2014 Fourth Quarter Highlights:

- Adjusted EBITDA increased by 11.5%

to €48.5 million

- Cash from operations of €60.2

million

- Volumes increased by 4.0% driven by

an increase in Specialty Carbon Black volumes of 8.2% and Rubber

Black of 3.0%

- Revenues increased to €316.8 million

despite the impact of lower oil prices on our selling

prices

- Loss for the quarter was €8.3

million

- Contribution margin improved by

10.0% or €9.4 million, compared to fourth quarter 2013

- Rubber Carbon Black Adjusted EBITDA

Margin expanded by 270 basis points to 12.7%

- Free Cash Flow per share for the

quarter totaled €0.55

Full Year 2014 Highlights:

- Adjusted EBITDA increased by 8.7% to

€207.7

- Cash from operations of €172.4

million

- Revenue for the year was €1,318.4

million and the loss for the year was €55.9 million

- Specialty Carbon Black volumes

increased by 6.7%

- Rubber Carbon Black adjusted EBITDA

Margin expanded by 197 basis points to 11.8%

- Contribution margin improved by 5.9%

or €23.3 million

- Dividend payment of €40 million or

€0.67 per share on December 22, 2014

- Free Cash Flow per share for the

year totaled €1.81

Orion Engineered Carbons S.A. ("Orion" or the "Company") (NYSE:

OEC), a worldwide supplier of specialty and high-performance carbon

black, today announced results for its fourth quarter of 2014.

In EUR

FourthQuarter2014

FourthQuarter2013

Full Year2014

Full Year2013

Revenue 316.8m 311.9m 1,318.4m

1,339.6m Volume (in kmt) 239.3

230.2 990.9 968.3

Contribution Margin 103.5m 94.1m

419.7m 396.4m Contribution Margin per metric

ton 433 409 424

409 Operating Result (EBIT) 21,6m 1.9m

104.3m 83.8m Adjusted EBITDA

48.5m 43.5m 207.7m

191.1m Profit or loss for the period (8.3m )

(17.0m ) (55.9m ) (19.0m ) Pro forma profit or loss

for the period(1)(3) N/A N/A

15.9m 6.4m EPS (2) (0.14 ) (0.39

) (1.11 ) (0.43 ) Pro forma EPS(2) N/A

N/A 0.27 0.11 Free Cash

Flow per Share (4) €0.55 N/A

€1.81 N/A

Notes:

(1) Pro forma profit or loss for full year 2014 prepared on the

same basis as the pro forma financial information included in our

prospectus dated July 24, 2014 (the “Prospectus”), filed in

connection with our initial public offering (the “IPO”), except

that the pro forma for the year ended December 31, 2014 reflects a

final interest rate of 5% per annum on the refinanced debt (assumed

4.5% per annum in the Prospectus), and a final number of

outstanding shares of 59.6 million (assumed in the Prospectus 58.9

million shares).

(2) EPS for the fourth quarter 2014 and Pro forma EPS calculated

using profit or loss for the period and based upon actual number of

shares outstanding of 59,635,126 as of December 31, 2014. EPS for

2013 calculated based upon using pre-IPO number of shares

outstanding of 43,750,000 and full year 2014 EPS calculated based

upon weighted average number of shares outstanding (43,750,000 pre

IPO and 59,635,126 post IPO).

(3) Pro forma profit for the year ended December 31, 2014

includes the impact of adjustment items of €25.7 million to EBITDA:

Consulting fees (€4.6 million) and restructuring expenses (€4.1

million) and other non-operating expenses of (€17.0 million) mainly

related to IPO-expenses and reconciliation of the difference

between EBITDA and adjusted EBITDA. Pro forma profit for the year

ended December 31, 2014 based upon Adjusted EBITDA (i.e., after

adjusting for IPO related costs, consulting fees and restructuring

expenses, and the non-cash impact of unrealized currency losses on

an after tax basis using an underlying group tax rate of 35%)

totaled €0.55 per share.

(4) Free Cash Flow per share is based on cash flows from

operations less investing activities.

"I am pleased with our fourth quarter results. We are

successfully executing our strategy of growing Specialty Carbon

Black volumes and improving Rubber Black EBITDA margins. This drove

fourth quarter Adjusted EBITDA growth of 11.5% over the prior year

while generating substantial cash from operations of over €60.2

million”, said Jack Clem, Orion’s Chief Executive Officer.

