Kiwi Rises On Higher RBNZ Inflation Expectations

19 May 2015 - 3:56PM

RTTF2

The New Zealand dollar strengthened against the other major

currencies in the Asian session on Tuesday, after the Reserve Bank

of New Zealand showed that its 2 year inflation expectations have

inched up slightly in the second quarter of 2015.

Data from the Reserve Bank of New Zealand showed that

twelve-months ahead inflation expectations in New Zealand inched up

slightly in the second quarter. Expectations for the next one-year

rose to 1.32 percent from 1.11 percent in the first quarter, the

report revealed. The survey was conducted by the Nielsen

Company.

Inflation expectations in the next 24 months also climbed to

1.85 percent from 1.80 percent in the previous three months

survey.

The currency fell slightly earlier after the release of the

nation's producer price output report.

Data from Statistics New Zealand showed that producer price

output in New Zealand fell 0.9 percent on quarter in the first

quarter of 2015, missing forecasts for a decline of 0.8 percent

after easing 0.1 percent in the previous three months. Producer

price input dropped 1.1 percent on quarter after losing 0.4 percent

in the three months prior.

On a yearly basis, PPI output shed 2.5 percent after losing 0.8

percent in the fourth quarter, while PPI inputs tumbled 4.0 percent

after falling 1.9 percent in the previous three months.

Monday, the NZ dollar fell against its major rivals, amid

expectations that the Reserve Bank of New Zealand is likely to cut

its official cash rate as part of the government measures to curb

Auckland's rising housing market prices. The NZ dollar fell 1.05

percent against the U.S. dollar, 0.60 percent against the Yen, 0.42

percent against the Euro and 0.37 percent against the Australian

dollar on Monday.

In the Asian trading today, the NZ dollar rose to a 4-day high

of 1.5207 against the euro, from an early low of 1.5366. On the

upside, 1.47 is seen as the next resistance level for the kiwi.

Moving away from early 6-day lows of 0.7358 against the U.S.

dollar and 88.28 against the yen, the kiwi advanced to 0.7426 and

89.08, respectively. If the kiwi extends its uptrend, it is likely

to find resistance around 0.77 against the greenback and 90.00

against the yen.

Against the Australian dollar, the kiwi climbed to a 4-day high

of 1.0754 from an early 6-day low of 1.0849. The kiwi may test

support near the 1.05 region. Data from the Conference Board showed

that Australia's leading economic index was down 0.1 percent in

March, following the 0.5 percent increase in February.

The coincident index added 0.5 percent after rising 0.4 percent

in the previous month.

Looking ahead, U.K. consumer, producer and retail price indices

for April, German ZEW economic sentiment index for May and Eurozone

final CPI for April and trade balance for March are due to be

released in the European session.

At 3:00 am ET, European Central Bank Governing Council member

Christian Noyer is expected to speak at a Euromoney conference on

inflation-linked bonds in Paris.

In the New York session, U.S. building permits and housing

starts for April are set to be published.

Bretton Woods Committee 2015 Annual Meeting will be conducted in

Washington D.C. at 8:30 am ET, in which World Bank Managing

Director Sri Mulyani Indrawati, U.S. Treasury Secretary Jacob Lew

and International Monetary Fund head Christine Lagarde are deliver

speeches.

At 11:30 am ET, Bank of Canada Governor Stephen Poloz will

address the Greater Charlottetown Area Chamber of Commerce in

Prince Edward Island, followed by a news conference.

Half-an-hour later, Swiss National Bank director Jean-Pierre

Danthine will deliver a speech titled "Swiss Monetary Policy Facts

and Fictions", in Geneva.

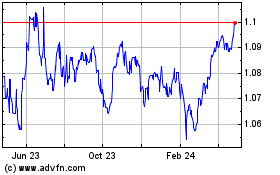

AUD vs NZD (FX:AUDNZD)

Forex Chart

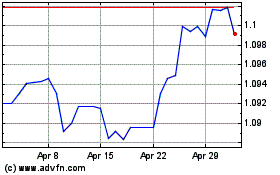

From Mar 2024 to Apr 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024