- 2014 year-end proved reserves of 2.82

billion BOE, an increase of nearly 3 percent

- 2014 domestic reserve replacement ratio

of 266 percent and total company replacement of 174 percent

- Three-year reserve replacement ratio of

169 percent

Occidental Petroleum Corporation (NYSE:OXY) announced today that

at year-end 2014, the company's preliminary worldwide proved

reserves totaled 2.82 billion barrels of oil equivalent (BOE)

compared to 2.74 billion BOE at the end of 2013, restated to

exclude California Resources Corporation. In 2014, the company had

proved reserve additions from all sources of 380 million BOE,

compared to production of 218 million BOE, for a production

replacement ratio of 174 percent.

The preliminary domestic proved reserves totaled 1.78 billion

BOE compared to 1.67 billion BOE at the end of 2013. In 2014, the

domestic operations had proved reserve additions from all sources

of 308 million BOE, compared to production of 116 million BOE, for

a production replacement ratio of 266 percent.

"We are pleased to have replaced 174 percent of our 2014

production largely through improved recovery and extensions and

discoveries. Over the last three years, we replaced 169 percent of

our production. Our 2014 program resulted in apparent finding and

development costs of $16.89 per BOE. For the last three-year

period, our finding and development costs averaged about $18.66 per

BOE including revisions," said Stephen I. Chazen, President and

Chief Executive Officer.

As of December 31, 2014, 63 percent of the company's proved

reserves consisted of oil, 13 percent of NGL and 24 percent of gas.

Of the total proved reserves, approximately 60 percent is in the

United States and 40 percent in international locations.

Approximately 70 percent of the proved reserves are developed and

30 percent are undeveloped. Total company revisions were negative

58 million BOE, which included 54 million from the write-down of

Bahrain. Total company proved additions, excluding revisions, were

438 million BOE, mostly coming from improved recovery. The proved

undeveloped reserves increased by 284 million BOE due to improved

recovery mainly in Permian Resources. These additions were offset

by transfers of 315 million BOE to proved developed, with the Al

Hosn Gas Project transfer accounting for 68 percent of the

total.

About Occidental

Petroleum

Occidental Petroleum Corporation is an international oil and gas

exploration and production company with operations in the United

States, Middle East/North Africa and Latin America regions.

Headquartered in Houston, Occidental is one of the largest U.S. oil

and gas companies, based on equity market capitalization.

Occidental’s midstream and marketing segment gathers, processes,

transports, stores, purchases and markets hydrocarbons and other

commodities in support of Occidental’s businesses. The company’s

wholly owned subsidiary, OxyChem manufactures and markets

chlor-alkali products and vinyls.

Forward-Looking

Statements

Portions of this press release contain forward-looking

statements and involve risks and uncertainties that could

materially affect expected results of operations, liquidity, cash

flows and business prospects. Actual results may differ from

anticipated results, sometimes materially, and reported results

should not be considered an indication of future performance.

Factors that could cause results to differ include, but are not

limited to: global commodity pricing fluctuations; supply and

demand considerations for Occidental’s products;

higher-than-expected costs; the regulatory approval environment;

reorganization or restructuring of Occidental’s operations; not

successfully completing, or any material delay of, field

developments, expansion projects, capital expenditures, efficiency

projects, acquisitions or dispositions; lower-than-expected

production from development projects or acquisitions; exploration

risks; general economic slowdowns domestically or internationally;

political conditions and events; liability under environmental

regulations including remedial actions; litigation; disruption or

interruption of production or manufacturing or facility damage due

to accidents, chemical releases, labor unrest, weather, natural

disasters, cyber attacks or insurgent activity; failure of risk

management; changes in law or regulations; or changes in tax rates.

Words such as “preliminary,” “estimate,” “project,” “predict,”

“will,” “would,” “should,” “could,” “may,” “might,” “anticipate,”

“plan,” “intend,” “believe,” “expect,” “aim,” “goal,” “target,”

“objective,” “likely” or similar expressions that convey the

prospective nature of events or outcomes generally indicate

forward-looking statements. You should not place undue reliance on

these forward-looking statements, which speak only as of the date

of this release. Unless legally required, Occidental does not

undertake any obligation to update any forward-looking statements,

as a result of new information, future events or otherwise.

