ICE Endex Transitions the UK’s On-the-Day Commodity Market to the ICE Trading Platform

02 April 2015 - 8:36PM

Business Wire

Intercontinental Exchange (NYSE: ICE), the leading global

network of exchanges and clearing houses, today announced that ICE

Endex has transitioned the UK’s On-the-Day Commodity Market (“OCM”)

to the ICE trading platform on April 1, 2015. Designated by OFGEM

and appointed by National Grid Gas, ICE Endex is the market

operator of the OCM.

Following the transition of the OCM balancing and spot markets,

all ICE Endex markets, including derivatives, continental balancing

and spot, are available on WebICE, ICE’s front-end trading

screen. All National Balancing Point (NBP) products offered by

ICE Futures Europe and ICE Endex are listed on the

ICE platform.

Pieter Schuurs, President, ICE Endex said: “We would like to

thank National Grid and our market users for their hard work and

support in ensuring the smooth transition of the OCM to the ICE

trading platform. This transition is an important achievement for

us, because all ICE Endex markets are now available on ICE’s

state-of-the-art WebICE trading platform. By leveraging ICE’s

innovative trading technology and our natural gas expertise, ICE

Endex is committed to delivering balancing and spot services that

continue to meet the sophisticated requirements of the markets we

serve in the UK and continental Europe.”

The ICE Endex OCM Indices (System Average Price, System Marginal

Buy and Sell Prices) are used by National Grid Gas in the UK as the

official price for the settlement of imbalances. Market

enhancements on WebICE include the real time publication of these

indices, which will support the trading experience of market

users.

Including the OCM transition yesterday, ICE Endex successfully

transferred all of its markets to the ICE trading platform in three

tranches. The derivatives markets, which includes the flagship TTF

and ZTP futures contracts, were transitioned first in October 2013

and the continental spot and balancing markets were migrated to the

ICE trading platform in April 2014.

The OCM, TTF and ZTP spot and balancing markets were previously

hosted on the APX trading platform. All markets will continue to be

cleared by APX Clearing and this service is expected to be migrated

to ICE Clear Europe during 2015.

About Intercontinental Exchange

Intercontinental Exchange (NYSE:ICE) operates the leading

network of regulated exchanges and clearing houses. ICE’s futures

exchanges and clearing houses serve global commodity and financial

markets, providing risk management and capital efficiency. The New

York Stock Exchange is the world leader in capital raising and

equities trading.

Trademarks of ICE and/or its affiliates

include Intercontinental Exchange, ICE, ICE block

design, NYSE and New York Stock Exchange. Information

regarding additional trademarks and intellectual property rights of

Intercontinental Exchange, Inc. and/or its affiliates is

located at www.intercontinentalexchange.com/terms-of-use

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 - Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange

Commission (SEC) filings, including, but not limited to, the

risk factors in ICE's Annual Report on Form 10-K for the year ended

December 31, 2014, as filed with the SEC on February 5, 2015.

SOURCE: Intercontinental Exchange

ICE-ENGY

Media Contact:Adaora Anunoby+44 20 7429

7147adaora.anunoby@theice.comorInvestor Contact:Kelly

Loeffler+1 770 857 4726kelly.loeffler@theice.com

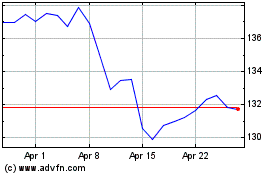

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Apr 2023 to Apr 2024