Aussie Falls On Disappointing Retail Trade Data

03 September 2015 - 10:58AM

RTTF2

The Australian dollar continued to be weak against the other

major currencies in the Asian session on Thursday, after data

showed that the nation's retail sales fell more-than-expected in

July.

Data from the Australian Bureau of Statistics showed that the

total value of retail sales in Australia was down a seasonally

adjusted 0.1 percent on month in July, coming in at A$24.311

billion. That was well shy of forecasts for an increase of 0.4

percent following the downwardly revised 0.6 percent gain in

June.

At the same time, the ABS also said Australia posted a

seasonally adjusted merchandise trade deficit of A$2.46 billion in

July, marking a 19 percent monthly gain. The headline figure topped

expectations for a deficit of A$3.16 billion following the A$3.05

billion shortfall in the previous month.

Exports were up A$612 million or 2.0 percent on month to

A$26.903 billion.

Meanwhile, the Australian stocks traded lower on the back of

disappointing retail sales data for the month of July. The

Australia's benchmark S&P/ASX200 Index is currently down 34.20

points or 0.67 percent at 5,067. The broader All Ordinaries Index

is also currently down 36.10 points or 0.71 percent at 5,083.

Wednesday, the Australian dollar fell against its major rivals

after data showed that the nation's economy grew at a

slower-than-expected pace in the second quarter of 2015. The

Australian dollar fell 0.34 percent against the U.S. dollar, 1.14

percent against the yen, 0.13 percent against the euro and 0.01

percent against the NZ dollar.

In the Asian trading, the Australian dollar fell to 84.29

against the yen and 1.6023 against the euro, from early 2-day highs

of 85.13 and 1.5883, respectively. At yesterday's close, the aussie

was trading at 84.68 against the yen and 1.5946 against the euro.

If the aussie extends its downtrend, it is likely to find support

around 81.00 against the yen and 1.66 against the euro.

Against the U.S. and the Canadian dollars, the aussie dropped to

0.7002 and 0.9294 from early 2-day highs of 0.7061 and 0.9365,

respectively. The aussie closed yesterday's deals at 0.7037 against

the greenback and 0.9336 against the loonie. On the downside, 0.69

against the greenback and 0.92 against the loonie are seen as the

next support level for the aussie.

The aussie edged down to 1.1014 against the NZ dollar, from an

early high of 1.1089. At yesterday's close, the aussie was trading

at 1.1074 against the kiwi. The aussie may test support near the

1.08 region.

Looking ahead, PMI reports from major European economies for

August and Eurozone retail trade data for July are due to be

released in the European session.

The European Central bank will announce its interest rate

decision at 7:45 am ET. Economists expect the interest rate to be

left unchanged at 0.05 percent. Following the announcement,

European Central Bank President Mario Draghi will hold the

customary post-meeting press conference at 8:30 am ET.

In the New York session, Canada and U.S. trade data for July,

U.S. weekly jobless claims for the week ended August 29 and U.S.

ISM non-manufacturing PMI for August are slated for release.

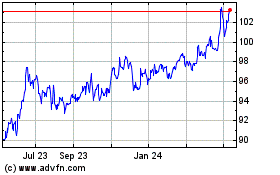

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

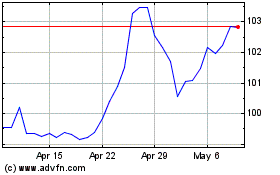

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024