Material risks that may affect Occidental’s results of operations

and financial position appear in Part I, Item 1A “Risk Factors” of

the 2013 Form 10-K. Occidental posts or provides links to important

information on its website at www.oxy.com.

Attachment 1

OIL AND GAS

PRELIMINARY RESERVES

The following tables set forth Occidental's net

interests in quantities of proved developed and undeveloped oil

(including condensate), NGLs, natural gas and changes in such

quantities. Reserves are stated net of applicable royalties.

Estimated reserves include Occidental's economic interests under

production-sharing contracts (PSCs) and other similar economic

arrangements.

Attachment 2 OIL AND GAS

PRELIMINARY RESERVES OIL RESERVES In millions of

barrels (MMbbl)

United Latin Middle East/

States America North Africa

Total PROVED DEVELOPED AND UNDEVELOPED RESERVES

Balance at December 31, 2011 1,019 96 386 1,501

Revisions of previous estimates (25 ) 4 (3 ) (24 ) Improved

recovery 81 7 30 118 Extensions and discoveries 3 - 27 30 Purchases

of proved reserves 52 - - 52 Production (61 ) (11 )

(67 ) (139 )

Balance at December 31, 2012

1,069 96 373 1,538 Revisions of previous estimates (36 ) (5 ) 12

(29 ) Improved recovery 137 7 60 204 Extensions and discoveries 4 -

14 18 Purchases of proved reserves 25 - - 25 Sales of proved

reserves (4 ) - - (4 ) Production (64 ) (10 )

(65 ) (139 )

Balance at December 31, 2013

1,131 88 394 1,613 Revisions of

previous estimates

(54 ) 6 40 (8

) Improved recovery

224 9 32 265

Extensions and discoveries

15 - 2 17

Purchases of proved reserves

33 - - 33

Sales of proved reserves

(9 ) - -

(9 ) Production

(67 )

(11 ) (63 ) (141

) Balance at December 31, 2014 1,273

92 405

1,770 Proved Developed Reserves

December 31, 2011 780 69 317 1,166 December 31, 2012 803 82 295

1,180 December 31, 2013 822 76 281 1,179

December 31, 2014

819 86 316 1,221

Attachment 3 OIL AND GAS PRELIMINARY RESERVES

NGL RESERVES In millions of barrels (MMbbl)

United Latin Middle East/ States

America North Africa Total PROVED DEVELOPED

AND UNDEVELOPED RESERVES Balance at December 31, 2011

158 - 55 213 Revisions of previous estimates 15 - - 15 Improved

recovery 3 - - 3 Extensions and discoveries - - 64 64 Purchases of

proved reserves 1 - - 1 Production (21 ) -

(3 ) (24 )

Balance at December 31, 2012 156 -

116 272 Revisions of previous estimates 53 - (1 ) 52 Improved

recovery 9 - - 9 Extensions and discoveries - - 22 22 Purchases of

proved reserves 7 - - 7 Sales of proved reserves - - - - Production

(21 ) - (3 ) (24 )

Balance at

December 31, 2013 204 - 134 338

Revisions of previous estimates

6 - 8

14 Improved recovery

37 - - 37

Extensions and discoveries

2 - - 2

Purchases of proved reserves

3 - - 3

Sales of proved reserves

(10 ) - -

(10 ) Production

(20 )

- (2 ) (22

) Balance at December 31, 2014 222

- 140

362 Proved Developed Reserves December

31, 2011 123 - 55 178 December 31, 2012 124 - 53 177 December 31,

2013 151 - 51 202

December 31, 2014 147 -

109 256 Attachment 4

OIL AND GAS PRELIMINARY RESERVES GAS

RESERVES In billions of cubic feet (Bcf)

