Australia Shares End Higher for Second Straight Day

01 October 2015 - 5:31PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Energy stocks led a second day of strong

gains for Australia's equities market Thursday as worries over

China's pace of growth ebbed.

The advance has wiped out almost all of Tuesday's dive to a

two-year low, with broad gains across sectors pushing the

S&P/ASX 200 up 1.8% to end at 5112.1.

The Australian benchmark index echoed the recovery in most Asian

markets after China manufacturing data for September held steady

from the previous month.

"Our biggest trading partner looks as if it may have stemmed its

steady economic deterioration and this has clearly boosted a range

of sectors today," said Angus Nicholson, a market analyst at IG in

Melbourne.

Still, Mr. Nicholson said investors should be wary of such a

strong market performance over two consecutive days, adding that

the ASX could see some resistance as it approaches the 5150

level.

China's official manufacturing purchasing managers index for

September rose to 49.8 from 49.7 the previous month, against

economists' expectations it would remain unchanged. The Caixin

China manufacturing PMI was at a six-and-a-half-year low of 47.2 in

September, compared with a preliminary figure of 47.0 and 47.3 in

August. Readings below 50 indicate a contraction in manufacturing

activity.

The rise in market sentiment helped keep oil prices in positive

territory in Asian trade. Prices took a beating in the third

quarter, with Nymex and Brent crude each losing around 24% during

the period and weighing heavily on energy stocks.

Woodside Petroleum Ltd. (WPL.AU) rose 2.9%, Oil Search Ltd.

(OSH.AU) added 2.1% and Santos Ltd. (STO.AU) climbed 4.8%. Origin

Energy lTD. (ORG.AU) shares remained halted after it launched on

Wednesday an equity raising to help cut its debt burden.

The major banks were all higher, with Commonwealth Bank of

Australia (CBA.AU) and Westpac Banking Corp. (WBC.AU) each gaining

over 2%. Australia & New Zealand Banking Group Ltd. (ANZ.AU)

rose 1.6% after it said Chief Financial Officer Shayne Elliot would

succeed Mike Smith as chief executive in the new year.

OZ Minerals Ltd. (OZL.AU) shares surged 19% after private-equity

firm KKR & Co. confirmed it had bought a stake in the copper

and gold mining company.

For the day, 1.64 billion shares valued at 4.97 billion

Australian dollars (US$3.49 billion) were traded, Commonwealth

Securities said.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

October 01, 2015 03:16 ET (07:16 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

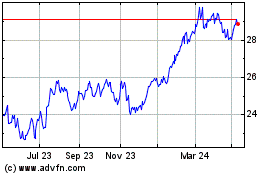

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

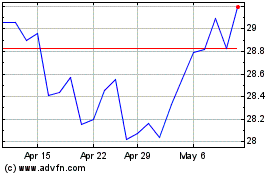

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Apr 2023 to Apr 2024