U.S. Dollar Weakens Ahead Of FOMC Minutes

08 October 2015 - 5:12PM

RTTF2

The U.S. dollar slipped against its key counterparts in early

European deals on Thursday, as traders focus on the Federal

Reserve's minutes of September meeting for more indications

regarding the timing of a potential rate hike.

The Fed publishes minutes of September 16-17 meeting at 2:00 pm

ET.

The minutes would provide more insights about how much the Fed

was concerned about recent global market turmoil and slowing growth

in China, which refrained it from raising interest rates at the

meeting.

Still, the Fed chair Janet Yellen, as well as her colleagues,

suggested that a rate hike is likely to happen this year. With

lackluster inflation and risk of slowing employment growth,

analysts are speculating that the Fed may wait for a few months

before hiking rates.

The Bank of England's monetary policy decision and the minutes

of the European Central Bank's September meeting, as well as the

start of the U.S. third-quarter earnings season could garner

attention during the course of the day.

The greenback has been modestly lower against the franc, yen and

the euro in the Asian session. Against the pound, it was

steady.

In European trades, the greenback edged down to 0.9659 versus

the franc, after having advanced to 0.9737 at 7:30 pm ET. If the

greenback extends slide, it may locate support around the 0.955

mark.

Figures from the State Secretariat for Economic Affairs showed

that Switzerland's unemployment rate rose in September in line with

economists' expectations.

The seasonally adjusted jobless rate climbed to 3.4 percent from

3.3 percent in August.

The greenback hit 1.5350 against the pound, a level unseen since

September 23. The greenback is seen finding support around the 1.55

region.

British house price growth slowed unexpectedly in September,

according to latest survey from the Royal Institution of Chartered

Surveyors.

The survey showed that monthly house price balance fell to +44

in September from +53 in August, which was the highest in more than

a year. Economists had expected the balance to rise again to

+55.

The greenback slipped to 6-day lows of 119.63 against the yen

and 1.1310 against the euro, off early highs of 120.11 and 1.1235,

respectively. On the downside, the greenback may possibly find

support around 118.00 against the yen and 1.14 against the

euro.

The greenback was trading lower at 1.3029 against the loonie,

0.6619 against the kiwi and 0.7194 against the aussie, coming off

from its prior highs of 1.3071, 0.6586 and 0.7165, respectively.

The next possible support for the greenback may be found around

1.29 against the loonie, 0.68 against the kiwi and 0.73 against the

aussie.

Looking ahead, the Bank of England is set to announce its rate

decision at 7:00 am ET. The bank is expected to hold its key rate

at 0.50 percent and quantitative easing at GBP 375 billion.

Half-an hour later, the European Central Bank releases minutes

of September meeting.

Canada housing starts for September and new housing price index

for August, as well as U.S. weekly jobless claims for the week

ended October 3 are set for release in the New York session.

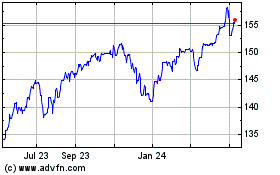

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

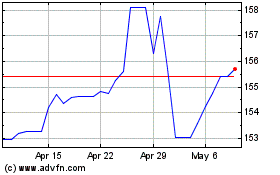

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024