2014 EBITDA and DCF Highest in Partnership’s

History

Pipeline and Storage Segment Throughput

Volumes Increase to Record Levels in the Fourth Quarter

Recently Closed on Immediately Accretive

Transaction to Acquire Full Ownership in Linden, NJ Refined

Products Terminal

NuStar Energy L.P. (NYSE: NS) today announced fourth quarter

2014 distributable cash flow from continuing operations available

to limited partners was $95.4 million, or $1.23 per unit, compared

to 2013 fourth quarter distributable cash flow from continuing

operations available to limited partners of $75.3 million, or $0.97

per unit. For the year ended December 31, 2014, distributable cash

flow from continuing operations available to limited partners was

$354.8 million, or $4.56 per unit, significantly higher than the

$257.8 million, or $3.31 per unit earned in 2013.

“2014 was a great year for NuStar,” said Brad Barron, President

and Chief Executive Officer of NuStar Energy L.P. and NuStar GP

Holdings, LLC. “We were able to achieve our primary goal of

covering our full-year distribution for 2014 through a renewed

focus on our core, fee-based pipeline and terminals businesses and

by significantly reducing our exposure to margin-based

operations.

“Record throughput volumes in both our pipeline and storage

segments, the renewal of eight million barrels of storage at two

key storage facilities, the completion of Phase 1 of our South

Texas Crude Oil Pipeline Expansion and our new state-of-the-art

dock in Corpus Christi, TX, all played a pivotal role in our return

to distribution coverage. Distributable cash flow from continuing

operations available to limited partners covers the distribution to

the limited partners by 1.12 times for the fourth quarter of 2014

and by 1.04 times for the full-year 2014, our highest annual

distribution coverage since 2011,” said Barron.

Barron went on to say, “Earlier this month, we announced that we

acquired the remaining 50% interest in a refined products terminal

in Linden, NJ, which is located in the New York Harbor. Owning this

terminal outright provides synergies with our adjacent wholly owned

terminal and may provide opportunities for future expansion. This

transaction was immediately accretive.”

Fourth Quarter and Full Year

Earnings Results

Fourth quarter earnings before interest, taxes, depreciation and

amortization (EBITDA) from continuing operations were $136.0

million, compared to fourth quarter 2013 negative EBITDA of $192.3

million. For the year ended December 31, 2014, the partnership

reported $547.9 million of EBITDA from continuing operations, the

highest we’ve reported in our history.

The partnership reported fourth quarter net income applicable to

limited partners of $41.5 million, or $0.54 per unit, compared to a

net loss applicable to limited partners of $368.3 million, or $4.73

per unit for the fourth quarter of 2013. Absent certain

adjustments, fourth quarter 2013 adjusted net income applicable to

limited partners would have been $16.6 million, or $0.21 per

unit.

For the year ended December 31, 2014, the partnership reported

net income applicable to limited partners of $163.3 million, or

$2.10 per unit, compared to a net loss applicable to limited

partners of $311.5 million, or $4.00 per unit, in 2013. Absent

certain adjustments, 2013 adjusted net income applicable to limited

partners would have been $58.8 million, or $0.75 per unit.

The partnership also announced that its board of directors has

declared a fourth quarter 2014 distribution of $1.095 per unit. The

fourth quarter 2014 distribution will be paid on February 13, 2015

to holders of record as of February 9, 2015.

2015 Earnings Guidance

“First quarter 2015 EBITDA results for our pipeline and storage

segments should be higher than last year’s first quarter. Both

segments should continue to benefit from increased throughput

volumes from Phase 1 of our South Texas Crude Oil Pipeline System,

which came online in the second quarter of 2014, while our storage

segment will also benefit from incremental EBITDA associated with

our recent acquisition of the Linden Terminal. First quarter 2015

EBITDA results for the fuels marketing segment should be comparable

to last year’s first quarter,” said Barron.

