Euro Down As Eurozone PPI Falls To More Than 5-year Low; ECB Meeting Awaited

03 March 2015 - 10:32PM

RTTF2

The euro fell against its major rivals in early European deals

on Tuesday, as Eurozone producer price inflation fell

more-than-expected to lowest since November 2009 in January, and

traders look forward to the European Central Bank's monetary policy

meeting for more details about the quantitative easing program.

The ECB meeting, taking place in Cyprus, is likely to disclose

exactly when the bank intend to launch its private and public asset

purchases, which are due to start in March. In its January meeting,

the ECB chief Mario Draghi announced 60 billion euros per month QE

program to counter deflation plaguing the euro area.

At its 2-day meeting ending on Thursday, the bank is unlikely to

announce new policy measures, retaining main refinancing rate

unchanged at 0.05 percent.

Eurozone producer prices declined the most since November 2009

on falling energy prices, according to data from Eurostat.

Producer prices fell more-than-expected 3.4 percent on a yearly

basis in January, following a 2.6 percent drop in December. This

was the biggest fall since November 2009, when prices fell 4.4

percent. Economists had forecast a decline of 3 percent.

Excluding energy, producer prices declined only 0.7 percent from

last year, after falling 0.4 percent in the previous month.

The euro was higher on Monday, aided by falling Eurozone jobless

rate in January, slower than expected decline in consumer prices in

February and positive business activity reports from most parts

across the region.

The euro retreated to 1.1165 against the greenback, down from an

early high of 1.1211. The next possible support for the

euro-greenback pair is seen around the 1.10 zone.

Having advanced to 0.7286 against the pound at 2:45 am ET, the

euro edged down to 0.7263. If the single currency extends decline,

0.70 is likely seen as its next support level.

The U.K. construction sector expanded strongly in February as

new orders logged the steepest rise since October 2014, survey data

from Markit showed.

The Chartered Institute of Procurement & Supply/Markit

construction Purchasing Managers' Index rose to 60.1 in February

from 59.1 in January. It was forecast to fall to 59.

The euro that advanced to 134.43 against the yen at 6:45 pm ET

pared gains to 133.70. The euro is poised to challenge support

around the 131.5 mark.

The euro held steady against the franc, after easing a bit from

an early 5-day high of 1.0756. The pair was valued at 1.0713 at

yesterday's close.

Switzerland's economy grew more than expected in the fourth

quarter, data from the State Secretariat for Economic Affairs

revealed.

Gross domestic product advanced 0.6 percent from the third

quarter, when it was up by 0.7 percent.

Looking ahead, Canada GDP for fourth quarter and industrial

product price index for January are due to be released in the New

York session.

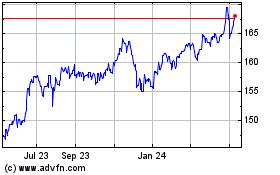

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

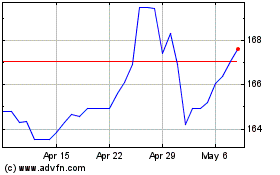

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024