Australian Dollar Declines Ahead Of China GDP Data

14 April 2015 - 8:54PM

RTTF2

The Australian dollar fell against its major rivals in European

deals on Tuesday, as traders await China GDP data due tomorrow,

amid concerns over slowdown in the world's second largest

economy.

China's GDP growth is expected to slow 7.0 percent in the first

quarter from last year, down from the 7.4 percent increase in the

previous quarter. That would be the slowest level of economic

output since the global recession.

Alongside the GDP data, reports on factory output, retail sales

and fixed asset investment are also due.

China is Australia's largest trading partner. The strong ties

between the two nations could impact the Australian currency.

The Australian stock market also ended lower on concerns over

slowdown in China. The benchmark S&P/ASX200 index was down 13.7

points, or 0.23 percent, at 5,947 points, while the broader All

Ordinaries index fell 11.9 points, or 0.2 percent, to 5,916

points.

In economic front, data from the Australian Bureau of Statistics

showed that the total value of owner occupied housing commitments

in Australia increased in February.

The value of owner occupied housing commitments, excluding

alterations and additions, rose a seasonally adjusted 0.5 percent

month-on-month in February. On an unadjusted basis, it climbed 1.0

percent.

The currency fell sharply on Monday, after disappointing Chinese

trade data. For the day, the aussie slipped 1.13 percent against

the greenback, 0.88 percent against the euro, 1.01 percent against

the loonie, 0.14 percent against the kiwi and 1.17 percent against

the yen.

The aussie slipped to 90.46 versus the yen, its lowest since

April 2, from an early high of 91.37. The aussie is likely to

challenge support around the 87.5 zone.

The aussie reversed from early highs of 0.7623 against the

greenback and 1.3873 against the euro, edging down to 0.7554 and

1.3969, respectively. If the aussie extends slide, it may find

support around 0.74 against the greenback and 1.42 against the

euro.

Extending early decline, the aussie hit a 1-week low of 0.9518

versus the loonie. This is lower by 0.36 percent from Monday's

closing value of 0.9552. Continuation of the aussie's downtrend may

lead it to a support around the 0.94 area.

The aussie ticked down to 1.0152 against the NZ dollar, after

climbing to 1.0198 at 10:00 pm ET. Next key downside target for the

aussie is seen around the 1.00 mark. At yesterday's close, the pair

was valued at 1.0179.

Looking ahead, U.S. retail sales and producer price index for

March and business inventories for February are set for release in

the New York session.

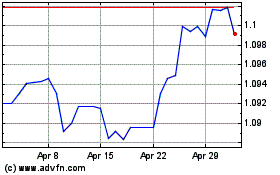

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

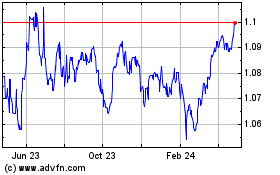

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024