Commenting on full-year 2015 guidance, Barron said, “Our

pipeline segment EBITDA should be $25 to $45 million higher than

2014, and storage segment EBITDA should be $10 to $30 million

higher than 2014, while EBITDA in our fuels marketing segment is

expected to be in the range of $20 to $30 million. Based on these

projections, we expect to once again cover our distribution for the

full-year 2015.”

With regard to capital spending projections for 2015, Barron

went on to say, “We plan to spend $400 to $420 million on internal

growth projects and acquisitions during 2015, while reliability

capital spending is expected to be in the range of $40 to $50

million.”

Fourth Quarter Earnings Conference Call

Details

A conference call with management is scheduled for 9:00 a.m. CT

today, January 30, 2015, to discuss the financial and operational

results for the fourth quarter of 2014. Investors interested in

listening to the presentation may call 800/622-7620, passcode

63734023. International callers may access the presentation by

dialing 706/645-0327, passcode 63734023. The partnership intends to

have a playback available following the presentation, which may be

accessed by calling 800/585-8367, passcode 63734023. International

callers may access the playback by calling 404/537-3406, passcode

63734023. The playback will be available until 10:59 p.m. CT on

February 27, 2015.

Investors interested in listening to the live presentation or a

replay via the internet may access the presentation directly by

clicking here or by logging on to NuStar Energy L.P.’s Web site at

www.nustarenergy.com.

The presentation will disclose certain non-GAAP financial

measures. Reconciliations of certain of these non-GAAP financial

measures to U.S. GAAP may be found in this press release, with

additional reconciliations located on the Financials page of the

Investors section of NuStar Energy L.P.’s Web site at

www.nustarenergy.com.

NuStar Energy L.P., a publicly traded master limited partnership

based in San Antonio, is one of the largest independent liquids

terminal and pipeline operators in the nation. NuStar currently has

8,643 miles of pipeline and 81 terminal and storage facilities that

store and distribute crude oil, refined products and specialty

liquids. The partnership’s combined system has approximately 93

million barrels of storage capacity, and NuStar has operations in

the United States, Canada, Mexico, the Netherlands, including St.

Eustatius in the Caribbean, and the United Kingdom. For more

information, visit NuStar Energy L.P.'s Web site at

www.nustarenergy.com.

This release serves as qualified notice to nominees under

Treasury Regulation Sections 1.1446-4(b)(4) and (d). Please note

that 100% of NuStar Energy L.P.’s distributions to foreign

investors are attributable to income that is effectively connected

with a United States trade or business. Accordingly, all of NuStar

Energy L.P.’s distributions to foreign investors are subject to

federal income tax withholding at the highest effective tax rate

for individuals and corporations, as applicable. Nominees, and not

NuStar Energy L.P., are treated as the withholding agents

responsible for withholding on the distributions received by them

on behalf of foreign investors.

Cautionary Statement Regarding Forward-Looking Statements

This press release includes forward-looking statements regarding

future events, such as the partnership’s future performance. All

forward-looking statements are based on the partnership’s beliefs

as well as assumptions made by and information currently available

to the partnership. These statements reflect the partnership’s

current views with respect to future events and are subject to

various risks, uncertainties and assumptions. These risks,

uncertainties and assumptions are discussed in NuStar Energy L.P.’s

and NuStar GP Holdings, LLC’s 2013 annual reports on Form 10-K and

subsequent filings with the Securities and Exchange Commission.

Actual results may differ materially from those described in the

forward-looking statements.

NuStar Energy L.P. and Subsidiaries

Consolidated Financial Information (Unaudited, Thousands

of Dollars, Except Unit and Per Unit Data) Three

Months Ended December 31, Year Ended December 31,

2014 2013 2014 2013

Statement of Income Data: Revenues: Service revenues $

270,895 $ 237,216 $ 1,026,446 $ 938,138 Product sales 410,843

548,171 2,048,672 2,525,594 Total

revenues 681,738 785,387 3,075,118 3,463,732

Costs and expenses: Cost of product sales 389,020 525,760

1,967,528 2,453,997 Operating expenses 135,359 112,463 472,925

454,396 General and administrative expenses 27,070 25,108 96,056

91,086 Depreciation and amortization expense 48,943 45,805 191,708

178,921 Goodwill impairment loss — 304,453 —

304,453 Total costs and expenses 600,392 1,013,589

2,728,217 3,482,853 Operating income (loss)

