EDISON EQUITY RESEARCH - ALDRIDGE MINERALS

02 April 2015 - 1:16AM

InvestorsHub NewsWire

EDISON EQUITY

RESEARCH: ALDRIDGE MINERALS - TURKISH PRECIOUS AND

BASE METAL DEVELOPER

After deducting C$7.1m in net cash as at 31 December 2014,

Aldridge’s enterprise value of C$11.6m, or US$9.3m, equates to

US$10.20 per in situ ounce of gold. That is close to the Canadian

average of US$9.78/oz including by-products (see Gold – The value

of gold and other metals, published in February 2015). However, in

this case by-products account for more than half the value of the

resource. Once these are taken into account, the company’s resource

multiple declines to just US$3.04/oz AuE. Finally, Aldridge’s EV

equates to just 3.8% of the net present value of its project. This

is consistent with a company that has completed a scoping study or

preliminary economic assessment (PEA), but cheap for a one that has

concluded a feasibility study, for which a more typical valuation

would be 20% of NPV.

Aldridge’s flagship asset, the 100%-owned Yenipazar project, is c

100km2 in area and located close to the geographic centre of

Turkey, c 200km (130 miles) east-southeast of the capital city,

Ankara. It is easily accessible via public roads and has good

access to rail transportation and electrical power supply.

To view our full report, please click here

Click here to view all of Edison Investment

Research’s published reports

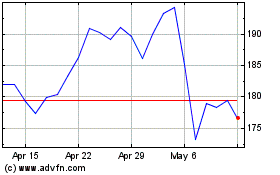

Federal Agricultural Mor... (NYSE:AGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

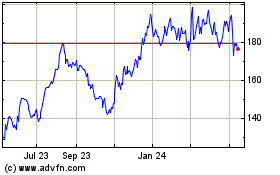

Federal Agricultural Mor... (NYSE:AGM)

Historical Stock Chart

From Apr 2023 to Apr 2024