Australia, NZ Dollars Rise After China HSBC Manufacturing PMI

25 February 2015 - 1:48PM

RTTF2

The Australia and New Zealand dollars strengthened against their

major currencies in the Asian session on Wednesday, after China's

manufacturing sector rebounded unexpectedly in February.

Data from Markit Economics showed that the China's HSBC

manufacturing purchasing managers' index, or PMI, rose to a

four-month high of 50.1 in February from 49.7 in January.

Economists expected the index to come in at 49.5.

The latest reading marked a slight expansion in manufacturing

activity. A reading above 50 signals expansion while that below 50

indicates contraction.

The Australian dollar rose to nearly a 4-week high of 0.7884

against the U.S. dollar, a 4-week high of 93.56 against the yen and

a 5-day high of 1.4386 against the euro, from yesterday's closing

quotes of 0.7830, 93.15 and 1.4478, respectively.

Against the Canadian dollar, the aussie edged up to 0.9824 from

yesterday'a closing value of 0.9774.

If the aussie extends its uptrend, it is likely to find

resistance around 0.81 against the greenback, 97.16 against the

yen, 1.40 against the euro and 1.00 against the loonie.

The NZ dollar rose to a 2-day high of 0.7535 against the U.S.

dollar, from yesterday's closing value of 0.7489.

Against the yen and the euro, the kiwi edged up to 89.41 and

1.5051 from yesterday's closing quotes of 89.09 and 1.5134,

respectively.

If the kiwi extends its uptrend, it is likely to find resistance

around 0.77 against the greenback, 92.50 against the yen and 1.47

against the euro.

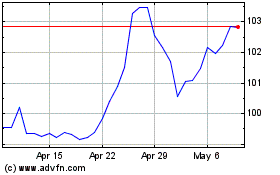

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

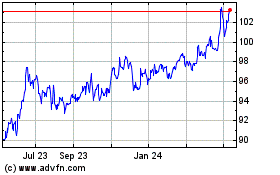

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024