Treasury Wine to Buy Diageo's Wine Operations

14 October 2015 - 10:40AM

Dow Jones News

SYDNEY—Australian vintner Treasury Wine Estates Ltd. said it

will buy Diageo PLC's U.S. and U.K. wine operations for a cash

payment of US$552 million.

Treasury Wine Chief Executive Michael Clarke said the

acquisition will transform the firm's U.S. business into a "larger

player of scale" in the luxury and masstige segments of the

high-growth U.S. market.

"The additional supply of luxury and masstige wine will be a

game-changer for our U.S. brands, providing us with an immediate

opportunity to step-change our growth in the U.S., Canada, Asia and

Latin America," he said.

Treasury Wine Estates plans to largely fund the deal via a 486

million Australian dollar (US$350 million) share offer, with the

balance funded by new U.S. dollar denominated debt facilities.

Under the entitlement offer, shareholders will receive two new

shares for every 15 existing shares held.

The deal also includes the assumption of capitalised leases of

US$48 million, taking the total deal value to US$600 million,

Treasury Wine said.

The acquisition is subject to certain regulatory approvals,

including antitrust approval in the U.S., and is expected to

complete in about three months.

Write to Rebecca Thurlow at rebecca.thurlow@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 13, 2015 19:25 ET (23:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

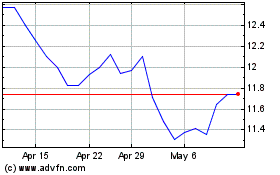

Treasury Wine Estates (ASX:TWE)

Historical Stock Chart

From Mar 2024 to Apr 2024

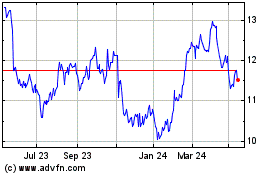

Treasury Wine Estates (ASX:TWE)

Historical Stock Chart

From Apr 2023 to Apr 2024

Real-Time news about Treasury Wine Estates Ltd (Australian Stock Exchange): 0 recent articles

More Trea Wine Fpo News Articles