TTM Technologies, Inc. Updates Its First Quarter 2015 Guidance

21 April 2015 - 11:00PM

TTM Technologies, Inc. (Nasdaq:TTMI) ("TTM"), a major global

printed circuit board ("PCB") manufacturer, today updated its first

quarter 2015 guidance in conjunction with its ongoing financing

activities related to its previously announced proposed acquisition

of Viasystems Group, Inc. (Nasdaq:VIAS).

Based on preliminary, unaudited financial results, TTM now

expects first quarter 2015 revenue to be approximately $329

million, compared to its previously announced range of $310 million

to $330 million and revenue of $292 million in the first quarter of

2014. Non-GAAP net income in the first quarter of 2015 is expected

to be approximately $0.13 per diluted share, compared to its

previously announced range of $0.06 to $0.12 per diluted share and

non-GAAP net income of $0.01 per diluted share in the first quarter

of 2014. TTM expects adjusted EBITDA in the first quarter of 2015

to be approximately $42 million, compared to $29 million in the

first quarter of 2014.

TTM's first quarter 2015 results are preliminary and are

therefore subject to change until completion of TTM's customary

quarterly closing and review procedures. TTM expects to report

actual results on April 29, 2015.

First Quarter 2015 Conference Call

Information

TTM will host a conference call and webcast to discuss first

quarter 2015 results and second quarter 2015 outlook on Wednesday,

April 29, 2015, at 4:30 p.m. Eastern Time (1:30 p.m. Pacific Time).

The conference call may include forward-looking statements.

Telephone access is available by dialing domestic 1-888-539-3678

or international 1-719-325-2420 (ID 2158367). The conference call

also will be webcast on TTM's website at www.ttmtech.com.

To Access a Replay of the Webcast

The replay of the webcast will remain accessible for one week

following the live event on TTM's website at www.ttmtech.com.

About TTM

TTM Technologies, Inc. is a major global printed circuit board

manufacturer, focusing on quick-turn and technologically advanced

PCBs and the backplane and sub-system assembly business. TTM stands

for time-to-market, representing how TTM's time-critical, one-stop

manufacturing services enable customers to shorten the time

required to develop new products and bring them to market.

Additional information can be found at www.ttmtech.com.

Forward-Looking Statements

This release contains forward-looking statements that relate to

future events or performance, including TTM's financial results for

the first quarter of 2015. TTM cautions you that such statements

are simply predictions and actual events or results may differ

materially. These statements reflect TTM's current expectations,

and TTM does not undertake to update or revise these

forward-looking statements except as required by law, even if

experience or future changes make it clear that any projected

results expressed or implied in this or other TTM statements will

not be realized. Further, these statements involve risks and

uncertainties, many of which are beyond TTM's control, which could

cause actual results to differ materially from the forward-looking

statements. These risks and uncertainties include, but are not

limited to, general market and economic conditions, including

interest rates, currency exchange rates and consumer spending,

demand for TTM's products, market pressures on prices of TTM's

products, warranty claims, changes in product mix, contemplated

significant capital expenditures and related financing

requirements, TTM's dependence upon a small number of customers and

other "Risk Factors" set forth in TTM's most recent SEC

filings.

About Our Non-GAAP Financial Measures

This release includes information about TTM's expected non-GAAP

earnings per share and adjusted EBITDA, which are non-GAAP

financial measures. TTM presents non-GAAP financial information to

enable investors to see TTM through the eyes of management and to

provide better insight into TTM's ongoing financial

performance.

Adjusted EBITDA is defined as earnings before interest expense,

income taxes, depreciation, amortization of intangibles,

stock-based compensation expense, gain on sale of assets, asset

impairments, restructuring, costs related to acquisitions, and

other charges. Management believes that the non-GAAP financial

information—which adds back amortization of intangibles,

stock-based compensation expense, non-cash interest expense on

debt, acquisition-related costs, asset impairments, restructuring

and other unusual or infrequent items as well as the associated tax

impact of these charges and discrete tax items—provides additional

useful information to investors regarding TT'M's ongoing financial

condition and results of operations.

A material limitation associated with the use of non-GAAP

financial measures is that they have no standardized measurement

prescribed by GAAP and may not be comparable to similar non-GAAP

financial measures used by other companies. TTM compensates for

these limitations by providing full disclosure of each non-GAAP

financial measure and reconciliation to the most directly

comparable GAAP financial measure. For a reconciliation of non-GAAP

earnings per share and adjusted EBITDA for the first quarter of

2014, please see TTM's press release dated April 30, 2014. The

non-GAAP financial measures should not be considered in isolation

from, or as a substitute for, financial information prepared in

accordance with GAAP.

Contact:

Todd Schull, CFO

714-327-3000

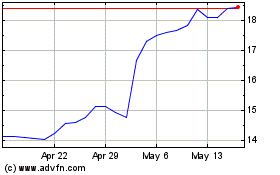

TTM Technologies (NASDAQ:TTMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

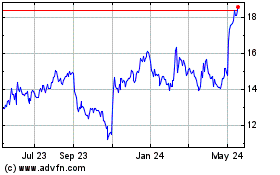

TTM Technologies (NASDAQ:TTMI)

Historical Stock Chart

From Apr 2023 to Apr 2024