Australian Dollar Declines On Risk Aversion

26 May 2015 - 7:17PM

RTTF2

The Australian dollar slipped against its major opponents on

Tuesday's European deals, as European stocks declined on continued

worries over Greece debt default and heightened political

uncertainty in Spain following local elections on Sunday.

Greece's government on Monday ruled out imposing controls over

capital flows after an opposition lawmaker suggested the move if

the country fails to strike a deal with its creditors soon. Gabriel

Sakellaridis, the spokesman for the Greek government, reportedly

said that the speculation of imposing capital controls was

"unfounded and malicious".

Meanwhile, Klaus Regling, the head of the European Stability

Mechanism, told Germany's Bild newspaper on Tuesday that without an

agreement on reforms with creditors, Greece will not get any new

loans.

Spanish Prime Minister Mariano Rajoy's Popular Party suffered

its worst result in 20 years in a municipal election, as the voters

punished his government for four years of austerity and a raft of

corruption scandals before a general election due in November.

The currency was steady against its major rivals, except the NZ

dollar, on Monday.

In the Asian session, the aussie was higher, as most Asian

bourses were up following the Chinese government's decision to open

an array of infrastructure projects to private investment, while

slashing taxes on imported clothing and other consumer goods.

The aussie declined to near a 5-week low of 0.7771 against the

greenback and near a 2-week low of 0.9593 against the loone, from

an early high of 0.7839 and a 4-day high of 0.9647,respectively.

The next possible support for the aussie may be located around 0.76

against the greenback and 0.955 against the loonie.

The aussie eased to 95.29 against the yen and 1.4018 against the

euro, after having advanced to a 4-day high of 95.73 and a 12-day

high of 1.3949, respectively in previous deals. Continuation of

downtrend may lead the aussie to support levels of around 94.00

against the yen and 1.42 against the euro.

The Australian currency pared gains to 1.0689 against the kiwi,

off an early high of 1.0718. The aussie is seen finding support

around the 1.05 mark.

Looking ahead, U.S. durable goods orders for April, U.S. S&P

Case-Shiller's house price index for March, the Conference Board's

U.S. consumer confidence index for May and new home sales data for

April are due to be released in the New York session.

At 12:30 pm ET, Federal Reserve Governor Stanley Fischer is

expected to speak on "The Federal Reserve and the Global Economy"

before a conference in honor of Professor Haim Ben-Shaharat at the

Tel Aviv University in Israel.

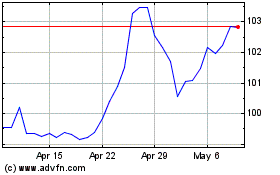

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

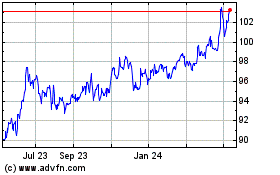

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024