Australian Dollar Extends Decline

27 February 2015 - 5:52PM

RTTF2

The Australian dollar extended its early decline against the

other major currencies in the Asian session on Friday, as most of

the economist expect the Reserve Bank to cut official interest

rates again in the next week's monetary policy meeting.

The Reserve Bank of Australia's interest rate decision is due

next Tuesday.

Most of the economist expect the bank to cut interest rates by

25 basis points to 2 per cent, having reduced the headline rate by

the same margin to 2.25 percent on February 3.

Higher unemployment rate, weak business investment expectations

together with low inflation are likely to push the RBA to cut its

key rates next Tuesday.

The RBA's rate cut decision also depend on when the U.S. Federal

Reserve begins hiking its interest rates. The Fed is expected to

begin hiking around the middle of the year, but any delays could

push the aussie higher.

In economic news, data from the Reserve Bank of Australia showed

that the total private sector credit in Australia was up 0.6

percent on month in January, exceeding expectations for a gain of

0.5 percent, which would have been unchanged from the December

reading. On a yearly basis, overall credit climbed 6.2 percent,

also topping forecasts for 6.0 percent and up from 5.9 percent in

the previous month.

Thursday, the Australian dollar fell on dissapointing

fourth-quarter private capex data which had also led to speculation

of an interest rate cut next week. The Australian dollar fell 1.10

percent against the U.S. dollar, 0.62 percent against the yen, 0.02

percent against the euro, 0.80 percent against the NZ dollar and

0.45 percent against the Canadian dollar.

In the Asian trading today, the Australian dollar fell to a

1-week low of 0.9727 against the Canadian dollar, from yesterday's

closing value of 0.9758. The aussie may test support near the 0.95

region.

Against the NZ dollar, the aussie dropped to an 8-day low of

1.0320 from yesterday's closing quote of 1.0346. On the downside,

1.02 is seen as the next support level for the aussie.

The aussie fell to 3-day lows of 92.72 against the yen and

0.7776 against the U.S. dollar, from yesterday's closing quotes of

93.13 and 0.7798, respectively. If the aussie extends its

downtrend, it is likely to find support around 89.09 against the

yen and 0.76 against the greenback.

The aussie edged down to 1.4403 against the euro, from

yesterday's closing quote of 1.4355. The aussie is likely to find

support around the 1.48 area.

Looking ahead, German import price index for January is due to

be released at 2:00 am ET.

In the European session, Swiss KOF leading indicaror index for

February is slated for release.

In the New York session, the second estimate of U.S. fourth

quarter GDP data , pending home sales for January, U.S. chicago PMI

for February and U.S. Reuters/University of Michigan's final

consumer sentiment index for February are due.

At 10:15 am ET, Federal Reserve Bank of New York President

William Dudley is exected to participate in a panel discussion,

along with Cleveland Fed President Loretta Mester, about the new

neutral for the federal funds rate and condition of the economy at

the 2015 US Monetary Policy Forum, in New York.

Subsequently, Federal Reserve Governor Stanley Fischer will

participate in a panel discussion about central banking with large

balance sheets at the 2015 US Monetary Policy Forum, in New York at

1:30 pm ET.

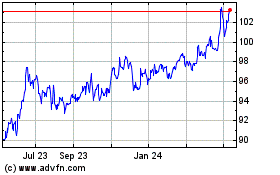

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

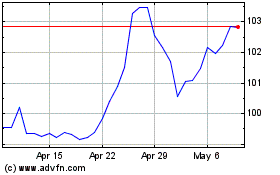

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024