U.S. Dollar Slides Against Majors

02 April 2015 - 6:12PM

RTTF2

The U.S. dollar weakened against the other major currencies in

the late Asian session on Thursday, as weaker U.S. jobs and

manufacturing data released overnight raised expectations that the

Federal Reserve may hold off raising U.S. interest rates until

later in the year.

Private sector job growth in the U.S. continued to slow in the

month of March, according to a report released by payroll processor

ADP on Wednesday. ADP said private sector employment climbed by

189,000 jobs in March following a slightly upwardly revised

increase of 214,000 jobs in February.

Economists had expected an increase of about 230,000 jobs

compared to the addition of 212,000 jobs originally reported for

the previous month.

Manufacturing activity in the U.S. saw continued growth in

March, although the pace of growth slowed more than anticipated,

the Institute for Supply Management said Wednesday. As well, a U.S.

construction spending saw some further downside in February, after

reporting a steep drop in spending in the previous month.

Traders will be watching for the U.S. jobs report for March due

Friday, which is closely watched by the Fed. While, the equity

markets will be closed for the Good Friday holiday.

Wednesday, the U.S. dollar fell 0.57 percent against the Swiss

franc and 0.31 percent against the yen.

In the late Asian trading today, the U.S. dollar fell to a 3-day

low of 0.9639 against the Swiss franc and a 2-day high of 1.0824

against the euro, from yesterday's closing values of 0.9663 and

1.0761, respectively. If the greenback extends its downtrend, it is

likely to find support around 1.10 against the euro and 0.93

against the franc.

Pulling away from an early more than a 3-week high of 0.7567

against the Australian dollar, the greenback edged down to 0.7599.

On the downside, 0.78 is seen as the next support level for the

greenback.

The greenback dropped to 1.4841 against the pound and 119.50

against the yen, from yesterday's closing quotes of 1.4822 and

119.73, respectively. The greenback may test support near 1.51

against the pound and 117.06 against the yen.

Against the New Zealand and the Canadian dollars, the greenback

edged down to 0.7479 and 1.2590 from yesterday's closing quotes of

0.7447 and 1.2619, respectively. The greenback is likely to find

support around 1.20 against the loonie and 0.77 against the

kiwi.

Looking ahead, U.K. Markit/CIPS construction PMI for March is

due to be released in the European session.

In the New York session, Canada merchandise trade data for

February, U.S. weekly jobless claims for the week ended March 28

and U.S. trade balance and factory orders - both for February are

slated for release.

At 3:45 pm ET, U.S. Federal Reserve Governor Lael Brainard is

expected to speak at the Ninth Biennial Federal Reserve System

Community Development Research Conference in Washington DC.

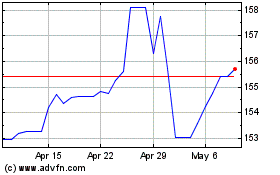

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

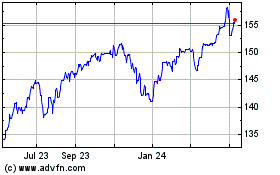

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024