SYDNEY—When South32 Ltd., the mining company spun out of BHP

Billiton Ltd., launched in May, its backers claimed its low debt

and focus on a clutch of commodities would help it weather any

stormy markets ahead.

Five months after one of the biggest breakups in corporate

mining history, those claims are already in doubt.

South32's stock has been in free fall as prices for its

products, including aluminum and coal, have fallen into a deep

slump. Last week, its shares dropped to a fresh nadir of 1.33

Australian dollars (US$0.96).

Despite a modest recovery this week, South32 is still down

nearly 30% since it listed. A company some touted as being worth as

much as US$15 billion before its launch now has a market value of

just more than US$6 billion.

South32 is doing worse than its peers amid this year's

broad-based commodities selloff. The company—listed in Sydney,

Johannesburg and London—has underperformed an index of Australia's

top resources companies, which is down roughly 15% since South32's

debut in May. Shares in its former parent, BHP, are down 16% over

the same period.

"One wouldn't classify it as a raging success," said Anthony

Sedgwick, a fund manager and co-founder at South Africa-based Abax

Investments Pty. Ltd., which has nevertheless kept a small holding

in South32 since its demerger.

The question now is whether South32's rocky start is a result of

bad timing, or if its problems run deeper.

In theory, corporate spinoffs create value by unleashing the

potential of business lines that may have been hidden within large

corporations. In South32's case, operations such as nickel and

manganese mining that were too small to make a difference to BHP's

profits were expected to blossom. That, in turn, was supposed to

benefit BHP investors, who received one share in the new company

for every share they owned in the mining giant.

Some saw flaws from the start. A key concern has been South32's

heavy reliance on operations in South Africa, where it runs coal

and manganese mines and an aluminum smelter. Resources companies

there have long grappled with issues such as frequent worker

strikes and surging electricity costs.

"Before the company listed, a lot of people were talking about

how spinoffs tend to outperform parent companies—but with South32,

we just didn't think that would be the case," said one London-based

fund manager who sold off his stake soon after the new company's

debut.

South32's cost-cutting efforts have also failed to keep pace

with collapsing prices—or market expectations, according to

analysts at Goldman Sachs, who describe its management's goals as

"uninspiring."

The miner reported a net loss of $919 million in its maiden

full-year fiscal report in August.

After the recent slide in commodity prices some of South32's

major operations, including its Cerro Matoso nickel mine in

Colombia and its South African manganese business, are now

unprofitable, according to Australian bank Macquarie Group. The

bank argues that the company should cut back production in such

places. South32 has already cut output at its Metalloys manganese

alloy smelter in South Africa and Alumar aluminum smelter in

Brazil, two operations it runs in joint venture with other

companies.

"The business looks rather challenged," said Ivor Pether, a fund

manager at U.K.-based Royal London Asset Management, who said he

"exited early."

Luck hasn't favored South32. Prices for manganese and

nickel—which together account for one-quarter of its underlying

earnings—as well as zinc have been the most volatile among major

commodities in recent times, Goldman said. That volatility

continued Friday after Glencore PLC said it would cut global zinc

production by a third, sending prices of the metal sharply

higher.

"We are hugely exposed to foreign-exchange and commodity

prices," South32 Chief Executive Graham Kerr said in a recent

interview.

Others say South32's modest ambitions could yet prove a

strength. Unlike many other mining companies, the company hasn't

borrowed excessively to fund massive investments or acquisitions.

Its net debt is equivalent to just 4% of its total capital, a very

low ratio by industry standards.

The company "has never been nor ever tried to sell itself as a

sexy story" of surging output or massive new projects, said Abax's

Mr. Sedgwick. "The attraction is that it is a pretty dull and

boring portfolio of assets."

For BHP at least, the spinoff appears to have worked. It has

benefited from unloading assets that were previously mere footnotes

for the group: Had it retained South32's poorly performing

businesses, the recent slide in BHP's shares could have been

deeper. In August, BHP said it had achieved its goal of cutting

annual costs by $4 billion two years ahead of schedule. It earlier

projected that carving out South32 would help it surpass that

target.

As for South32, one possibility is that it has now become cheap

enough to be an acquisition target. Analysts say one potential

buyer is X2 Resources, an investment fund founded by Mick Davis.

Some think the company could even look to acquire itself. "With

South32's global peers hamstrung by large debt levels, the company

has the opportunity to look to invest in growth at a period when

others do not," Goldman's analysts said.

Big spending doesn't seem to be Mr. Kerr's priority for now.

"Our job in the next 12 months is to deliver—nothing is going to

speak like actions," he said.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com and Alex

MacDonald at alex.macdonald@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 09, 2015 04:45 ET (08:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

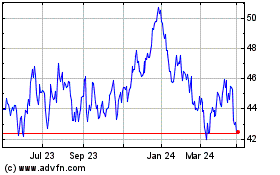

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

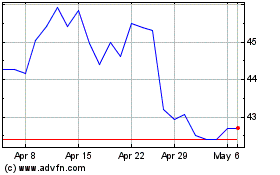

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024