Fourth Quarter 2014 Overview

An increase of 9.1 kmt resulted in a volume of 239.2 kmt in the

fourth quarter of 2014 compared to 230.2 kmt in the fourth quarter

of 2013. This performance reflected increased volumes in both the

Specialty and Rubber Carbon Black segments. Increased volumes in

the Rubber Carbon Black segment were mainly driven by increased

demand in the Americas, whereas in the Specialty Carbon Black

segment increased volumes were the result of the strong performance

in Europe and North America.

Revenues increased by €4.9 million, or 1.6%, to €316.8 million

in the fourth quarter of 2014 from €311.9 million in the fourth

quarter of 2013. Volume increased by 4.0% in the fourth quarter of

2014 compared to the fourth quarter of 2013. Revenue increases were

tempered by the pass through effect of declining oil prices and

somewhat offset primarily by foreign exchange impacts, driven

primarily by the US Dollar strengthening against the Euro.

Contribution margin increased by €9.4 million, or 10%, to €103.5

million in the fourth quarter of 2014 from €94.1 million in the

fourth quarter of 2013, driven by gains in Specialty Carbon Black

volumes in Europe and Rubber Carbon Black volumes in Korea and the

Americas, partially offset by Europe as well as foreign exchange

effects.

Adjusted EBITDA increased by 11.5% to €48.5 million in the

fourth quarter of 2014 from €43.5 million in the fourth quarter of

2013, reflecting the impact of the increased Contribution Margin

per metric ton, increased volumes and good cost control, while

continuing to invest in technical sales capabilities in Specialty

Carbon Black.

Full year 2014 Overview

An increase of 22.6 kmt resulted in a total volume of 990.9 kmt

in 2014 as compared to 968.3 kmt in 2013. This performance was

driven by volume growth in the Specialty Carbon Black segment

particularly in the Americas as well as Europe. Increased volumes

in our Rubber Carbon Black segment in the Americas and in South

Korea were partly offset by weaker demand in Europe and South

Africa.

Volumes grew by 2.3%, supporting an increase in Contribution

Margin of €23.3 million, or 5.9%, to €419.7 million in 2014 from

€396.4 million in 2013, In addition to volume growth, we benefited

from continued improvements in operating efficiency.

Despite the increase in volumes, revenues decreased by €21.2

million, or 1.6%, to €1,318.4 million in 2014 from €1,339.6 million

in 2013 mainly due to both the impact of the pass through effect of

lower oil prices on our selling prices and changes in mix.

Adjusted EBITDA increased by €16.5 million, or 8.7% to €207.7

million in 2014 from €191.1 million in 2013 as a result of the

increase of Contribution Margin and our continued focus on cost

control.

Quarterly Segment Results

Specialty Carbon Black

Volumes for the Specialty Carbon Black segment increased by 3.7

kmt, or 8.2% to 48.8 kmt in the fourth quarter of 2014, reflecting

increased demand in Europe and the Americas.

Revenues of the segment also increased by €4.1 million, or 4.5%

to €94.7 million in the fourth quarter of 2014 from €90.5 million

in the fourth quarter of 2013, as a result of increased volumes.

Foreign exchange changes were offset by the pass through effect of

lower oil prices and changes in mix.

Gross profit of the segment increased by €5.2 million, or 21.4%,

to €29.1 million in the fourth quarter of 2014 from €23.9 million

in the fourth quarter of 2013 as a result of profitable growth and

the impact of higher depreciation charges in the prior year

quarter.

Adjusted EBITDA of the segment decreased by €1.2 million, to

€20.2 million in the fourth quarter of 2014 versus €21.4 million in

the fourth quarter of 2013 due to an increase in expenses

associated with the build-up of technical selling and the

associated support infrastructure footprint in Asia as well as

other regions, in order to support future growth in this

segment.

Rubber Carbon Black

Volumes in the Rubber Carbon Black segment increased by 5.6 kmt,

or 3.0%, to 190.5 kmt in the fourth quarter of 2014 versus 184.9

kmt in the fourth quarter of 2013, reflecting increased demand in

North America, which was offset by somewhat weaker demand in

Europe, Brazil and South Africa.

