U.S. Dollar Extends Rally On Upbeat Housing Data

20 May 2015 - 12:00AM

RTTF2

The U.S. dollar continued its rise against the other major

currencies in early New York deals on Tuesday, as the housing

starts in the U.S. improved to a 7-1/2-year high in April,

signaling that the Fed could raise interest rates later this

year.

A report from the Commerce Department showed that housing starts

surged up 20.2 percent to an annual rate of 1.135 million in April

from the revised March estimate of 944,000.

Economists had expected housing starts to climb to a rate of

1.029 million from the 926,000 originally reported for the previous

month.

With the bigger than expected increase, housing starts reached

their highest level since hitting 1.197 million in November of

2007.

Building permits, an indicator of future housing demand, also

increased by 10.1 percent to an annual rate of 1.143 million in

April from the revised March rate of 1.038 million.

Traders now focus on the Federal Reserve's minutes of its April

meeting, due tomorrow, for further direction on interest rate

outlook.

The greenback added onto Monday's gains in the previous session.

It rose 0.52 percent against the yen, 1.16 percent against the

franc, 1.14 percent against the euro and 0.46 percent against the

pound yesterday.

The greenback appreciated to an 8-day high of 1.5446 against the

pound, up by 1.31 percent from Monday's closing value of 1.5651.

Continuation of the greenback's uptrend may lead it to a resistance

surrounding the 1.54 zone.

The pound saw heavy selling pressure after data showed that U.K.

consumer prices turned negative in April.

Data from the Office for National Statistics showed that U.K.

consumer prices fell 0.1 percent in April from last year, while it

was forecast to remain flat as seen in March.

The greenback added 1.56 percent to hit a weekly high of 1.1135

against the euro, from yesterday's closing value of 1.1312. The

greenback is seen finding support around the 1.10 area.

The euro has been sliding after comments from an ECB official

that the lender would moderately frontload its purchase activity in

May and June.

Benoît Cœuré, member of the Executive Board of the ECB, said at

a conference on Monday, "...we are also aware of seasonal patterns

in fixed-income market activity with the traditional holiday period

from mid-July to August characterised by notably lower market

liquidity."

The greenback spiked up to 2-week highs of 0.9376 against the

Swiss franc and 120.45 against the yen, up from Monday's closing

values of 0.9261 and 119.97, respectively. On the upside, the

greenback is likely to find resistance around 0.95 against the

franc and 121.00 against the yen.

The greenback strengthened to 1.2220 against the loonie, a level

unseen since April 23. This marks a 0.52 percent increase from

Monday's closing quote of 1.2157. The greenback is poised to test

resistance around the 1.25 level.

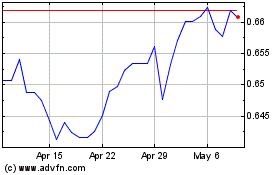

Extending early rise, the greenback rallied to a weekly high of

0.7924 against the aussie. This may be compared to Monday's closing

quote of 0.7986. Extension of the greenback's rally may lead to a

resistance around the 0.787 area.

Reversing from an early low of 0.7444 against the NZ dollar, the

greenback climbed back to 0.7367. The greenback is thus approaching

closer to its early 6-day high of 0.7358. If the greenback extends

rise, 0.73 is possibly seen as its next resistance level.

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024