New Concept Energy, Inc. (NYSE MKT: GBR), (the “Company” or

“NCE”) a Dallas-based oil and gas company, today reported Results

of Operations for the fourth quarter ended December 31, 2014.

During the three months ended December 31, 2014 the Company

reported a net loss of $436,000 or ($0.23) per share, compared to

net income of $124,000 or $0.06 per share for the same period ended

December 31, 2013.

During the year ended December 31, 2014 the Company reported a

net loss of $779,000 or ($0.40) per share, compared to net income

of $426,000 or $0.22 per share for the same period ended December

31, 2013.

Revenues: Total revenues were $4.4 million in 2014 and $4.2

million in 2013. Net revenue for our oil and gas operation

increased by $200,000 for the first nine months of the year but

decreased by $200,000 in the final quarter of the year. The

fluctuation was principally due to the price the Company received

for its oil in 2014 as compared to 2013. The revenue for the

retirement community increased by approximately $200,000 in 2014

compared to 2013 principally due to rate increases.

Operating Expenses: Operating expenses were $5.3 million in 2014

and $5.1 million in 2013.

Oil & gas operating expenses decreased by a net of $214,000

in 2014. Pursuant to the requirements of the “full cost ceiling

test” in 2013 the Company recorded a non-cash charge to operations

of $200,000 to write down its investment of $250,000 in two small

wells in Arkansas.

Real estate operating expenses were $2.6 million in 2014 as

compared to $2.5 million in 2013. The principal cause of the

increase was non-payroll related expenses at the Company’s

retirement facility.

Corporate Expenses were $823,000 in 2014 and $500,000 in 2013.

The increase is primarily due to consulting fees paid to assist the

Company in its oil and gas operations and to identify new oil and

gas opportunities.

Interest Income & Expense: Interest Expense was $91,000

in 2014 as compared to $114,000 in 2013. The decrease was due to a

reduction in the long term debt owed to the previous owners of the

Company’s oil and gas operation in West Virginia / Ohio.

Other Income & (Expense): Other income & (expense) was

$197,000 for 2014 as compared to ($189,000) in 2013. The balances

in 2014 and 2013 are comprised of numerous events.

Bad Debt Expense (Recovery): In 2011 the company recorded a bad

debt expense with respect to a note receivable of $10 million. In

2013 and 2012 the company recovered $1.6 million and $2.1 million,

respectively, and recorded income.

About New Concept Energy, Inc.

New Concept Energy, Inc. is a Dallas-based oil and gas company

which owns oil and gas wells and mineral leases in Ohio and in West

Virginia. In addition, the Company leases and operates a retirement

center in King City, Oregon. For more information, visit the

Company’s website at info@newconceptenergy.com.

NEW CONCEPT ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATION (amounts in

thousands, except per share data)

Year Ended December 31, 2014

2013 2012

Revenue Oil and gas operations, net of royalties $ 1,489 $

1,477 $ 1,182 Real estate operations 2,874

2,745 2,762 4,363 4,222

3,944

Operating expenses Oil and

gas operations 1,853 1,867 1,820 Real estate operations 1,616 1,555

1,465 Lease expense 961 942 924 Corporate general and

administrative 823 500 577 Accretion of asset retirement obligation

- - 68 Impairment of natural gas and oil properties -

200 912 5,253

5,064 5,766 Operating earnings (loss) (890 )

(842 ) (1,822 )

Other income (expense) Interest

income 5 9 - Interest expense (91 ) (114 ) (208 ) Bad debt expense

(recovery) - note receivable - 1,562 2,076 Other income (expense),

net 197 (189 ) 122 111 1,268

1,990 Earnings (loss) from continuing operations (779 ) 426

168 Net income (loss) applicable to common shares $ (779 ) $

426 $ 168 Net income (loss) per common

share-basic and diluted $ (0.40 ) $ 0.22 $ 0.09

Weighted average common and equivalent shares outstanding -

basic 1,947 1,947 1,947

NEW CONCEPT ENERGY, INC.

AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (amounts

in thousands) December 31

2014 2013 Assets

Current assets Cash and cash equivalents $ 300 $ 1,621

Accounts receivable from oil and gas sales 216 195 Other current

assets 182 203

Total current assets 698

2,019

Oil and natural gas properties (full

cost accounting method) Proved developed and undeveloped oil

and gas properties, net of depletion 8,809 9,190

Property

and equipment, net of depreciation Land, buildings and

equipment - oil and gas operations 1,476 1,442 Other 162

183

Total property and equipment 1,638 1,625

Other assets (including $126,000 and $122,000 in 2014 and

2013 due from related parties) 1,129 474

Total assets $ 12,274 $ 13,308

NEW CONCEPT

ENERGY, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS -

CONTINUED (amounts in thousands, except share amounts)

December 31 2014

2013 Liabilities and stockholders'

equity Current liabilities Accounts payable -

trade (including $494 in 2014 due to related parties) $ 673 $ 121

Accrued expenses 229 965 Current portion of long term debt

881 185

Total current liabilities 1,783

1,271

Long-term debt Notes payable less current

portion 1,428 2,195 Asset retirement obligation 2,770

2,770

Total liabilities 5,981 6,236

Stockholders' equity Series B convertible preferred stock,

$10 par value, liquidation value of $100 authorized 100 shares,

issued and outstanding one share 1 1 Common stock, $.01 par value;

authorized, 100,000,000 shares; issued and outstanding, 1,946,935

shares at December 31, 2014 and 2013 20 20 Additional paid-in

capital 58,838 58,838 Accumulated deficit (52,566 )

(51,787 ) 6,293 7,072

Total liabilities & stockholders' equity $ 12,274

$ 13,308

New Concept Energy, Inc.Gene Bertcher,

800-400-6407info@newconceptenergy.com

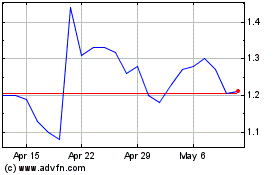

New Concept Energy (AMEX:GBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

New Concept Energy (AMEX:GBR)

Historical Stock Chart

From Apr 2023 to Apr 2024