U.S. Dollar Slides Against Majors

01 September 2015 - 1:05PM

RTTF2

The U.S. dollar weakened against the other major currencies in

the Asian session on Tuesday, as downbeat manufacturing data out of

China intensified worries about the outlook for global growth,

which could reduce the chance of Federal Reserve interest rate hike

at its next meeting.

Investors are worried about whether the financial turmoil in

China could postpone the Fed rate hike.

Some economists expect that the Federal Reserve may keep its

interest rates at zero-level at its upcoming policy meeting on

September 16-17. Meanwhile, some say that the Fed might wait until

the end of the year or longer to raise its interest rates.

However, some indicate that the Fed could lift rates at its next

meeting.

Traders remain cautious ahead of the U.S. employment report, due

on Friday, as the Federal Open Market Committee assesses the

economic data to find whether the economy is strong enough to

weather a rate hike.

Monday, the U.S. dollar showed mixed trading against its major

rivals. While the greenback, held steady against the yen, the euro

and the pound, it rose against the Swiss franc.

In the Asian trading now, the U.S. dollar fell to a 5-day low of

120.58 against the yen and a 4-day low of 1.1276 against the euro,

from yesterday's closing quotes of 121.21 and 1.1208, respectively.

If the greenback extends its downtrend, it is likely to find

support around 118.00 against the yen and 1.15 against the

euro.

Against the pound and the Swiss franc, the greenback dropped to

1.5404 and 0.9607 from yesterday's closing quotes of 1.5341 and

0.9669, respectively. The greenback may test support near 1.55

against the pound and 0.93 against the franc.

Against the Australia, the New Zealand and the Canadian dollars,

the greenback edged down to 0.7152, 0.6388 and 1.3123 from

yesterday's closing quotes of 0.7112, 0.6335 and 1.3138,

respectively. On the downside, 0.72 against the aussie, 0.66

against the kiwi and 1.29 against the loonie are seen as the next

support level for the greenback.

Looking ahead, manufacturing PMI reports for August from major

European economies, German unemployment rate for August, Bank of

England's U.K. mortgage approvals data for July and U.K. M3 money

supply data for July are due to be released in the European

session.

In the European session, Canada GDP data for second quarter,

Markit's final U.S. manufacturing PMI for August, the Institute for

Supply Management's manufacturing PMI for August and construction

spending data for July are slated for release.

At 12:00 pm ET, Swiss National Bank head Thomas Jordan addresses

a business gathering in Zurich. Subsequently, Federal Reserve Bank

of Boston President Eric Rosengren is expected to speak on the

economic outlook before the Forecasters Club of New York at 1:10 pm

ET.

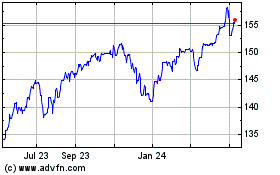

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

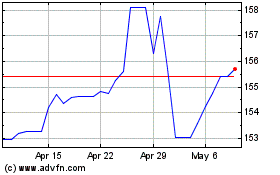

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024