81,346 (228,202 ) 346,901 (19,121 ) Equity in earnings (loss) of

joint ventures 3,059 (13,341 ) 4,796 (39,970 ) Interest expense,

net (31,735 ) (34,270 ) (131,226 ) (127,119 ) Interest income from

related party — 1,553 — 6,113 Other income, net 2,683 3,424

4,499 7,341 Income (loss) from continuing

operations before

income tax expense

55,353 (270,836 ) 224,970 (172,756 ) Income tax expense 484

4,666 10,801 12,753 Income (loss) from

continuing operations 54,869 (275,502 ) 214,169 (185,509 ) Loss

from discontinued operations, net of tax (Note 1) (1,475 ) (99,778

) (3,791 ) (99,162 ) Net income (loss) $ 53,394 $ (375,280 )

$ 210,378 $ (284,671 ) Net income (loss) applicable to

limited partners $ 41,522 $ (368,327 ) $ 163,339 $

(311,516 ) Net income (loss) per unit applicable to limited

partners Continuing operations $ 0.55 $ (3.60 ) $ 2.14 $ (2.89 )

Discontinued operations (Note 1) (0.01 ) (1.13 ) (0.04 ) (1.11 )

Total $ 0.54 $ (4.73 ) $ 2.10 $ (4.00 )

Weighted-average limited partner units outstanding 77,886,078

77,886,078 77,886,078 77,886,078

EBITDA from continuing operations (Note 2) $ 136,031 $ (192,314 ) $

547,904 $ 127,171 DCF from continuing operations (Note 2) $ 108,173

$ 88,115 $ 405,890 $ 308,877

December 31, 2014

2013 Balance Sheet Data: Debt, including current

portion (a) $ 2,826,452 $ 2,655,553 Partners’ equity (b) 1,716,210

1,903,794 Consolidated debt coverage ratio (Note 3) 4.0x 4.4x

NuStar Energy L.P. and

Subsidiaries Consolidated Financial Information -

Continued (Unaudited, Thousands of Dollars, Except Barrel

Data) Three Months Ended December 31, Year

Ended December 31, 2014 2013 2014

2013 Pipeline: Refined products pipelines

throughput (barrels/day) 533,521 514,975 510,737 487,021 Crude oil

pipelines throughput (barrels/day) 490,969 377,937

437,757 365,749 Total throughput (barrels/day)

1,024,490 892,912 948,494 852,770 Throughput revenues $ 130,812 $

109,768 $ 477,030 $ 411,529 Operating expenses 44,421 31,769

154,106 134,365 Depreciation and amortization expense 20,036

18,832 77,691 68,871 Segment operating income

$ 66,355 $ 59,167 $ 245,233 $ 208,293

Storage: Throughput (barrels/day) 918,929 807,414 887,607

781,213 Throughput revenues $ 31,867 $ 27,629 $ 123,051 $ 104,553

Storage lease revenues 111,142 105,956 441,455

451,996 Total revenues 143,009 133,585 564,506 556,549

Operating expenses 74,952 71,596 277,554 279,712 Depreciation and

amortization expense 26,368 24,439 103,848 99,868 Goodwill and

asset impairment loss — 304,453 — 304,453

Segment operating income (loss) $ 41,689 $ (266,903 )

$ 183,104 $ (127,484 )

Fuels Marketing: Product sales

$ 414,205 $ 549,167 $ 2,060,017 $ 2,527,698 Cost of product sales

392,734 530,197 1,983,339 2,474,612

Gross margin 21,471 18,970 76,678 53,086 Operating expenses 18,563

11,849 51,857 53,185 Depreciation and amortization expense —

7 16 27 Segment operating income (loss) $

2,908 $ 7,114 $ 24,805 $ (126 )

