Australian Dollar Falls On Disappointing Trade Figures

02 July 2015 - 3:32PM

RTTF2

The Australian dollar weakened against the other major

currencies in the Asian session on Thursday after data showed that

the trade deficit for May rose more than economists expected.

Data from the Australian Bureau of Statistics showed that

Australia posted a seasonally adjusted merchandise trade deficit of

A$2.751 billion in May. This missed forecasts for a shortfall of

A$2.225 billion following the downwardly revised A$4.136 billion

deficit in April.

However, exports were up 1.0 percent on month or A$206 million

to A$25.528 billion. While, imports sank 4.0 percent on month or

A$1.179 billion to A$28.279 billion.

Traders are likely to focus on news regarding Greece and the

Labor Department's U.S. monthly jobs report. The report is being

released a day earlier than usual due to the July 4th holiday.

Economists currently expect the report to show an increase of

about 230,000 jobs in June following the jump of 280,000 jobs

reported for May. The unemployment rate is also expected to dip to

5.4 percent.

Wednesday, the Australian dollar showed mixed trading against

its major rivals. While the aussie rose against the yen, the euro

and the Canadian dollar, it fell against the U.S. dollar.

Meanwhile, the aussie held steady against the NZ dollar.

In the Asian trading today, the Australian dollar fell to a

3-day low of 0.7628 against the U.S. dollar, from yesterday's

closing value of 0.7643. On the downside, 0.75 is seen as the next

support level for the aussie.

Pulling away from a early high of 94.42 against the yen, the

aussie dropped to 94.14. This may be compared to an early 2-day low

of 94.05. The aussie may test support near the 92.00 region.

Against the euro and the Canadian dollar, the aussie edged down

to 1.4484 and 0.9605 from yesterday's closing quotes of 1.4454 and

0.9618, respectively. If the aussie extends its downtrend, it is

likely to find support around 1.48 against the euro and 0.93

against the loonie.

Looking ahead, U.K. Nationwide house price index for June is due

to be release at 2:00 am ET. Additionally, U.K. CIPS/Markit

construction PMI for June and Eurozone PPI for May are slated for

release.

In the New York session, U.S. weekly jobless claim for the week

ended June 27, U.S. jobs data and factory orders, both for June,

are set to be announced.

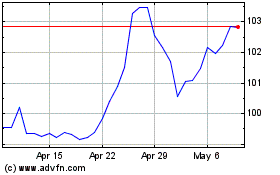

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

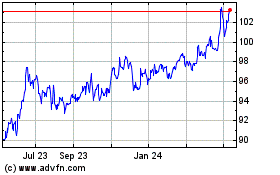

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024