Euro At Multi-day Low Against Pound After Eurozone PMI

01 October 2015 - 3:12PM

RTTF2

The euro fell to a multi-day low against the pound in the early

European session on Thursday, after data showed that Eurozone

manufacturing activity grew at a slower pace as estimated in

September.

Data from Markit showed that the Eurozone manufacturing

Purchasing Managers' Index fell to a five-month low of 52 in

September from 52.3 in August. The reading came in line with flash

estimate.

Germany's final PMI dropped to 52.3 in September from 53.3 in

August. The flash score was 52.5. Data signaled slowdown in new

orders and production growth in September.

Output at French manufacturers increased for the first time in

three months. The French PMI came in at 50.6, up from 48.3 in

August. It was above the flash estimate of 50.4.

European Central Bank chief Mario Draghi will deliver a speech

in Washington at 9.30 am ET. Investors await his speech to hear

further about QE to help ward off deflation in the region and keep

the economy on track.

International Monetary Fund Managing Director Christine Lagarde

predicted moderate growth in advanced economies this year but said

global growth will be disappointing and uneven amid the twin

prospects of rising U.S. interest rates and slowing expansion in

China.

In the Asian session today, the euro showed mixed performance

against its major rivals.

In the early European trading, the euro fell 3-day low of 0.7356

against the pound, from an early high of 0.7389. If the euro

extends its downtrend, it is likely to find support around the 0.72

area.

Data from the Chartered Institute of Procurement & Supply

and Markit Economics showed that the British manufacturing activity

expanded at the weakest pace in three months in September.

The seasonally adjusted Purchasing Managers' Index, or PMI, fell

slightly to 51.5 in September from 51.6 in August, which was

revised up from 51.5. Economists had forecast the index to fall to

51.3.

Meanwhile, the euro rose to 1.0909 against the Swiss franc, from

an early 8-day low of 1.0874, and held steady thereafter.

Data from the Credit Suisse showed that Switzerland's

manufacturing sector contracted in September after rebounding a

month ago. The procure.ch Purchasing Managers' Index fell to 49.5

from 52.2 in August. It was forecast to drop marginally to

51.8.

Against the yen, the euro advanced to 134.24, from an early low

of 133.78, and held steady thereafter.

Data from Nikkei revealed that the manufacturing sector in Japan

remained in expansion territory, with a final manufacturing PMI

score of 51.0. That was up from last month's preliminary score of

50.9, although it was down from the eight-month high reading of

51.7 in August.

The euro fell to 6-day low of 1.1135 against the U.S. dollar,

from an early high of 1.1178 and held steady thereafter.

Looking ahead, PMI reports for September from U.S. and Canada,

U.S. weekly jobless claims for the week ended September 26 and U.S.

construction spending data for August are slated for release in the

New York session.

At 9:30 am ET, European Central Bank chief Mario Draghi will

deliver a speech on the occasion of the awarding of the Atlantic

Council Global Citizens Award in Washington.

Subsequently, at 2:30 pm ET, Federal Reserve Bank of San

Francisco President John Williams is expected to speak about the

economic outlook in Salt Lake City, U.S.

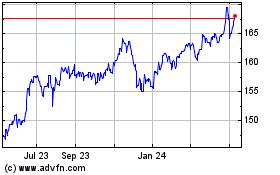

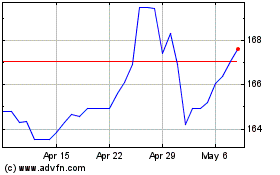

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024