BHP Billiton to Sell About $3 Billion in Bonds

14 October 2015 - 9:52AM

Dow Jones News

By Christopher Whittall And Mike Cherney

BHP Billiton Ltd. is planning to sell around $3 billion of U.S.

dollar hybrid bonds this week, according to a deal notice released

Tuesday and a person familiar with the deal.

The plan is the latest test of reviving demand for

commodity-related investments. Investors this year have sold

mining-company bonds following a slowdown in China and a fall in

commodities prices. But gains over the past week in

commodity-related asset prices are likely to boost demand for BHP

debt, said Henry Peabody, who helps oversee the $1.2 billion Eaton

Vance Bond Fund.

"That helps the prospects for this deal," he said. "Investors

should be willing to give the company capital," he said.

The average yield on debt issued by metals and mining companies

hit a six-year high of 6.4% in late September, according to

Barclays, compared to a recent low of 3.3% in April. Yields rise as

prices fall.

The average yield on mining companies' debt has since dropped to

5.3%, according to Barclays, following a bounce in commodities

prices.

The miner is also planning to sell corporate hybrid bonds

denominated in euros and sterling, though no official announcement

has yet been made, according to people familiar with the deal.

Hybrid bonds are a risky form of corporate debt that combine

aspects of both debt and equity. Interest payments can be deferred,

and the bonds are junior to all other forms of debt in the event of

a default. Companies issue the debt because it allows them to raise

capital without diluting existing shareholders.

Investors are being offered a yield of around 7% on a 60-year

dollar bond that can be retired after 10 years, according to a

person familiar with the deal. The pricing of that bond, scheduled

for Wednesday, will be used as a reference point to price a second

60-year dollar bond that can be retired after five years, the

person said.

BHP Billiton said in a statement filed with Australian

Securities Exchange last month that it would begin marketing Sept.

28 a multi-currency hybrid corporate bond that it expected to be

treated as half debt, half equity by ratings companies. BHP

Billiton is rated A1 by Moody's Investors Services and A+ by

Standard and Poor's.

The low interest-rate environment makes it an "opportune moment"

to consider issuing these securities, the company said. The

proceeds will be used for general corporate purposes, including

refinancing other near-term debt when it comes due, the company

said.

Philippe Berthelot, head of credit at Natixis Asset Management,

said he hasn't decided whether to buy the bonds.

Mr. Berthelot, whose firm oversees $355 billion, said that

corporate hybrid securities have been one of the worst bond

investments so far this year in terms of performance.

Corporate hybrid bonds recorded a negative total return of

around minus 4% in September, according to Barclays, driven by a

sharp selloff in the hybrid debt of auto maker Volkswagen AG.

"That is why you have to think," said Mr. Berthelot, who said he

would make his final decision depending on the pricing of the new

BHP Billiton debt.

Bank of America Merrill Lynch, Barclays PLC, BNP Paribas SA and

Goldman Sachs Inc. are underwriting.

Write to Christopher Whittall at christopher.whittall@wsj.com

and Mike Cherney at mike.cherney@wsj.com

(END) Dow Jones Newswires

October 13, 2015 18:37 ET (22:37 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

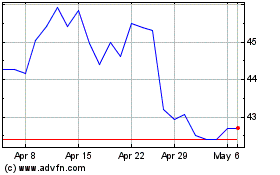

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024