Despite the increase in volumes and favorable effects of

currency exchange rate changes, revenues of the segment only

slightly increased to €222.2 million in the fourth quarter of 2014

versus €221.4 million in the fourth quarter of 2013 primarily as a

result of the impact of the pass though effect of declining oil

prices on our selling prices as well as changes in mix.

Gross profit of the segment increased by €13.1 million, to €44.0

million in the fourth quarter 2014 from €30.9 million in the fourth

quarter of 2013 as a result of profitable volume growth in 2014, as

well as the effect of higher depreciation charges in the fourth

quarter of 2013 in part associated with the closure of our plant in

Portugal.

Adjusted EBITDA of this segment increased by €6.2 million, or

28.3%, to €28.3 million in the fourth quarter 2014 from €22.0

million in the fourth quarter of 2013 reflecting the development of

gross profit without the impact of reduced depreciation.

Balance Sheet and Cash Flow

As of December 31, 2014, the Company had cash and cash

equivalents of €70.5 million.

The Company’s non-current indebtedness as of December 31, 2014

was €670.2 million, mainly comprising the non-current portion of

our new term loan liabilities net of transaction costs of

€669.8 million. The Dollar denominated portion of this loan

increased during the fourth quarter by €10.3 million when converted

to Euro based on the year end 2014 closing exchange rate.

Cash inflows from operating activities in the fourth quarter of

2014 amounted to €60.2 million were derived from a consolidated

loss for the period of €8.3 million, adjusted for depreciation and

amortization of €20.0 million as well as cash and non-cash finance

cost of €23.4 million impacting the net income, and a decrease in

net working capital of €24.9 million. Net working capital totaled

€219.7 million at December 31, 2014 reflecting about 68 days of

sales.

Cash outflows from investing activities in the fourth quarter of

2014 amounted to €27.3 million comprised mainly of expenditures for

improvements in our plants in the United States, Korea and Germany.

We plan to continue financing our future capital expenditures with

cash generated by our operating activities.

Cash outflows for financing activities in the fourth quarter

amounted to €(46.4) million and comprised of our dividend payment

on December 22, 2014 of €40.0 million, repayments of local credit

facilities of €9.6 million, repayments on the New Credit Facility

of €1.7 million and interest payments of €9.5 million. Cash flow

from financing activities was positively affected by cash received

from realized gains from foreign currency derivatives of €13.5

million representing short term foreign currency hedges against the

US dollar portion of our term loan entered into concurrently with

the IPO. Effective with year end of 2014 these short term currency

hedges have not been renewed.

2015 Full Year Outlook

“As we move into 2015, we believe we are well positioned to

continue our strong financial and operational performance. Our

primary geographies continue to perform in line with our

expectations and we believe we are well positioned to execute our

strategy of growing Specialty Carbon Black volumes and improving

Rubber Carbon Black margins, while driving robust cash flows.

Consistent with this outlook, we expect full year Adjusted

EBITDA to be in the range of €210 million and €225 million for

2015. This outlook is based on the following assumptions:

· Volume growth in line with current GDP expectations

· Reasonable stability in oil prices and exchange rates based on

current prices and rates

Dividend Policy

We also expect to continue to generate strong free cash flows

and anticipate paying four quarterly dividends in 2015, the first

in April after the Annual General Meeting. We expect that our total

dividend payment for 2015 will be at a level consistent with our

2014 annual dividend payment of €40 million,” said Jack Clem, Chief

Executive Officer.

Conference Call

As previously announced, Orion will hold a conference call

tomorrow, Thursday, March 5, 2015, at 8:30 a.m. (ET). The dial-in

details for the conference call are as follow:

U.S. Toll Free: 1-877-407-4018 International:

1-201-689-8471 U.K. Toll Free: 0 800 756 3429 Germany Toll Free: 0

800 182 0040 Luxembourg Toll Free: 800 28 522 Luxembourg Local: 352

2786 0689

A replay of the conference call may be accessed by phone at the

following numbers through March 12, 2015:

U.S. Toll Free: 1-877-870-5176 International:

1-858-384-5517 Conference ID: 13601284

Additionally, a live and archived webcast of the conference call

will be available on the investor relations section of the

Company's website at: www.orioncarbons.com.

