Rio Tinto Upbeat on Steel Outlook, Doubles Down on Costs

03 September 2015 - 2:02PM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--Rio Tinto PLC (RIO.LN) expressed confidence in the

outlook for demand for its iron ore on Thursday, as the company

forecast global steel demand to rise an average 2.5% a year until

2030.

The miner, the world's No. 2 exporter of iron ore, projected

non-Chinese steel demand to increase 65% over that period, and

reiterated an earlier estimate that China would produce one billion

tons of crude steel a year by 2030.

Rio Tinto said it expected to see "growing global demand for

high-quality iron ore."

Its iron-ore chief executive, Andrew Harding, meanwhile said the

miner was determined to deepen cost cutting at its operations in

Western Australia's Pilbara mining region, with "some 400

efficiency initiatives" being undertaken.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 02, 2015 23:47 ET (03:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

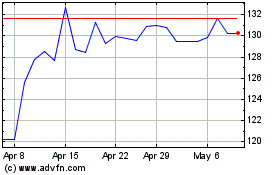

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

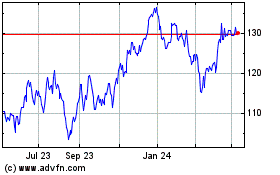

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024