Canadian Dollar Advances Amid Rising Oil Prices

20 May 2015 - 10:30PM

RTTF2

The Canadian dollar strengthened against its major counterparts

in European deals on Wednesday, as oil prices rose and traders

await Canada wholesale sales for March, due shortly.

Crude for July delivery rose $0.58 to $58.57 a barrel.

The oil prices received support after data from American

Petroleum Institute showed late Tuesday that crude inventories fell

more-than-expected last week. API said the crude inventories to

have fallen by 5.2 million barrels last week. The EIA will release

official inventory data at 10:30 am ET.

The Statistics Canada will release Canada wholesale sales for

March at 8:30 am ET. The sales are forecast to improve to 0.9

percent on a monthly basis, reversing from a 0.4 percent fall

registered a month earlier.

The loonie was higher against the other major currencies, except

the greenback in Asian trading.

Reversing from an early multi-week low of 1.2255 against the

greenback, the loonie edged up to 1.2204. If the loonie extends

rise, 1.20 is possibly seen as its next resistance level.

The loonie rallied to a 2-day high of 99.03 against the Japanese

yen, from Tuesday's closing value of 98.64. Further uptrend may

lead the loonie to a resistance around the 100.00 mark.

The loonie extended rise to a 2-day high of 0.9639 against the

aussie, compared to yesterday's closing quote of 0.9675. Next key

resistance for the loonie may be located around the 0.955

region.

The loonie was trading at 1.3582 against the euro, hovering at

an early weekly high of 1.3549. The loonie is seen finding

resistance near the 1.35 area.

Looking ahead, the Federal Reserve's minutes of its April 28-29

meeting will be out at 2:00 pm ET.

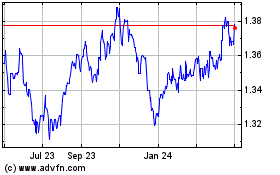

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

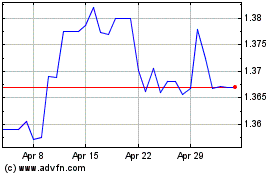

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024