Consolidation and Intersegment Eliminations: Revenues $

(6,288 ) $ (7,133 ) $ (26,435 ) $ (32,044 ) Cost of product sales

(3,714 ) (4,437 ) (15,811 ) (20,615 ) Operating expenses (2,577 )

(2,751 ) (10,592 ) (12,866 ) Total $ 3 $ 55 $ (32 ) $

1,437

Consolidated Information: Revenues $ 681,738 $

785,387 $ 3,075,118 $ 3,463,732 Cost of product sales 389,020

525,760 1,967,528 2,453,997 Operating expenses 135,359 112,463

472,925 454,396 Depreciation and amortization expense 46,404 43,278

181,555 168,766 Goodwill and asset impairment loss — 304,453

— 304,453 Segment operating income (loss)

110,955 (200,567 ) 453,110 82,120 General and administrative

expenses 27,070 25,108 96,056 91,086 Other depreciation and

amortization expense 2,539 2,527 10,153 10,155

Consolidated operating income (loss) $ 81,346 $

(228,202 ) $ 346,901 $ (19,121 )

NuStar Energy L.P. and

Subsidiaries

Consolidated Financial Information -

Continued

(Unaudited, Thousands of Dollars,

Except Per Unit Data)

Notes:

(1) The results of operations for the following have been

reported as discontinued operations for all periods presented: (i)

the San Antonio Refinery and related assets, which we sold on

January 1, 2013, and (ii) certain storage assets that were

classified as “Assets held for sale” on the consolidated balance

sheet as of December 31, 2013. (2) NuStar Energy L.P.

utilizes financial measures, earnings before interest, taxes,

depreciation and amortization (EBITDA) from continuing operations,

distributable cash flow (DCF) from continuing operations, DCF from

continuing operations per unit, adjusted net income and adjusted

net income per unit (EPU), which are not defined in U.S. generally

accepted accounting principles (GAAP). Management uses these

financial measures because they are widely accepted financial

indicators used by investors to compare partnership performance. In

addition, management believes that these measures provide investors

an enhanced perspective of the operating performance of the

partnership’s assets and the cash that the business is generating.

None of EBITDA from continuing operations, DCF from continuing

operations, DCF from continuing operations per unit, adjusted net

income and adjusted EPU are intended to represent cash flows from

operations for the period, nor are they presented as an alternative

to net income or income from continuing operations. They should not

be considered in isolation or as substitutes for a measure of

performance prepared in accordance with GAAP. For purposes of

segment reporting, we do not allocate general and administrative

expenses to our reported operating segments because those expenses

relate primarily to the overall management at the entity level.

Therefore, EBITDA reflected in the segment reconciliations exclude

any allocation of general and administrative expenses consistent

with our policy for determining segmental operating income, the

most directly comparable GAAP measure. The following is a

reconciliation of income (loss) from continuing operations to

EBITDA from continuing operations and DCF from continuing

operations:

Three Months Ended December

31, Year Ended December 31, 2014

2013 2014 2013 Income (loss) from

continuing operations $ 54,869 $ (275,502 ) $ 214,169 $ (185,509 )

Plus interest expense, net and interest

income from related party

31,735 32,717 131,226 121,006 Plus income tax expense 484 4,666

10,801 12,753 Plus depreciation and amortization expense 48,943

45,805 191,708 178,921 EBITDA from

continuing operations 136,031 (192,314 ) 547,904 127,171 Equity in

(earnings) loss of joint ventures (3,059 ) 13,341 (4,796 ) 39,970

Interest expense, net and interest income from related party

(31,735 ) (32,717 ) (131,226 ) (121,006 ) Reliability capital

expenditures (10,373 ) (11,600 ) (28,635 ) (39,939 ) Income tax

expense (484 ) (4,666 ) (10,801 ) (12,753 ) Distributions from

joint ventures 1,708 2,169 7,587 7,956 Other items (a) 11,686

315,718 19,732 311,675 Mark-to-market impact on hedge transactions

(b) 4,399 (1,816 ) 6,125 (4,197 ) DCF from continuing

operations $ 108,173 $ 88,115 $ 405,890 $ 308,877

Less DCF from continuing operations

available to general partner

12,766 12,766 51,064 51,064

DCF from continuing operations available

to limited partners

$ 95,407 $ 75,349 $ 354,826 $ 257,813

DCF from continuing operations per limited

partner unit

$ 1.23 $ 0.97 $ 4.56 $ 3.31 (a) Other items for the

three months and year ended December 31, 2014 mainly consist of (i)

