchmark S&P/ASX 200 index

is currently down 1.40 points or 0.03 percent at 5,307 and the

broader All Ordinaries index is down 0.80 points or 0.02 percent at

5,288. The New Zealand's benchmark NZSE 50 index is also down 4.92

points or 0.09 percent at 5,633. While, the Japanese benchmark

Nikkei 225 index is currently up 278.98 points or 1.64 percent at

17,293.

Monday, the Australia and New Zealand dollars held steady

against their most major rivals, while the yen fell 0.47 percent

against the euro, 0.01 percent against the pound and 0.01 percent

against the U.S. dollar.

In the Asian trading today, the yen fell to a 5-day low of

137.09 against the euro, from yesterday's closing quote of 136.3.

If the yen extends its downtrend, it is likely to find support

around the 140.60 area.

Against the U.S., the yen dropped to a 1-week low of 118.30,

from yesterday's closing quote of 117.53. The yen may test support

near the 120.00 region.

The yen, which ended yesterday's deals at 177.59 against the

pound and 133.37 against the Swiss franc, edged down to 178.22 and

134.69, respectively. The yen is likely to find support around

181.26 against the pound and 140.10 against the franc.

The Australian dollar also fell to a 5-day low of 0.8159 against

the U.S. dollar and a 4-day low of 1.4189 against the euro in the

Asian trading today, from yesterday's closing quotes of 0.8210 and

1.4124, respectively. If the aussie extends its downtrend, it is

likely to find support around 0.80 against the greenback and 1.46

against the euro.

Pulling away from nearly a 2-week high of 97.15 against the yen,

the aussie edged down to 96.41, respectively. The aussie may test

support near the 94.10 area.

Against the Canadian dollar, the aussie edged down to 0.9774

from yesterday's value of 0.9801. This may be compared to an early

5-day low of 0.9773. On the downside, 0.9773 is seen as the next

support level for the aussie.

The NZ dollar also fell to a 5-day low of 1.4995 against the

euro in the Asian trading today, from yesterday's closing quote of

1.4901. If the kiwi extends its downtrend, it is likely to find

support around the 1.53 area.

Against the U.S. and the Australian dollars, the kiwi dropped to

5-day lows of 0.7720 and 1.0582 from yesterday's closing quotes of

0.7771 and 1.0541, respectively. The kiwi is likley to find support

near 0.76 against the greenback and 1.06 against the aussie.

Moving away from an early 1-week high of 91.90 against the yen,

the kiwi edged down to 91.29. On the downside, the kiwi may test

support near the 89.80 region.

Looking ahead, the German producer price index for December is

due to be released at 2:00 am ET.

In the European session, German ZEW economic sentiment index for

January is set to be published.

In the New York session, U.S. NAHB's housing market index for

January and Canada manufacturing sales for November are due to be

announced.

At 10:00 am ET, Federal Reserve Governor Jerome Powell will

speak on "Reforming the US Dollar London Interbank Offer Rate

(LIBOR)" at a Brookings Institution event in Washington DC.

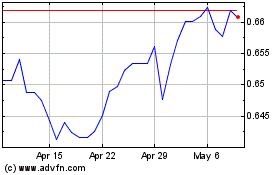

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024