Summit Financial Group, Inc. Restores Dividend to Common Shareholders and Announces Q1 2015 Dividend of $0.08 Per Share

02 March 2015 - 10:00PM

Summit Financial Group, Inc. ("Summit") (Nasdaq:SMMF) today

announces its intent to restore paying regular dividends to its

common shareholders, and its Board of Directors recently declared a

first quarter 2015 dividend of $0.08 per share payable on March 31,

2015 to common shareholders of record as of the close of business

on March 16, 2015.

Summit is a $1.44 billion financial holding company

headquartered in Moorefield, West Virginia. Summit provides

community banking services primarily in the Eastern Panhandle and

South Central regions of West Virginia and the Northern and

Shenandoah Valley regions of Virginia, through its bank subsidiary,

Summit Community Bank, Inc., which operates fifteen banking

locations. Summit also operates Summit Insurance Services, LLC in

Moorefield, West Virginia and Leesburg, Virginia.

FORWARD-LOOKING STATEMENTS

This press release contains comments or information that

constitute forward-looking statements (within the meaning of the

Private Securities Litigation Act of 1995) that are based on

current expectations that involve a number of risks and

uncertainties. Words such as "expects", "anticipates", "believes",

"estimates" and other similar expressions or future or conditional

verbs such as "will", "should", "would" and "could" are intended to

identify such forward-looking statements.

Although we believe the expectations reflected in such

forward-looking statements are reasonable, actual results may

differ materially. Factors that might cause such a difference

include our ability to consummate, and the results of, the private

placement and rights offering; changes in the financial and

securities markets, including changes with respect to the market

value of our financial assets; economic and political conditions,

especially in the Eastern Panhandle and South Central regions of

West Virginia and the Northern and Shenandoah Valley regions of

Virginia; real estate prices and sales in the Company's markets;

changes in interest rates and interest rate relationships; demand

for products and services; the degree of competition by traditional

and non-traditional competitors; changes in banking laws and

regulations; changes in tax laws; the impact of technological

advances; the outcomes of contingencies; trends in customer

behavior as well as their ability to repay loans; and changes in

the national and local economies.

Investors are cautioned not to place undue reliance on

forward-looking statements, which speak only as of the date hereof.

We undertake no obligation to revise these statements following the

date of this press release. Additional information regarding risk

factors can be found in the Company's filings with the Securities

and Exchange Commission.

CONTACT: Teresa Ely, Director of Shareholder Relations

Telephone: (304) 530-0526

Email: tely@summitfgi.com

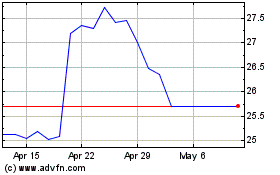

Summit Financial (NASDAQ:SMMF)

Historical Stock Chart

From Mar 2024 to Apr 2024

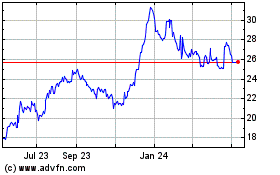

Summit Financial (NASDAQ:SMMF)

Historical Stock Chart

From Apr 2023 to Apr 2024