U.S. Dollar Extends Fall Amid Bets On Fed's Rate Cut

16 April 2015 - 4:09PM

RTTF2

The U.S. dollar continued to be weaker against the other major

currencies in the Asian session on Thursday, as weak U.S. economic

data arose uncertainty over the timing of the Federal Reserve's

interest rate hike.

The Federal Reserve's report on Wednesday showed U.S. industrial

production to have dropped more than expected in March. The Fed

said industrial production fell 0.6 percent in March after inching

up 0.1 percent in February. Economists expected production to drop

by 0.3 percent.

Meanwhile, manufacturing activity in New York unexpectedly

contracted in April, due partly to continued decline in new orders,

with the index turning negative for the first time since last

December.The New York Fed's general business conditions index

dropped to a negative 1.2 in April from a positive 6.9 in March,

with a negative reading indicating a contraction in regional

manufacturing activity.

The index turned negative for the first time since last

December, surprising economists, who had expected the index to inch

up to 7.0.

The market now focus on U.S. housing data later in the day, for

further clues.

Wednesday, the U.S. dollar fell against its most major rivals.

The U.S. dollar fell 0.34 percent against the pound, 0.20 percent

against the yen and 0.81 percent against the Swiss franc.

In the Asian trading today, the U.S. dollar fell to 1.2249

against the Canadian dollar for the first time since January 21,

from yesterday's closing value of 1.2288. If the greenback extends

its downtrend, it is likely to find support around the 1.17

area.

Against the euro and the pound, the greenback dropped to 1-week

low of 1.0746 and 1.4879 from yesterday's closing quotes of 1.0682

and 1.4837, respectively. On the downside, 1.10 against the euro

and 1.52 against the pound are seen as the next support level for

the greenback.

The greenback slipped to an 8-day low of 0.9605 against the

Swiss franc, from yesterday's closing value of 0.9640. The

greenback may test support near the 0.94 region.

Against the Australia and the New Zealand dollars, the greenback

slid to nearly a 3-week low of 0.7781 and a 3-week low of 0.7637

from yesterday's closing quotes of 0.7674 and 0.7584, respectively.

The greenback is likely to find support near 0.80 against the

aussie and 0.77 against the kiwi.

The greenback edged down to 118.78 against the yen. At

yesterday's close, the greenback was trading at 119.12 against the

yen. The next possible downside target for the greenback is seen at

116.98 level.

Looking ahead, Swiss producer and import prices for March is due

to be released at 3:15 am ET.

In the New York session, U.S. building permits and housing

starts - both for March, U.S. weekly jobless claims for the week

ended April 11 and Reserve Bank of Philadelphia's manufacturing

index for April are slated for release.

At 1:00 am ET, Federal Reserve Bank of Atlanta President Dennis

Lockhart will deliver a speech about the US economic outlook and

monetary policy at the Palm Beach County Convention Center.

After 10 minutes, Federal Reserve Bank of Cleveland President

Loretta Mester will speak on the economy before the Forecasters

Club of New York.

Subsequently, Federal Reserve Bank of Boston President Eric

Rosengren participates in "The U.S. Economic Outlook and

Implications for Monetary Policy" event hosted by Chatham House in

London at 1:30 pm ET.

At 3:00 pm ET, Federal Reserve Governor Stanley Fischer will

participate in a panel discussion titled "The Elusive Pursuit of

Inflation" at the International Monetary Fund Spring Meetings in

Washington DC at 3:00 pm ET.

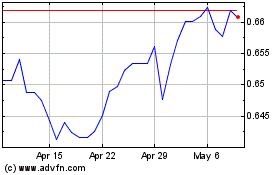

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024