To learn more about Orion, please visit the company's Web site

at www.orioncarbons.com. Orion uses

its Web site as a channel of distribution for material Company

information. Financial and other material information regarding

Orion is routinely posted on the Company's Web site and is readily

accessible.

About Orion Engineered Carbons

Orion is a worldwide supplier of Carbon Black. The Company

offers standard and high-performance products for coatings,

printing inks, polymers, rubber and other applications. Our

high-quality Gas Blacks, Furnace Blacks and Specialty Carbon Blacks

tint, colorize and enhance the performance of plastics, paints and

coatings, inks and toners, adhesives and sealants, tires, and

manufactured rubber goods such as automotive belts and hoses. With

1,360 employees worldwide, Orion runs 14 global production sites

and four Applied Technology Centers. For more information visit our

website.

Forward Looking Statements

This document contains certain forward-looking statements with

respect to our financial condition, results of operations and

business, including those in the “2015 Full Year Outlook” section

above. Forward-looking statements are statements of future

expectations that are based on management’s current expectations

and assumptions and involve known and unknown risks and

uncertainties that could cause actual results, performance or

events to differ materially from those expressed or implied in

these statements. Forward-looking statements include, among others,

statements concerning the potential exposure to market risks,

statements expressing management’s expectations, beliefs,

estimates, forecasts, projections and assumptions and statements

that are not limited to statements of historical or present facts

or conditions. Some of these statements can be identified by terms

and phrases such as “anticipate,” “believe,” “intend,” “estimate,”

“expect,” “continue,” “could,” “should,” “may,” “plan,” “project,”

“predict” and similar expressions. Factors that could cause our

actual results to differ materially from those expressed or implied

in such forward-looking statements include those factors detailed

under the captions “Note Regarding Forward-Looking Statements” and

“Risk Factors” in the Prospectus. You should not place undue

reliance on forward-looking statements. Each forward-looking

statement speaks only as of the date of the particular statement.

New risk factors and uncertainties emerge from time to time and it

is not possible for our management to predict all risk factors and

uncertainties, nor can we assess the impact of all factors on our

business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those

contained in any forward-looking statements. We undertake no

obligation to publicly update or revise any forward-looking

statement– including the “2015 Full Year Outlook” section above –

as a result of new information, future events or other information,

other than as required by applicable law.

Non-IFRS Financial Measures Reconciliations

In this release we refer to Adjusted EBITDA and Contribution

Margin which are financial measures that have not been prepared in

accordance with International Financial Reporting Standards as

issued by the International Accounting Standards Board (“IFRS”) or

the accounting standards of any other jurisdiction and may not be

comparable to other similarly titled measures of other companies.

Adjusted EBITDA is defined as operating result (EBIT) before

depreciation and amortization, adjusted for acquisition related

expenses, restructuring expenses, consulting fees related to Group

strategy, share of profit or loss of associates and certain other

items. Adjusted EBITDA is used by our management to evaluate our

operating performance and make decisions regarding allocation of

capital because it excludes the effects of certain items that have

less bearing on our underlying business performance. Our use of

Adjusted EBITDA has limitations as an analytical tool, and you

should not consider it in isolation or as a substitute for analysis

of our financial results as reported under IFRS. Some of these

limitations are: (a) although Adjusted EBITDA excludes the impact

of depreciation and amortization, the assets being depreciated and

amortized may have to be replaced in the future and thus the cost

of replacing assets or acquiring new assets, which will affect our

operating results over time, is not reflected; (b) Adjusted EBITDA

does not reflect interest or certain other costs that we will

continue to incur over time and will adversely affect our profit or

loss, which is the ultimate measure of our financial performance

and (c) other companies, including companies in our industry, may

calculate Adjusted EBITDA or similarly titled measures differently.

Because of these and other limitations, you should consider

Adjusted EBITDA alongside our other IFRS-based financial

performance measures, such as consolidated profit or loss for the

period and our other IFRS financial results.

Contribution Margin is calculated by subtracting variable costs

(raw materials, packaging, utilities and distribution costs) from

our revenue. We believe that Contribution Margin and Contribution

Margin per metric ton are useful since we see these measures as

indicating the portion of revenue that is not consumed by variable

costs (raw materials, packaging, utilities and distribution costs)

and therefore contributes to the coverage of all other costs and

profits.

