Yen Advances After BOJ's Monetary Policy Decision

21 January 2015 - 3:28PM

RTTF2

The Japanese yen strengthened against the other major currencies

in the Asian session on Wednesday, after data showed that the Bank

of Japan announced its decision to leave its monetary policy

unchanged in its January meeting.

The bank decided by a 8-1 vote to maintain its target of raising

the monetary base at an annual pace of about JPY 80 trillion.

Also, the bank lefts its asset purchase policy unchanged.

The yen rose to a 1-week high of 90.12 against the NZ dollar, a

5-day high of 97.35 against the Canadian dollar and a 2-day high of

136.14 against the euro, from yesterday's closing quotes of 90.72,

98.05 and 137.16, respectively.

Against the U.S. and the Australian dollars, the yen edged up to

117.65 and 96.60 from yesterday's closing quotes of 118.78 and

94.06, respectively.

Against the pound and the Swiss franc, the yen edged up to

178.42 and 134.76 from yesterday's closing quotes of 179.89 and

135.44, respectively.

If the yen extends its uptrend, it is likely to find resistance

around 89.60 against the kiwi, 96.50 against the loonie, 134.33

against the euro, 175.34 against the pound, 113.56 against the

franc, 115.14 against the greenback and 94.14 against the

aussie.

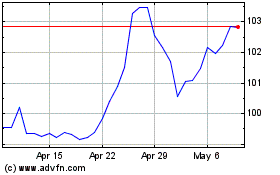

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

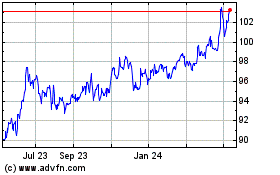

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024