Chevron Announces $35.0 Billion Capital and Exploratory Budget for 2015

31 January 2015 - 12:31AM

Business Wire

Chevron Corporation (NYSE:CVX) today announced a $35.0 billion

capital and exploratory investment program for 2015. Included in

the 2015 program are $4.0 billion of planned expenditures by

affiliates, which do not require cash outlays by Chevron. The 2015

budget is 13% lower than total investments for 2014.

“We continue to execute against a consistent set of business

strategies which are focused on creating long-term value for our

shareholders. Although commodity prices have fallen recently, we

believe long-term market fundamentals remain attractive,” said

Chairman and CEO John Watson. “Our investment priorities are

ensuring safe, reliable operations and progressing our queue of

projects under construction. Once on-line, these new projects are

expected to measurably increase our production and cash

generation,” he said.

“We will continue to monitor and be responsive to market

conditions, and to actively pursue cost reductions throughout our

supply chain in order to lower overall outlays. We anticipate

growing flexibility in our spend as projects under construction are

completed and as supplier contracts are renewed. We are testing our

short-cycle investments, particularly base business and

unconventional assets, at current prices and are selecting only the

most attractive opportunities to move forward,” Watson

continued.

Highlights of the Capital and

Exploratory Spending Program

Chevron 2015 Planned Capital &

Exploratory Expenditures $ Billions U.S. Upstream

8.2 International Upstream

23.4

Total Upstream 31.6 U.S. Downstream 2.0 International

Downstream

0.8

Total Downstream 2.8 Other

0.6

TOTAL (Including Chevron’s Share of Expenditures by Affiliated

Companies) 35.0 Expenditures by Affiliated

Companies

(4.0)

Cash Expenditures by Chevron Consolidated Companies

31.0

For Upstream, approximately $12 billion of planned upstream

capital spending is directed at existing base producing assets,

which includes shale and tight resource investments (~$3.5

billion). Roughly $14 billion is related to the construction of

major capital projects already underway, primarily LNG (~$8.5

billion) and deepwater developments (~$3.5 billion). Global

exploration funding accounts for approximately $3 billion.

Roughly 75 percent of affiliate expenditures are associated with

investments by Tengizchevroil LLP in Kazakhstan and Chevron

Phillips Chemical Company LLC (CPChem) in the United States.

Chevron is one of the world's leading integrated energy

companies, with subsidiaries that conduct business worldwide. The

company is involved in virtually every facet of the energy

industry. Chevron explores for, produces and transports crude oil

and natural gas; refines, markets and distributes transportation

fuels and lubricants; manufactures and sells petrochemical

products; generates power and produces geothermal energy; provides

energy efficiency solutions; and develops the energy resources of

the future, including biofuels. Chevron is based in San Ramon,

California. More information about Chevron is available at

www.chevron.com.

CAUTIONARY STATEMENTS RELEVANT TO

FORWARD-LOOKING INFORMATION FOR THE PURPOSE OF “SAFE HARBOR”

PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF

1995

This press release contains forward-looking statements relating

to Chevron’s operations that are based on management’s current

expectations, estimates and projections about the petroleum,

chemicals and other energy-related industries. Words such as

“anticipates,” “expects,” “intends,” “plans,” “targets,”

“forecasts,” “projects,” “believes,” “seeks,” “schedules,”

“estimates,” “may,” “could,” “budgets,” “outlook” and similar

expressions are intended to identify such forward-looking

statements. These statements are not guarantees of future

performance and are subject to certain risks, uncertainties and

other factors, many of which are beyond the company’s control and

are difficult to predict. Therefore, actual outcomes and results

may differ materially from what is expressed or forecasted in such

forward-looking statements. The reader should not place undue

reliance on these forward-looking statements, which speak only as

of the date of this press release. Unless legally required, Chevron

undertakes no obligation to update publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Among the important factors that could cause actual results to

differ materially from those in the forward-looking statements are:

changing crude oil and natural gas prices; changing refining,

marketing and chemicals margins; actions of competitors or

regulators; timing of exploration expenses; timing of crude oil

liftings; the competitiveness of alternate-energy sources or

product substitutes; technological developments; the results of

operations and financial condition of equity affiliates; the

inability or failure of the company’s joint-venture partners to

fund their share of operations and development activities; the

potential failure to achieve expected net production from existing

and future crude oil and natural gas development projects;

potential delays in the development, construction or start-up of

planned projects; the potential disruption or interruption of the

company’s production or manufacturing facilities or

delivery/transportation networks due to war, accidents, political

events, civil unrest, severe weather or crude oil production quotas

that might be imposed by the Organization of Petroleum Exporting

Countries; the potential liability for remedial actions or

assessments under existing or future environmental regulations and

litigation; significant investment or product changes required by

existing or future environmental statutes, regulations and

litigation; the potential liability resulting from other pending or

future litigation; the company’s future acquisition or disposition

of assets and gains and losses from asset dispositions or

impairments; government-mandated sales, divestitures,

recapitalizations, industry-specific taxes, changes in fiscal terms

or restrictions on scope of company operations; foreign currency

movements compared with the U.S. dollar; the effects of changed

accounting rules under generally accepted accounting principles

promulgated by rule-setting bodies; and the factors set forth under

the heading “Risk Factors” on pages 27 through 29 of the company’s

2013 Annual Report on Form 10-K. In addition, such results could be

affected by general domestic and international economic and

political conditions. Other unpredictable or unknown factors not

discussed in this press release could also have material adverse

effects on forward-looking statements.

Chevron CorporationKurt Glaubitz, +1 925-790-6928

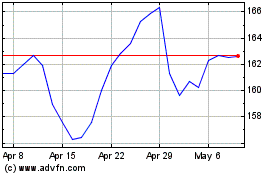

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

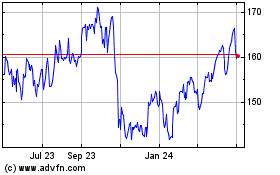

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024