We define Net Working Capital as the total of inventories and

current trade receivables, less trade payables. Net Working Capital

is a non-IFRS financial measure, and other companies may use a

similarly titled financial measure that is calculated differently

from the way we calculate Net Working Capital.

Consolidated statements of financial

position of Orion Engineered Carbons S.A.as at December 31,

2014 and 2013

Dec 31, 2014 Dec 31, 2013

ASSETS

In EUR k In EUR k Non-current assets Goodwill 48,512 48,512 Other

intangible assets 110,952 125,501 Property, plant and equipment

358,216 333,454 Investment in joint ventures 4,657 4,608 Other

financial assets 5,931 1,691 Other assets 3,750 4,119 Deferred tax

assets 57,084 43,105 589,102 560,990

Current assets Inventories 125,298 123,171 Trade receivables

199,486 197,623 Emission rights - 1,977 Other financial assets

1,001 637 Other assets 26,166 40,151 Income tax receivables 10,575

11,938 Cash and cash equivalents 70,544 70,478

433,070 445,975

1,022,172

1,006,965 Dec 31, 2014 Dec

31, 2013

EQUITY AND

LIABILITIES

In EUR k In EUR k Equity Subscribed capital 59,635 43,750 Reserves

51,569 (99,048 ) Profit or loss for the period (55,939 ) (18,953 )

55,265 (74,251 ) Non-current liabilities Pension provisions

48,629 35,943 Other provisions 14,169 15,014 Liabilities to

shareholders - 256,161 Financial liabilities 670,189 538,175 Other

liabilities 2,101 1,368 Deferred tax liabilities 44,281

43,797 779,369 890,458 Current liabilities

Other provisions 40,808 44,268 Liabilities to banks - 2,103 Trade

payables 105,074 99,511 Other financial liabilities 10,684 15,828

Income tax liabilities 11,552 5,969 Other liabilities 19,420

23,079 187,538 190,758

1,022,172

1,006,965 Consolidated income

statements of Orion Engineered Carbons S.A.for the three

months ended December 31, 2014 and December 31, 2013

Oct 1 to Dec 31,2014

Oct 1 to Dec 31,2013

Jan 1 to Dec 31,2014

Jan 1 to Dec 31,2013

In EUR k In EUR k In EUR k In EUR k

Revenue

316,835 311,856 1,318,399 1,339,620

Cost of sales (243,762 ) (256,987

) (1,017,342 ) (1,070,817 )

Gross profit 73,073 54,870

301,057 268,803 Selling expenses

(25,457 ) (22,663 ) (99,642 ) (92,062 ) Research and development

costs (3,615 ) (2,375 ) (12,953 ) (10,085 ) General and

administrative expenses (14,696 ) (14,760 ) (54,602 ) (52,524 )

Other operating income 1,531 935 4,452 8,344 Other operating

expenses (9,287 ) (14,115 ) (33,994 ) (38,663 )

Operating result

(EBIT) 21,550 1,891 104,318

83,813 Financial result (23,247

) (21,468 ) (142,833 )

(95,235 ) Profit or (loss) before income taxes

(1,697 ) (19,577 ) (38,515

) (11,422 ) Income taxes (6,612 ) 2,622

(17,424 ) (7,531 )

Profit or (loss) for the period (8,309 )

(16,954 ) (55,939 ) (18,953 ) Net Earnings per Share (EUR

per share)*, basic and diluted (0.14 ) (0.39 ) (1.11 ) (0.43 )

* Based on 59,635,126 actual shares as of

December 31, 2014 and 43,750,000 actual shares until July 25,

2014,

Interim condensed consolidated

statements of cash flows of Orion Engineered Carbons S.A. for the

three months and year ended Dec 31, 2014 and 2013 -

unaudited

Q 4 2014 Q 4 2013 2014 2013 In

EUR k In EUR k In EUR k In EUR k

Profit or loss for the

period (8,309 ) (16,954 )