United

Latin Middle East/ States

America North Africa Total PROVED

DEVELOPED AND UNDEVELOPED RESERVES Balance at December 31,

2011 2,449 33 1,925 4,407 Revisions of previous estimates (581

) - 62 (519 ) Improved recovery 207 11 34 252 Extensions and

discoveries 7 - 784 791 Purchases of proved reserves 80 - - 80

Production (207 ) (5 ) (165 ) (377 )

Balance at December 31, 2012 1,955 39 2,640 4,634 Revisions

of previous estimates (46 ) (11 ) (43 ) (100 ) Improved recovery

251 1 16 268 Extensions and discoveries 13 - 232 245 Purchases of

proved reserves 34 - - 34 Sales of proved reserves (2 ) - - (2 )

Production (193 ) (5 ) (158 ) (356 )

Balance at December 31, 2013 2,012 24

2,687 4,723 Revisions of previous estimates

(111 ) 3 (273 ) (381

) Improved recovery

284 4 25 313

Extensions and discoveries

27 - 101 128

Purchases of proved reserves

46 - - 46

Sales of proved reserves

(371 ) - -

(371 ) Production

(173 )

(4 ) (154 ) (331

) Balance at December 31, 2014 1,714

27 2,386

4,127 Proved Developed Reserves

December 31, 2011 1,723 32 1,555 3,310 December 31, 2012 1,454 36

1,816 3,306 December 31, 2013 1,495 23 1,684 3,202

December 31,

2014 1,128 26 1,915 3,069

Attachment 5 OIL AND GAS PRELIMINARY

RESERVES TOTAL RESERVES In millions of BOE

(MMBOE) (a)

United Latin Middle East/

States America North Africa

Total PROVED DEVELOPED AND UNDEVELOPED RESERVES

Balance at December 31, 2011 1,585 101 762 2,448 Revisions

of previous estimates (107 ) 4 7 (96 ) Improved recovery 119 9 36

164 Extensions and discoveries 4 - 222 226 Purchases of proved

reserves 66 - - 66 Production (116 ) (12 ) (98

) (226 )

Balance at December 31, 2012 1,551 102 929

2,582 Revisions of previous estimates 10 (7 ) 4 7 Improved recovery

188 8 63 259 Extensions and discoveries 6 - 74 80 Purchases of

proved reserves 37 - - 37 Sales of proved reserves (5 ) - - (5 )

Production (117 ) (11 ) (94 ) (222 )

Balance at December 31, 2013 1,670 92 976 2,738 Revisions of

previous estimates (67 ) 6 3 (58 ) Improved recovery 310 9 35 354

Extensions and discoveries 22 - 19 41 Purchases of proved reserves

43 - - 43 Sales of proved reserves (81 ) - - (81 ) Production

(116 ) (11 ) (91 ) (218 )

Balance at

December 31, 2014 1,781 96

942 2,819

Proved Developed

Reserves December 31, 2011 1,190 74 631 1,895 December 31, 2012

1,169 88 651 1,908 December 31, 2013 1,222 80 613 1,915 December

31, 2014 1,154 90 744 1,988 (a) Natural gas volumes have

been converted to barrels of oil equivalent (BOE) based on energy

content of six thousand cubic feet (Mcf) of gas to one barrel of

oil.

Attachment 6

PRELIMINARY COSTS INCURRED ($ Millions) Costs

incurred in oil and gas property acquisition, exploration and

development activities, whether capitalized or expensed, were as

follows:

United Latin Middle

East/ States America North Africa

Total For the Year Ended December 31, 2014 Property

acquisition costs Proved properties

$ 771 $

- $ - $ 771 Unproved properties

842 - - 842 Exploration costs

379 4 180 563 Development costs

3,665 305 2,138

6,108 Costs Incurred $

5,657 $ 309 $

2,318 $ 8,284 For the

Year Ended December 31, 2013 Property acquisition costs Proved

properties $ 343 $ - $ - $ 343 Unproved properties 151 - - 151

Exploration costs 293 11 79 383 Development costs 2,659

329 2,117 5,105

Costs Incurred $ 3,446 $ 340 $ 2,196 $

5,982

For the Year Ended December 31, 2012

Property acquisition costs Proved properties $ 1,333 $ - $ 14 $

1,347 Unproved properties 573 - - 573 Exploration costs 379 1 114

494 Development costs 3,271 304

2,025 5,600

Costs Incurred $ 5,556

$ 305 $ 2,153 $ 8,014

Attachment 7 PRELIMINARY MULTI-YEAR

DATA WORLDWIDE 2012 2013

2014 3-Yr Average Reserves Replacement

(Million BOE) Revisions (96 ) 7

(58 ) (49 ) Improved

recovery 164 259

354 259 Extensions and discoveries

226 80

41 116

Organic without revisions (A) 390 339

395 375 Organic with

revisions (B) 294 346

337 326 Purchases 66

37

43 49 Total

reserve additions (C) 360 383

380 375 Production (D) 226 222

218 222

Costs Incurred ($ Millions)

Acquisitions 1,920 494

1,613 1,342 Exploration costs 494 383

563 480 Development costs 5,600 5,105

6,108 5,604 Organic (E)

6,094 5,488

6,671

6,084 Total costs incurred (F) 8,014

5,982

8,284 7,426

Finding & Development Costs per BOE Organic

without revisions (E) / (A) $ 15.63 $ 16.19

$ 16.89 $

16.22 Organic with revisions (E) / (B) $ 20.73 $ 15.86

$

19.80 $ 18.66 All-in (F) / (C) $ 22.26 $ 15.62

$

21.80 $ 19.80

Reserve Replacement Ratio

Organic without revisions (A) / (D) 173 % 153 %

181 %

169 % Organic with revisions (B) / (D) 130 % 156 %

155

% 147 % All-in (C) / (D) 159 % 173 %

174 % 169 %

UNITED STATES

2012 2013

2014 3-Yr Average

Reserves Replacement

(Million BOE) Revisions (107 ) 10

(67 ) (55 )

Improved recovery 119 188

310 206 Extensions and discoveries

4 6

22 11

Organic without revisions (A) 123 194

332 217 Organic with

revisions (B) 16 204

265 162 Purchases 66

37

43 49 Total

reserve additions (C) 82 241

308 211 Production (D) 116 117

116 116

Costs Incurred ($ Millions)

Acquisitions 1,906 494

1,613 1,338 Exploration costs 379 293

379 350 Development costs 3,271 2,659

3,665 3,198 Organic (E)

3,650 2,952

4,044

3,548 Total costs incurred (F) 5,556

3,446

5,657 4,886

Finding & Development Costs per BOE Organic

without revisions (E) / (A) $ 29.67 $ 15.22

$ 12.18 $

16.35 Organic with revisions (E) / (B) $ 228.13 $ 14.47

$

15.26 $ 21.90 All-in (F) / (C) $ 67.76 $ 14.30

$

18.37 $ 23.16

Reserve Replacement Ratio

Organic without revisions (A) / (D) 106 % 166 %

286 %

187 % Organic with revisions (B) / (D) 14 % 174 %

228

% 140 % All-in (C) / (D) 71 % 206 %

266 % 182

%

Occidental Petroleum CorporationMedia:Melissa E.

Schoeb713-366-5615melissa_schoeb@oxy.comorInvestors:Christopher M.

Degner212-603-8111christopher_degner@oxy.comOn the web:

www.oxy.com

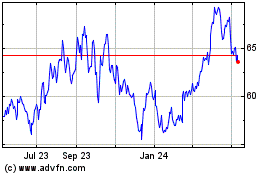

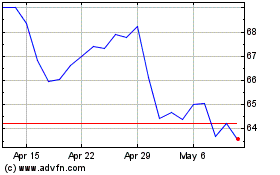

Occidental Petroleum (NYSE:OXY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Occidental Petroleum (NYSE:OXY)

Historical Stock Chart

From Apr 2023 to Apr 2024