Yen Advances As BoJ Refrains From Adding More Stimulus

07 October 2015 - 12:19PM

RTTF2

The Japanese yen was modestly higher in Asian deals on

Wednesday, after the Bank of Japan held off from further easing and

maintained its target for expanding monetary base at an annual pace

of about JPY 80 trillion, by an 8 to 1 vote.

The decision was in line with economists' expectations.

The bank said that the annual rate of increase in consumer

prices was flat. Inflation expectations appear to be rising on the

whole from a somewhat longer-term perspective.

The BoJ maintained its optimistic assessment of the economy by

stating that the economy has continued to recover moderately as a

trend.

Traders await more signals about any potential future BoJ

easing, when its chief Haruhiko Kuroda holds press conference in

the afternoon.

The risk-on mode in Asia limited further gains in the currency.

The Asian markets are mostly higher, as oil prices extended gain

after U.S. Department of Energy's latest forecast showed tighter

oil supplies next year.

The currency was trading lower against the pound, franc and the

euro on Tuesday. Against the U.S. dollar, it trended higher.

The yen strengthened to a 5-day high of 119.76 against the

greenback, up by 0.37 percent from Tuesday's closing value of

120.20. The yen is seen challenging resistance around the 118.5

mark.

The yen advanced to 123.87 against the franc and 135.03 against

the euro, coming off from its prior more than a 2-week low of

124.42 and a 2-day low of 135.63, respectively. The yen ended

Tuesday's trading at 124.30 versus the franc and 135.44 versus the

euro. On the upside, the yen may locate resistance around 122.00

against the franc and 133.00 against the euro.

Having fallen to near a 2-week low of 183.36 against the pound

at 9:40 pm ET, the yen reversed direction with the pair trading at

182.50. The pair was worth 182.98 when it finished Tuesday's

trading. If the yen extends gains, 181.00 is possibly seen as its

next resistance level.

The yen rebounded to 91.94 against the loonie and 85.93 against

the aussie, from its early more than a 5-week low of 92.37 and more

than a 2-week low of 86.37, respectively. The next possible

resistance levels for the yen may be found around 90.5 against the

loonie and 84.00 against the aussie.

Preliminary Japanese leading index for August is due at 1:00 am

ET.

German industrial production for August is set for release in

the pre-European session at 2:00 am ET.

U.K. industrial and manufacturing output for August will be

published in the European session.

Canada building permits for August, Energy Information

Administration's crude inventory data for the week ended October 2

and U.S. consumer credit for August are to be released in the New

York session.

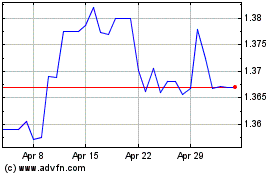

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024