(55,939 ) (18,953 ) Income taxes

6,612 (2,622 ) 17,424

7,531 Profit or loss before income taxes

(1,697 ) (19,577 ) (38,515

) (11,422 ) Depreciation and amortization of

intangible assets and property, plant and equipment 20,010 29,813

77,083 76,060 Other non-cash expenses/income (163 ) 5,101 - (3,889

) Increase/decrease in trade receivables 24,676 13,211 9,897 5,001

Increase/decrease in inventories 18,610 15,975 4,138 25,549

Increase/decrease in trade payables (18,388 ) (12,414 ) 1,524 4,401

Increase/decrease in provisions (1,531 ) 2,842 (6,957 ) 1,802

Increase/decrease in other assets and liabilities that cannot be

allocated to investing or financing activities 8,036 3,794 5,821

21,870 Finance income (11,751 ) (16,881 ) (39,341 ) (17,136 )

Finance costs 35,173 38,532 182,695 112,736 Cash paid for income

taxes (12,794 ) (4,563 ) (23,928 ) (24,118 )

Cash flows for

operating activities 60,183 55,833

172,417 190,854 Cash paid for the

acquisition of intangible assets and property, plant and equipment

(27,253 ) (18,551 ) (64,454 ) (77,155 )

Cash flows from

investing activities (27,253 ) (18,551

) (64,454 ) (77,155 ) Cash

received from borrowings, net of transaction costs - - 645,724

2,103 Cash repayments of non-current financial liabilities (1,735 )

- (621,961 ) - Repayments of borrowings (9,230 ) (6,018 ) (2,311 )

- Interest and similar expenses paid (9,527 ) (30,130 ) (121,138 )

(117,279 ) Interest and similar income received 14,092 -

29,693 471 Dividends paid to shareholders (40,000 ) -

(40,000 ) -

Cash flows from financing activities

(46,400 ) (36,148 ) (109,993

) (114,705 )

Change in cash (13,470 ) 1,134

(2,030 ) (1,006 ) Change in cash

resulting from exchange rate differences 103 (941 ) 2,096 (3,378 )

Cash and cash equivalents at the beginning of the period 83,911

70,284 70,478 74,862

Cash and cash

equivalents at the end of the period 70,544

70,478 70,544 70,478

Adjusted EBITDA is reconciled to profit or

loss as follows:

Reconciliation of profit or loss

In EUR k

For the three monthsended Dec 31,

For the twelve monthsended Dec 31,

2014

2013

2014

2013

Adjusted EBITDA 48,460

43,472 207,661

191,066 Share of profit of joint

venture (175 ) (184 )

-520 -365 Restructuring

expenses(1) (1,075 ) (7,499 )

(4,082 )

(15,146

)

Consulting fees related to Group strategy(2) (746 )

(4,261 ) (4,610 )

(12,484

)

Expenses related to capitalized emission rights -

- -

(2,706

)

Other non-operating (3) (4,904 ) 176

(17,048 )

(492

)

EBITDA 41,560

31,704 181,401

159,873 Depreciation, amortization and

impairment of intangible assets and property, plant and equipment

(20,010 ) (29,813 )

(77,083 )

(76,060

)

Earnings before taxes and finance income/costs (operating result

(EBIT)) 21,550

1,891 104,318

83,813 Other finance income

11,751 16,881

39,342 17,136 Share of profit of

joint ventures 175 184

520 365 Finance

costs (35,173 ) (38,532 )

(182,695 )

(112,736

)

Income taxes (6,612 ) 2,622

(17,424 )

(7,531

)

Profit or loss for the period (8,309

) (16,954 )

(55,939 )

(18,953

)

(1) Restructuring expenses primarily include

personnel-related costs for all three periods and IT-related costs

in particular in connection with the roll out of our global SAP

platform in 2012 and 2013. (2) Consulting fees related to

the Group strategy include external consulting fees from

establishing and implementing our operating, tax and organizational

strategies. (3)

Other non-operating include in period

ended December 31, 2014 €10,731k IPO related costs as well as an

impairment of inventories in EMEA totaling €3.9 million resulting

in part from a cancellation of a customer contract.

Orion Engineered Carbons S.A.Diana Downey, +1

832-445-3865Investor Relations

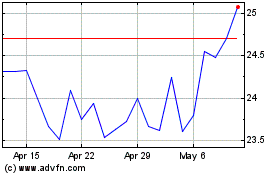

Orion (NYSE:OEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

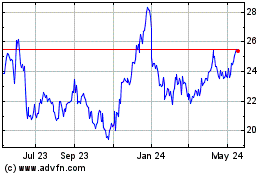

Orion (NYSE:OEC)

Historical Stock Chart

From Apr 2023 to Apr 2024