a net increase in deferred revenue associated with throughput

deficiency payments and construction reimbursements and (ii) a

lower of cost or market adjustment of $3.8 million. Other items for

the three months and year ended December 31, 2013 mainly consist of

(i) a non-cash goodwill impairment charge totaling $304.5 million

and (ii) an increase in deferred revenue associated with throughput

deficiency payments and construction reimbursements received in the

period. (b) DCF from continuing operations excludes the

impact of unrealized mark-to-market gains and losses that arise

from valuing certain derivative contracts, as well as the

associated hedged inventory. The gain or loss associated with these

contracts is realized in DCF from continuing operations when the

contracts are settled.

NuStar Energy L.P. and

Subsidiaries

Consolidated Financial Information - Continued

(Unaudited, Thousands of Dollars, Except Per Unit Data)

Notes (continued):

The following is a reconciliation of net

loss and EPU to adjusted net income and EPU:

Three Months EndedDecember 31,

2013 Year EndedDecember 31, 2013 Net loss / EPU $

(375,280 ) $ (4.73 ) $ (284,671 ) $ (4.00 ) Certain

adjustments: Goodwill and asset impairment loss 406,982 4.99

406,982 4.99 Gain on sale of certain assets — — (9,295 ) (0.12 )

Other adjustments (3,387 ) (0.05 ) (8,928 ) (0.12 ) Total certain

adjustments 403,595 4.94 388,759 4.75 Adjusted net income 28,315

104,088 GP interest and incentive and noncontrolling interest

(11,751 ) (45,251 ) Adjusted net income / EPU

applicable to limited partners $ 16,564 $ 0.21 $

58,837 $ 0.75

The following is a reconciliation of projected incremental

operating income to projected incremental EBITDA for the year ended

December 31, 2015:

Pipeline Segment Storage Segment

Projected incremental operating income $ 15,000 - 30,000 $ 5,000 -

20,000 Plus projected incremental depreciation and amortization

expense 10,000 - 15,000 5,000 - 10,000 Projected

incremental EBITDA $ 25,000 - 45,000 $ 10,000 - 30,000

The following is a reconciliation of projected operating income

to projected EBITDA for our fuels marketing segment:

Year EndedDecember 31,

2015

Projected operating income $ 20,000 - 30,000 Plus projected

depreciation and amortization expense — Projected EBITDA $

20,000 - 30,000 (3) The consolidated debt coverage

ratio is calculated as consolidated debt to consolidated EBITDA, as

defined in our $1.5 billion five-year revolving credit agreement.

NuStar Energy, L.P., San AntonioInvestors, Chris Russell,

Treasurer and Vice President Investor RelationsInvestor Relations:

210-918-3507orMedia, Mary Rose Brown, Executive Vice

President,Corporate Communications: 210-918-2314Web site:

http://www.nustarenergy.com

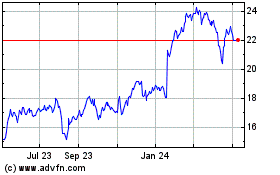

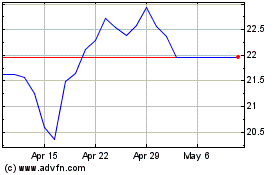

NuStar Energy (NYSE:NS)

Historical Stock Chart

From Mar 2024 to Apr 2024

NuStar Energy (NYSE:NS)

Historical Stock Chart

From Apr 2023 to Apr 2024