Australian Dollar Rises As RBA Keeps Rates In Hold

03 March 2015 - 3:16PM

RTTF2

The Australian dollar strengthened against the other major

currencies in the Asian session on Tuesday, following the

announcement of the Reserve Bank of Australia to leave its cash

rate unchanged at its March meeting.

The monetary policy board maintained the cash rate at 2.25

percent after lowering the rate by 25 basis points last month. The

bank was widely expected to cut its rate by another quarter point

today.

The Australian dollar rose to 1.4230 against the euro for the

first time since January 28. At yesterday's close, the pair was

trading at 1.4398.

Moving away from an early 1-week low of 0.7750 against the U.S.

dollar and a 4-day low of 92.97 against the yen, the aussie

advanced to 5-day highs of 0.7839 and 93.80, respectively. The

aussie closed yesterday's deals at 0.7765 against the greenback and

93.28 against the yen.

Against the New Zealand and the Canadian dollars, the aussie

rose to 5-day highs of 1.0398 and 0.9810 from yesterday's closing

quotes of 1.0336 and 0.9731, respectively.

If the aussie extends its uptrend, it is likely to find

resistance around 1.38 against the euro, 0.80 against the

greenback, 96.50 against the yen, 1.06 against the kiwi and 1.00

against the loonie.

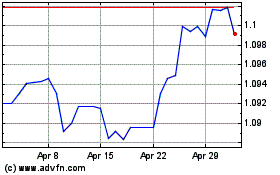

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

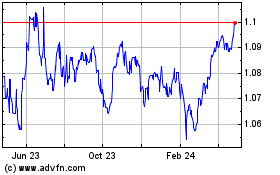

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024